On-chain information reveals the Bitcoin buying and selling quantity has been growing lately, which may assist additional the asset’s rally.

Bitcoin Buying and selling Quantity Has Registered A Massive Increase Not too long ago

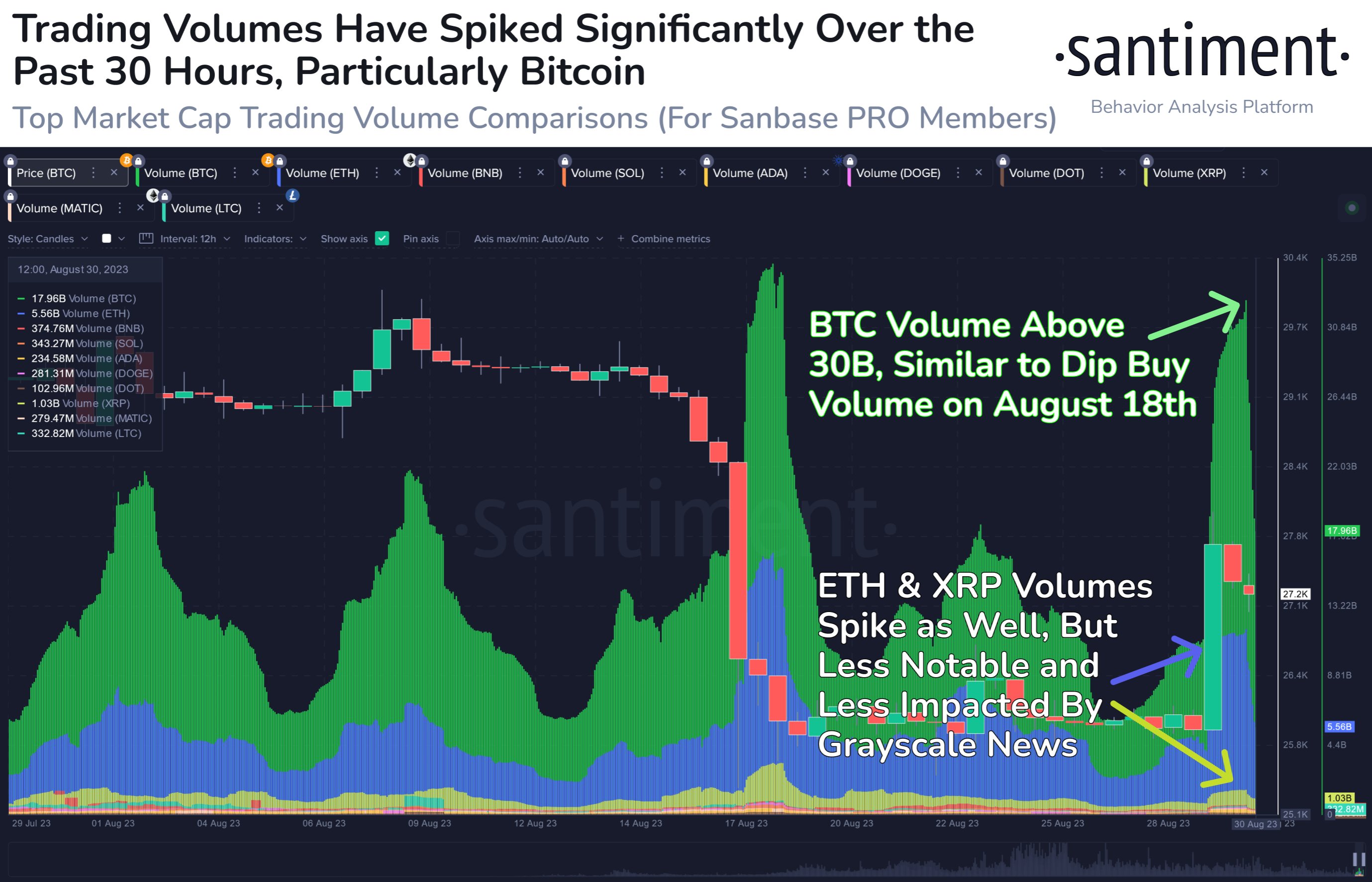

In keeping with information from the on-chain analytics agency Santiment, BTC continues to see excessive volumes. The “buying and selling quantity” right here refers to measuring the each day whole quantity of a particular asset being moved round on the blockchain.

When the worth of this metric is excessive, it implies that many tokens of the cryptocurrency in query are at present observing some motion. Such a pattern implies that merchants are energetic available in the market proper now.

Then again, low values of the indicator recommend the community goes by way of a interval of low exercise, a potential signal that the final curiosity within the coin amongst buyers has dropped.

Now, here’s a chart that reveals the pattern within the buying and selling quantity for a number of the most important property within the sector over the previous month:

The worth of the metric appears to have seen some speedy rise in latest days | Supply: Santiment on X

The above graph reveals that the highest property have seen some uplift on this metric with the most recent rallies of their respective costs, however Bitcoin’s extraordinary progress is a transparent standout.

Ethereum and XRP have additionally seen vital spikes of their buying and selling volumes, however the sharpness of their growths has remained unchanged, like what BTC has noticed.

On the top of this newest quantity spike, about $30 billion within the asset had moved throughout the chain within the previous 24-hour span, probably the most the indicator had touched since August 18th.

Bitcoin had noticed a pointy crash from the $29,000 stage to below the $26,000 mark. The quantity had ushered in following this crash, because the merchants had reacted in varied methods, with some panic promoting whereas others took the chance to purchase.

Contemplating that the height of the spike had coincided with the underside for the asset, it’s potential that a number of the amount had been flowing for dip accumulation.

Traditionally, spikes within the quantity after unstable occasions like a crash or a rally have usually been frequent, as these are the moments when the buyers’ consideration is abruptly introduced in the direction of the asset. When the amount doesn’t go up even in such occasions, it could possibly get a bit regarding.

Any sharp transfer within the value is mostly solely sustainable when there may be a considerable amount of gasoline behind it within the type of merchants, so the amount not solely spiking but additionally persevering with to rise with the most recent Bitcoin rally might be a optimistic signal for the surge’s sustainability.

BTC Worth

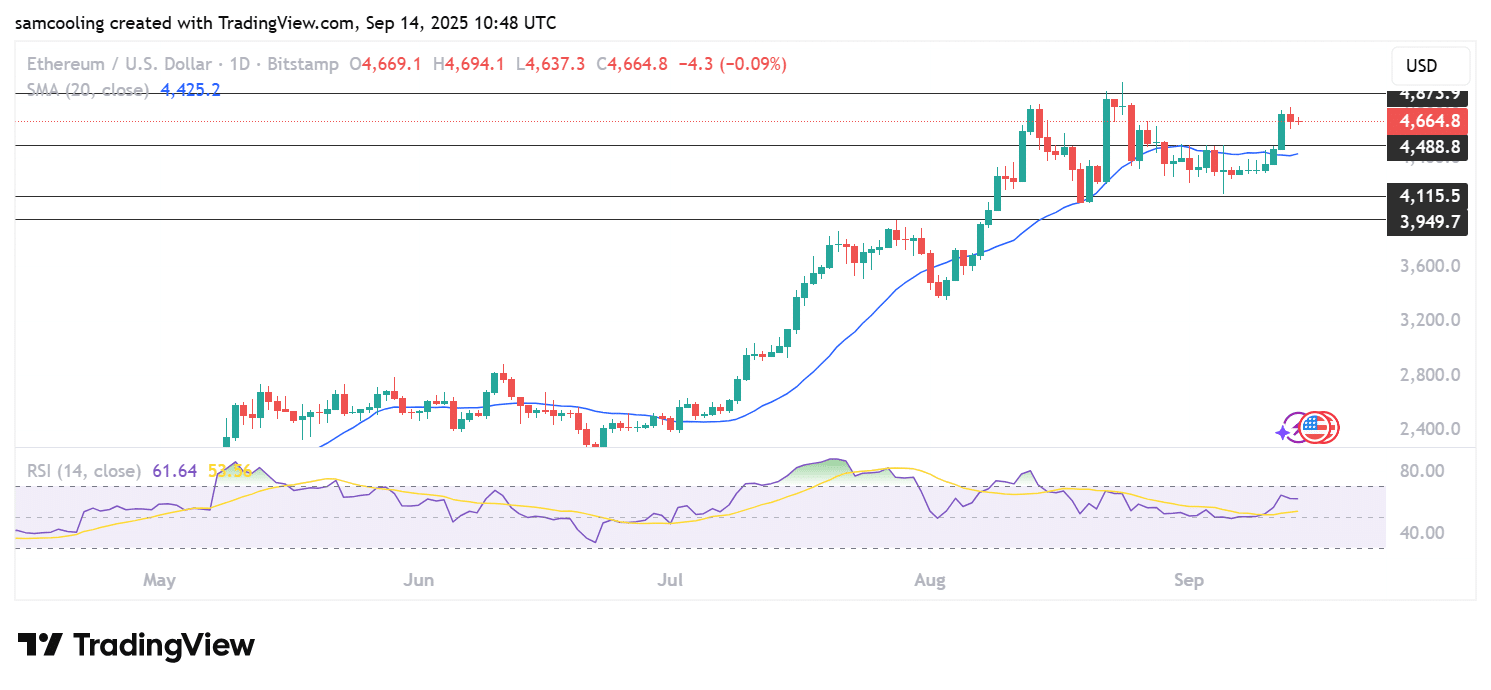

Bitcoin had earlier damaged above the $27,000 stage, however right now, the asset seems to have slumped under the mark, because it’s at present buying and selling round $26,900.

BTC has declined a bit through the previous day | Supply: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, Santiment.internet