Fast Take

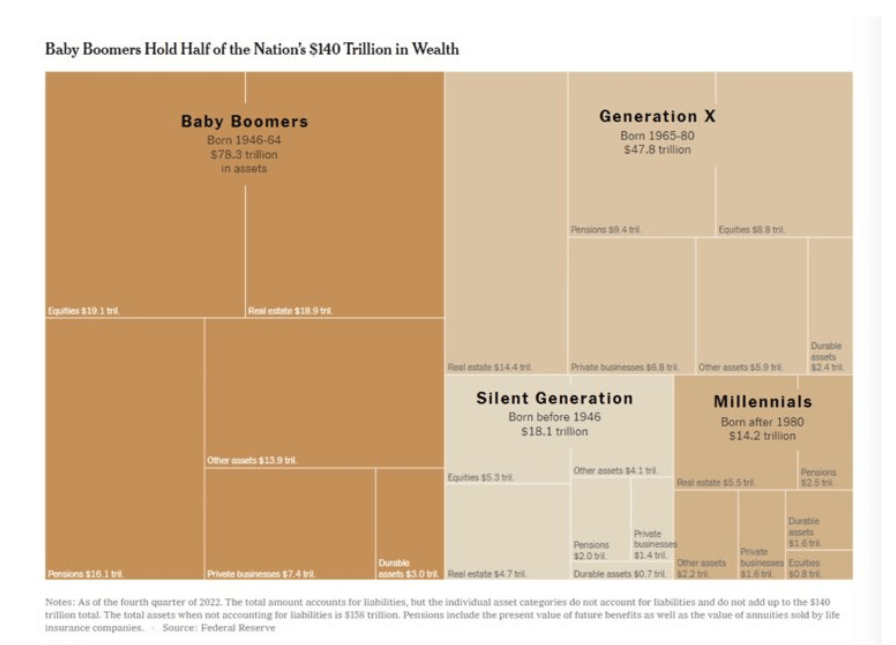

U.S. wealth, as per Federal Reserve knowledge, stands at roughly $140 trillion, an unlimited treasure trove coloured by generational divisions. These variations are thrown into stark reduction when one considers that child boomers oversee roughly $78 trillion in belongings, predominantly in equities and actual property. Era X follows with a good $47.8 trillion. Nonetheless, millennials, tasked with navigating an more and more advanced monetary panorama, maintain a mere $14 trillion, whereas the silent era instructions an estimated $18 trillion.

These figures underscore a strong wealth hole between the generations, the place the youngest are at a major drawback. Nonetheless, the gears of time are inexorable and convey with them inevitable change. As child boomers transfer into retirement and bequeath their belongings to future generations, and millennials step into their prime incomes years, shifts in asset valuations are anticipated.

This generational wealth transition may have a profound influence on the monetary panorama, resulting in potential modifications in funding traits and market dynamics. As this wealth cycle evolves, monitoring these shifts is essential to understanding the long run trajectory of the U.S. financial system.

The submit Generational wealth shift poised to reshape U.S. funding traits and market dynamics appeared first on CryptoSlate.