On-chain knowledge exhibits exchanges have seen internet Bitcoin withdrawals throughout the previous three months, the longest streak within the asset’s historical past.

Exchanges See Bitcoin Withdrawals Exceed Deposits For Three Consecutive Months

An analyst on X defined that the overall variety of Bitcoin alternate withdrawals has been greater than the deposits not too long ago. The variety of deposits and withdrawals and the variety of such transactions are referred to right here.

All transfers on the community that go from a self-custodial pockets to a central alternate entity would rely as deposit transactions, whereas people who go the alternative means can be withdrawals.

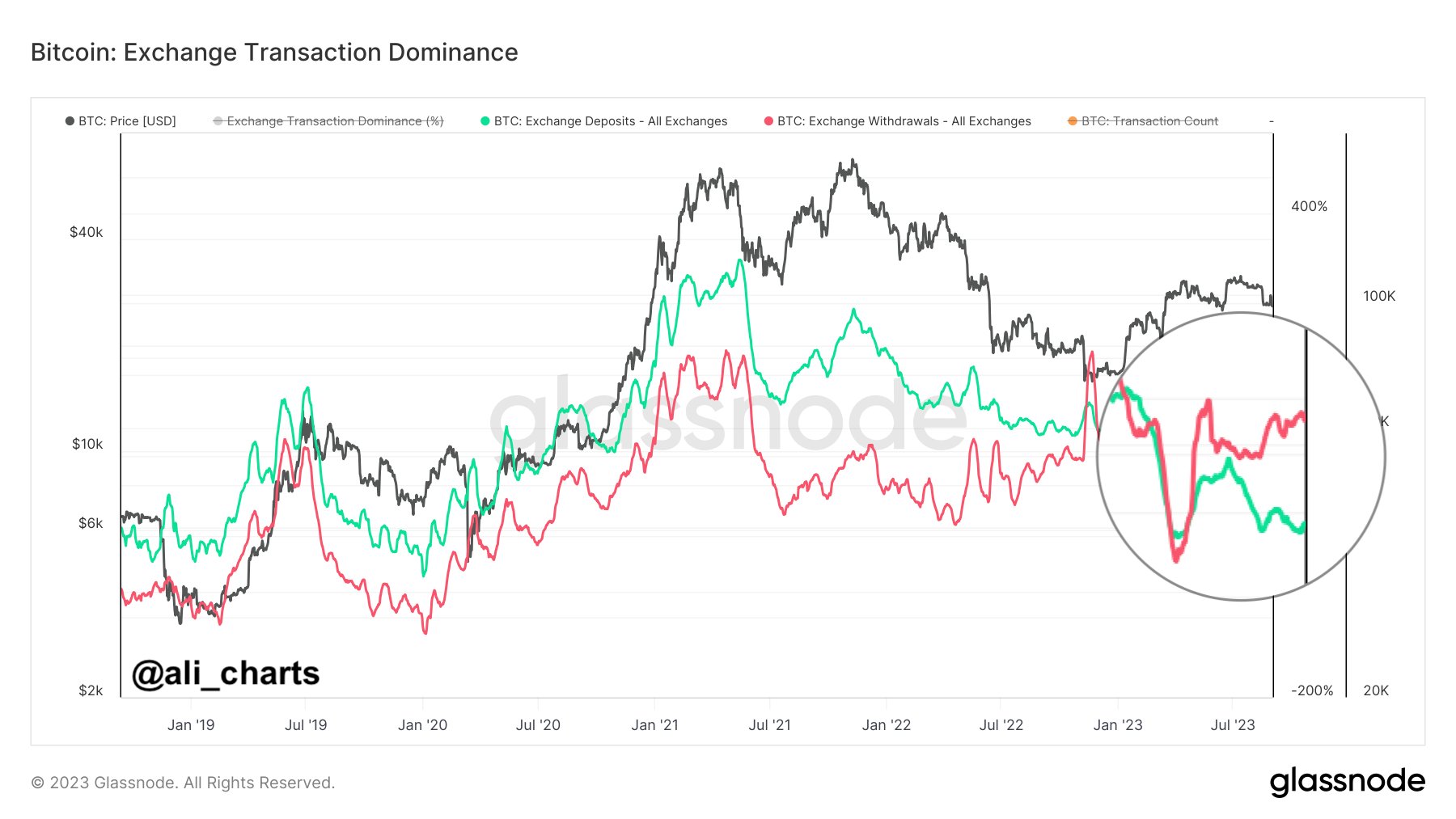

Now, here’s a chart that exhibits the pattern within the Bitcoin alternate withdrawals and deposits over the previous couple of years:

How the 2 metrics have modified in worth in recent times | Supply: @ali_charts on X

As displayed within the above graph, the Bitcoin alternate withdrawal transactions have been increased than the deposit transactions for round three months. This streak is a report for the cryptocurrency, as deposits have normally surged again above withdrawals earlier than lengthy each time this sample types.

There might be a number of interpretations of what this uncommon run of withdrawals would possibly say concerning the market. The analyst has listed a couple of hypotheses which will clarify this pattern.

First and maybe the obvious one might be that the holders select to carry their Bitcoin for prolonged intervals as a substitute of collaborating in buying and selling or promoting (which they typically use exchanges for).

The second rationalization could also be that the traders have turn out to be extra cautious of central entities, in order that they go for the safety that self-custodial wallets present. This may make sense in gentle of a number of bankruptcies the sector has seen throughout the previous yr, the place recognized names like FTX have gone down.

One other speculation is simply the reverse of the primary one: the withdrawals are regular, however the deposits are muted, a results of holders not eager to promote their cash by these platforms, in order that they aren’t making that many deposits anymore.

Lastly, the analyst notes, “given the latest regulatory adjustments within the US, traders choose to maintain their property off exchanges to keep away from potential issues.” Binance, the most important alternate on this planet when it comes to buying and selling quantity, has significantly been below fireplace recently.

One other analyst has regarded on the particular person alternate reserves (the overall quantity of Bitcoin sitting in a platform’s wallets) of Binance and Coinbase in a CryptoQuant Quicktake put up, to see how they’ve shifted through the years.

Seems like the worth of the metric is pink at the moment | Supply: CryptoQuant

Binance had been seeing rising Bitcoin reserves for a superb chunk of the previous yr (regardless of components just like the bear market), however the alternate has been seeing internet withdrawals not too long ago.

Coinbase, alternatively, has been seeing withdrawals for fairly some time now, implying that the platform has continually been bleeding cash.

The alternate continues to see outflows | Supply: CryptoQuant

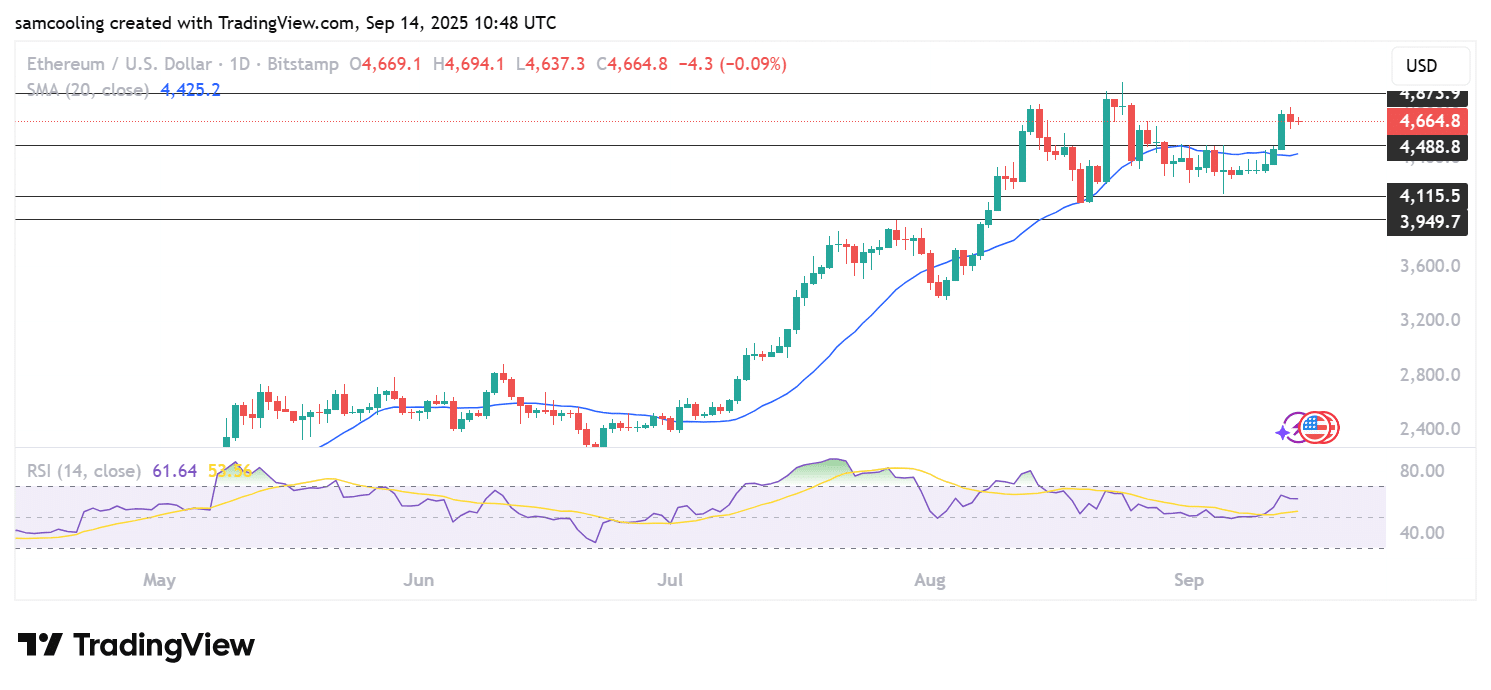

BTC Worth

Bitcoin has remained stagnant not too long ago because the asset continues to be priced across the $25,900 degree.

BTC continues to consolidate sideways | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com, Glassnode.com