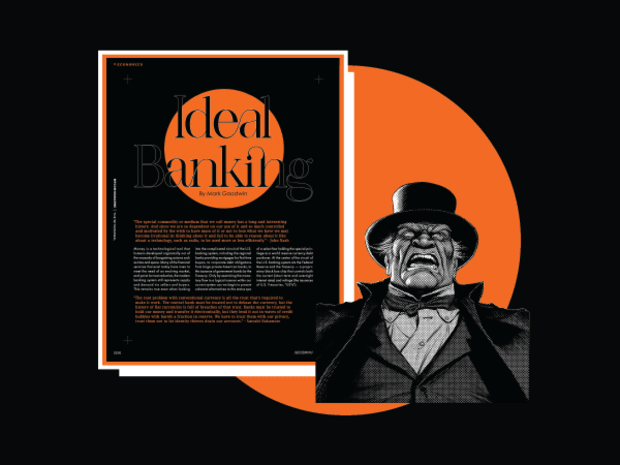

This text is featured in Bitcoin Journal’s “The Withdrawal Subject”. Click on right here to subscribe now.

A PDF pamphlet of this text is accessible for obtain.

“The particular commodity or medium that we name cash has a protracted and attention-grabbing historical past. And since we’re so depending on our use of it and a lot managed and motivated by the want to have extra of it or to not lose what we have now we might change into irrational in desirous about it and fail to have the ability to purpose about it like a couple of know-how, similar to radio, for use kind of effectively.” – John Nash

Cash is a technological device that people developed organically out of the need of bargaining axioms similar to time and house. Lots of the monetary providers that exist at the moment have risen to satisfy the necessity of an evolving market, and but at its most reductive, the fashionable banking system nonetheless represents provide and demand by way of sellers and consumers. This stays true even when trying into the difficult circuit of the U.S. banking system, together with the regional banks offering mortgages for first-time consumers, to company debt obligations from giant non-public American banks, to the issuance of presidency bonds by the Treasury. Solely by inspecting the financial stream in a logical method inside our present system can we start to current coherent alternate options to the established order of a choose few holding the particular privilege as a world reserve forex debt pardoner. On the heart of the circuit of the U.S. banking system sits the Federal Reserve and the Treasury — a proprietary black field chip that controls each the present (short-term and in a single day rates of interest) and voltage (the issuances of U.S. Treasuries, “USTs”).

“The foundation downside with typical forex is all of the belief that’s required to make it work. The central financial institution should be trusted to not debase the forex, however the historical past of fiat currencies is stuffed with breaches of that belief. Banks should be trusted to carry our cash and switch it electronically, however they lend it out in waves of credit score bubbles with barely a fraction in reserve. We’ve got to belief them with our privateness, belief them to not let identification thieves drain our accounts.” – Satoshi Nakamoto

Tracing The Circuit

The reserve asset on the backside of the stack of the U.S. economic system isn’t the U.S. greenback, however moderately U.S. Treasuries. Offshore greenback markets such because the eurodollar have lengthy operated beneath the phantasm of greenback creation by these European banks with out hardly touching U.S.-issued authorities debt. The Treasury points debt within the type of USTs to be bought to non-public banks, who later create credit score by way of {dollars} of their buyer accounts with the intention to finance the price range of the U.S. authorities, in addition to service any excellent nationwide debt. The thought of issuing new debt to service outdated debt would appear illogical, and in some ways it’s, but turns into much more conceivable with the correct understanding that not all debt is created equal. Debt, at the least within the Treasury issuance instance above, is demarcated by each the proportion of revenue generated as yield, and the period till stated bond reaches maturity. Traditionally, and maybe logically, the longer the period (twenty years vs one 12 months), the upper the yield (2.4% vs 1.2%, utilizing actual charges from March 2022). Essentially the most liquid denomination of presidency debt are short-term Treasury payments, known as T-bills, that are any bonds with a maturity date lower than one 12 months; usually, the yields on these bonds are most instantly influenced by short-term federal funding charges. When the federal government needs to promote extra debt, it will probably enhance the yield on these T-bills by growing the short-term rate of interest on provide, driving yield-seeking capital again into the U.S. banking system in the hunt for revenue. When charges rise, the price to borrow will increase and these new debt devices absorb extra greenback liquidity.

Conversely, when charges fall, the price to borrow decreases, and thus the demand for private debt will increase. To place it merely, if charges are at or close to zero, extra individuals will tackle debt as a result of negligible further financial price of ultimately paying it again. When charges are larger, and there’s market-high yield to be made on merely loaning {dollars} to the federal government by buying government-issued securities, there’s little accessible provide to be loaned out, and even much less demand as a result of excessive prices of borrowing. The difficulty with this credit-debt boom-bust cycle is that it’s levered by trusted third events, culminating with a purchaser and lender of final resort on the trendy Federal Reserve — who’re in actual fact really restricted of their capability to govern the quick finish of the yield curve. The yield curve demonstrates the completely different yields supplied by the bond market, denoted by their period. When there’s sudden and extreme relative volatility inside short-term rates of interest, the yield curve can invert, which means short-term debt now pays the next yield than long-term bonds. If merely held to maturity, typically so long as 30 years, Treasury bonds won’t ever yield a cloth loss, but when short-term liquidity wants strike a financial institution within the type of depositors withdrawing, banks are pressured to promote and notice a loss.

The well being and effectivity of the U.S. banking system might be measured in how risky short-term rates of interest are, the state of the yield curve, overseas and home curiosity in government-issued bonds, and the discrepancy between excellent liabilities and reserves — be it securities or money.

The New Greenback: FedNow, Not Retail CBDCs

The greenback has been digitized for a very long time; be it the Zelle or Venmo credit in your retail account, or the greenback stability in your checking account at Financial institution of America. However usually talking, the mechanisms behind the switch of Treasuries and different reserve property backing these numbers on a display have remained on the technical agility of a fax machine. The greenback stands out as the world reserve forex, and might be transacted by way of intermediaries on apparent centralized banker rails, or much less clearly on Ethereum rails by way of ERC-20 tokens within the type of fashionable retail stablecoins, however the U.S. Treasuries held by these novel credit score creators stay the world reserve asset. The general public has usually feared the direct issuance of some type of retail CBDC (central financial institution digital forex) because of surveillance considerations and forex seizure from a centralized issuer, however fewer notice each the extent of economic surveillance already imposed by banks, by no means thoughts the flexibility for these trusted third events to censor, blacklist and even expose retail to their counter-party threat. All of those actions are made more and more potential by way of the digitization of the forex with an encroaching reliance on centralized fee rails, however up till this July, the communication community for interbank asset trades has remained lossy and gradual.

FedNow, slated to launch subsequent month, serves a number of functions, however maybe none as essential as creating a way more environment friendly lever for the Fed to have 365/24/7 affect on in a single day banking charges, similar to SOFR, successfully setting the price of borrowing short-term liquidity between fractionalized non-public banks trying to satisfy their depositors’ withdrawals. You’ve gotten most likely heard the phrase “reverse repo” a couple of times, however the underlying mechanic is commonly misunderstood. The “repo” stands for a repurchasing settlement; basically a contract between two entities wherein Financial institution A, with extra greenback liquidity, agrees to lend money to Financial institution B, with in a single day liquidity wants, by way of a short-term mortgage collateralized by Financial institution B’s property similar to USTs, with the situations that Financial institution B will repurchase their securities, normally the subsequent morning (“in a single day”), plus a percentage-based price that Financial institution A will get to maintain. A reverse repo is actually the identical conduct, besides that Financial institution A is bond-rich, cash-poor and thus asking Financial institution B for dollar-denominated liquidity. This precise state of affairs got here to fruition inside the current regional financial institution failures within the U.S., and the Fed created new mechanisms to backstop the liquidity wants of the depositors. Within the case of the ever-growing reverse repo market, Financial institution B is routinely the biggest American banks, and typically even the Fed instantly. FedNow is a digital lever, made potential by way of the web, for full centralized management on the in a single day charge of borrowing {dollars}, the required transferring of Treasuries between banks, and thus the reshoring of dollar-denominated exercise away from the Eurodollar market, and again to america inside the scope of the Fed and the Treasury.

“It’s not all about funds. We can have exchanges ceaselessly. We can have banks ceaselessly.” – Calle

Banking Is Extra Than Funds

Did you discover that at no level above have been funds even talked about? Bitcoin in its present state isn’t essentially prepared to interchange the greenback as a world medium of trade, which takes benefit of economic providers to scale over time and house, however it’s probably poised to interchange USTs as a world reserve asset and an interbanking settlement community. For Bitcoin to service the numerous capabilities of a banking system, there must be additional tooling past the peer-to-peer fee networks innate to the bottom layer and the Lightning Community, probably the most mentioned second layer. Paper cash represents {dollars} as money, a bodily bearer asset for settling debt obligations, but the vast majority of U.S. {dollars} at the moment exist solely as credit score in a consumer’s account stability at a trusted third get together similar to a financial institution. In stark distinction, Bitcoin itself incorporates zero account balances, and as a substitute depends on a UTXO mannequin: Non-fungible unspent transaction outputs that when signed and spent can switch fungible satoshis, the atomic unit of bitcoin, between pockets addresses. The handle stability of your pockets is an aggregation of the a number of UTXOs related along with your non-public key. By sharing a UTXO between two or extra events, sometimes within the type of Lightning channels, Layer 2 fee options create near-instant, probabilistically trustless settlements permitting for account balances. By taking a UTXO and making a shared channel with a peer, you create the capabilities of credit score and debt inside the Bitcoin community. Some situations of LN even enable sub-satoshi denominations similar to “msats” — a actually unrecognizable unit on the baselayer, and thus solely current as a type of credit score or debt. As a result of nature of Layer 2 options being able to simulate credit score and debt, these providers allow a trustless iteration of yield by way of routing charges, and trust-minimized monetary providers akin to the standard banking system. Tooling constructed on high of Bitcoin can create analogs to legacy mortgage, yield, and liquidity-sharing providers. Sadly, a big side of the trustlessness of Layer 2s with the ability to finalize and settle again to the mainchain is an open topological community and an ever-surveilled open ledger, considerably lowering the capability for personal monetary exchanges.

“Truly there’s a excellent purpose for Bitcoin-backed banks to exist, issuing their very own digital money forex, redeemable for Bitcoins. Bitcoin itself can not scale to have each single monetary transaction on the earth be broadcast to everybody and included within the block chain. There must be a secondary degree of fee techniques which is lighter weight and extra environment friendly.” – Hal Finney

Enter ecash

Chaumian mints have been invented by cryptographer and mathematician David Chaum in a 1982 paper titled “Blind Signatures For Untraceable Funds”. Chaumian mints make the most of blind signatures to signify ecash in mint-specific denominations to create near-perfect privateness inside the federation. This newly discovered privateness is on the expense of reserve asset custody and potential financial debasement relying on each the coding of the mint occasion in addition to malicious actions from mint authority signatures; it is a state of affairs almost an identical to the downsides of utilizing a legacy monetary establishment. Ecash makes use of the same token mechanic to bitcoin in that whereas a single pockets can seem to include an mixture account stability, in actuality the ecash pockets stability is definitely distributed amongst many iterations of widespread denominations of ecash tokens issued by the mint. The mint itself is totally unaware of the account which funded the preliminary issuance of ecash, and at redemption merely sees that it had beforehand validated this token by way of a blind signature. When utilizing any privacy-preserving fee protocol, there are all the time two anonymity units: inside and out of doors the protocol. Whereas a Chaumian mint can provide near-perfect privateness when transacting inside the federated mint itself, an exterior settlement from the mint might be seen with a low variety of consumer withdrawals, unassuming metadata assortment, and a large number of poor operational safety selections by customers. A consumer may generate ecash from a Chaumian mint occasion by way of a comparatively non-public sender-side LN fee, take the newly generated tokens and fund one other outbound sender-side LN fee with zero capability for the mint to generate consumer account stability data, nor related metadata with correct exterior privateness method. With low-cost, close to on the spot, and completely non-public funds, if authored appropriately, Chaumian mints can bridge the gaps between Layer 2 balances and even base layer UTXOs.

The New Mint

Chaumian mint building sorts differ primarily in two methods: the federation building itself and the ecash token denominations it points. A federation can include a single signature with administrative entry to issuing its ecash, in addition to being able to signal for the mint’s reserve asset when processing withdrawals. A federation may allow multisignature capabilities to comparable mint duties, distributing tasks away from a single level of failure to a quorum of trusted third events. Ecash token denominations are distinctive to the mint, however theoretically determined at launch of the occasion. In lossy parallel to Bitcoin’s UTXO mannequin, there are not any account balances, however moderately aggregates of ecash tokens that have been issued as widespread denominations (suppose $5, $10, and $20 notes). These widespread denominations enable for higher fungibility and much higher anonymity units inside the mint, particularly when mixed with issuance validation by way of blind signatures. All of those selections, together with the relative issuance per reserve asset — say ecash token per satoshi — are to be made by the founders of the Chaumian mint, usually upon its genesis. Cashu is a well-liked, open-source, single-signature occasion (created by open-source developer Calle) that’s able to being spun up rapidly, leaning on tooling similar to LNBits to create quick and straightforward operability with customers already on the Lightning Community. Fedimint, a multisignature occasion, permits for a extra decentralized mint consensus amongst federation members, creating extra administrative checks inside the mint when minting ecash tokens, and when ultimately redeemed, signing transactions to withdraw from the bitcoin reserve.

Coincidentally, the primary consumer considerations when utilizing ecash come from its privacy-preserving qualities. As a result of there being no account balances, efficiently auditing a mint to test its supposed reserves towards its liabilities is moderately tough. And since there are not any accounts, a trusted custodian should be liable for holding sufficient of the reserve asset towards the overall provide of ecash held by unknown customers of the mint. The mint itself is a trusted third get together liable for each applicable financial issuance and with the ability to make depositors complete at time of redemption. That is one other prudent parallel to our present banking system, equally true in each a regional financial institution and the Federal Reserve itself, in fact, with none-to-little of the privateness advantages. These considerations might be theoretically met with intelligent proof-of-liability schemes such because the one proposed for Cashu by Calle, which publicly generates a month-to-month token burn record and a month-to-month token issuance record, rotating issuance keys after each month-to-month epoch. Each of those lists merely include the blind signatures representing their particular ecash denominations from their issuance, and customers can test that their very own transactions are current of their respective month-to-month record. The liabilities of the mint is the distinction between the mint and the burn record, and thus needs to be equally demonstrated inside the reserve asset pockets. Proof of reserves is straightforward with a bitcoin-backed monetary service (a public bitcoin pockets), however proof-of-liabilities is considerably tougher. Considerations of financial debasement and related custodial threat are nonnegotiable on the bottom layer of Bitcoin, and but these actual dangers are simply mitigated relying on how you utilize the mint. If a Chaumian mint occasion similar to Cashu or Fedimint sees consumer quantity at important scale largely for terribly short-term fee wants, correct utilization of ecash — funding and withdrawing from a busy mint almost instantaneously — leaves little time for financial debasement nor reserve asset theft.

“I imagine this would be the final destiny of Bitcoin, to be the ‘high-powered cash’ that serves as a reserve forex for banks that subject their very own digital money. Most Bitcoin transactions will happen between banks, to settle internet transfers. Bitcoin transactions by non-public people will likely be as uncommon as… properly, as Bitcoin primarily based purchases are at the moment.” – Hal Finney

Minting Your Personal Financial institution

Belief is a mandatory element of lots of the useful monetary providers employed by the U.S. banking system. This stays true now in addition to through the gold window. Loans, fractional reserve banking, and counterparty threat is all potential on a bitcoin customary, very like it was on earlier exhausting cash requirements. By decentralizing the manipulation of financial issuance away from central pardoners, bitcoin has supplanted USTs as the best reserve asset for a brand new banking system. Whereas it’s maybe seen as a failure to easily change the instrument banks use to settle their reserves with bitcoin, the elimination of those particular privileges from the Fed as reserve asset issuers — and the substitute being a disinflationary, censorship-resistant asset — can have profound results on the present establishment of financial manipulation. Bitcoin’s base layer merely can not service 8 billion individuals, however correct tooling in layers can enable this scarce, impartial asset unfettered entry to a secure financial coverage; a revolution in banking, monetary, and financial actuality as we all know it. Layer 2s are delegated as such because of their trustless capability to settle again to the mainchain with none third get together. However ecash permits a wholly new interoperability between Layer 2s and conventional monetary providers, with an innate capability to be created particularly and well timed in accordance to buyer calls for and wishes. Behind each on-line neighborhood that warrants sure privateness wants for his or her customers could possibly be one other distinctive interplay of Cashu. So as to distribute mining rewards privately, mining pool operators can use instruments similar to FediPools to maximise anonymity units derived from mining reward funds.

The way forward for banking isn’t stablecoin issuers offering alternatives for the World South to purchase U.S. debt; the longer term is each web site, each digital neighborhood, threatening to run their very own ecash occasion, backed by bitcoin — the one impartial reserve asset — when their present monetary counterparties are ultimately minimize off. David Chaum constructed the tooling and constructed the concepts wanted for everybody to be their very own financial institution within the Eighties, and but these have been the times of double-digit rates of interest, and the biggest onshoring of greenback demand within the trendy financial period. Now, because the U.S. banking system is displaying critical basic cracks — from UST markets marking unrealized period threat losses, to growing depositor centralization within the Huge 4 American banks, to literal authorities seizure of among the largest regional banks within the nation — it’s no shock {that a} second wave to the ecash revolution has begun.

This text is featured in Bitcoin Journal’s “The Withdrawal Subject”. Click on right here to subscribe now.

A PDF pamphlet of this text is accessible for obtain.