Riot Platforms (NASDAQ: RIOT) inventory worth continued its sell-off at the same time as Bitcoin and different cryptocurrencies held regular. The shares plunged to a low of $8.90 on Tuesday, the bottom stage since April sixth. It has retreated by greater than 56% from its highest level this 12 months, which means it’s in a deep bear zone.

Bitcoin is holding rather well

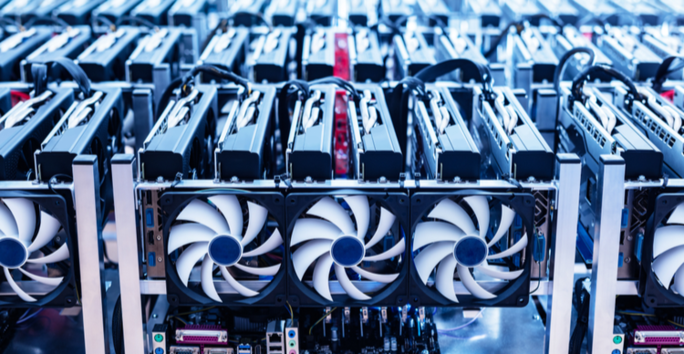

Riot Platforms is a serious firm within the Bitcoin mining business. The corporate runs a few of the largest mining rigs on the earth. For instance, its Rockdale facility is the largest mining and internet hosting facility in North America. It has a deployed hash fee of 10.7 EH/s.

Riot Platforms and different mining firms like Marathon Digital, Cipher Mining, and Argo Blockchain are likely to do properly when Bitcoin worth is rising. This explains why the shares jumped to a excessive of over $20.6 when Bitcoin surged to the year-to-date excessive of $32,000.

Subsequently, it’s fairly shocking that the Riot Platforms share worth has plunged at the same time as Bitcoin has accomplished properly previously few weeks. Bitcoin has remained above $26,200 even because the worry and greed index has dropped to the intense worry zone of 25. The Dow Jones, Nasdaq 100, and S&P 500 have additionally slipped sharply lately.

I imagine that Riot Platforms and Marathon Digital are good speculative buys. For one, I imagine that Bitcoin can be a lot greater than the place it’s immediately. Bitcoin halving is coming in 2024, which is able to probably push its worth greater.

Additional, I think that the Securities and Change Fee (SEC) will approve a spot Bitcoin ETF. Moreover, the main candidates are a few of the largest firms within the business like Blackrock, Constancy, and WisdomTree.

Most significantly, Bitcoin has held fairly properly even because the Federal Reserve has hiked rates of interest to the best level in additional than 20 years.

Riot Platforms inventory worth forecast

The each day chart exhibits that the RIOT share worth has been in a powerful bearish development previously few months. It lately crashed beneath the important thing help at $14.45, the best level in April this 12 months. The inventory has dropped beneath the important thing help at $10.07, the bottom level on August twenty fifth.

Most significantly, the 50-day and 200-day weighted transferring averages (WMA) are about to kind a loss of life cross. Subsequently, the inventory will probably stay underwater for some time. If this occurs, the subsequent stage to observe can be at $8.