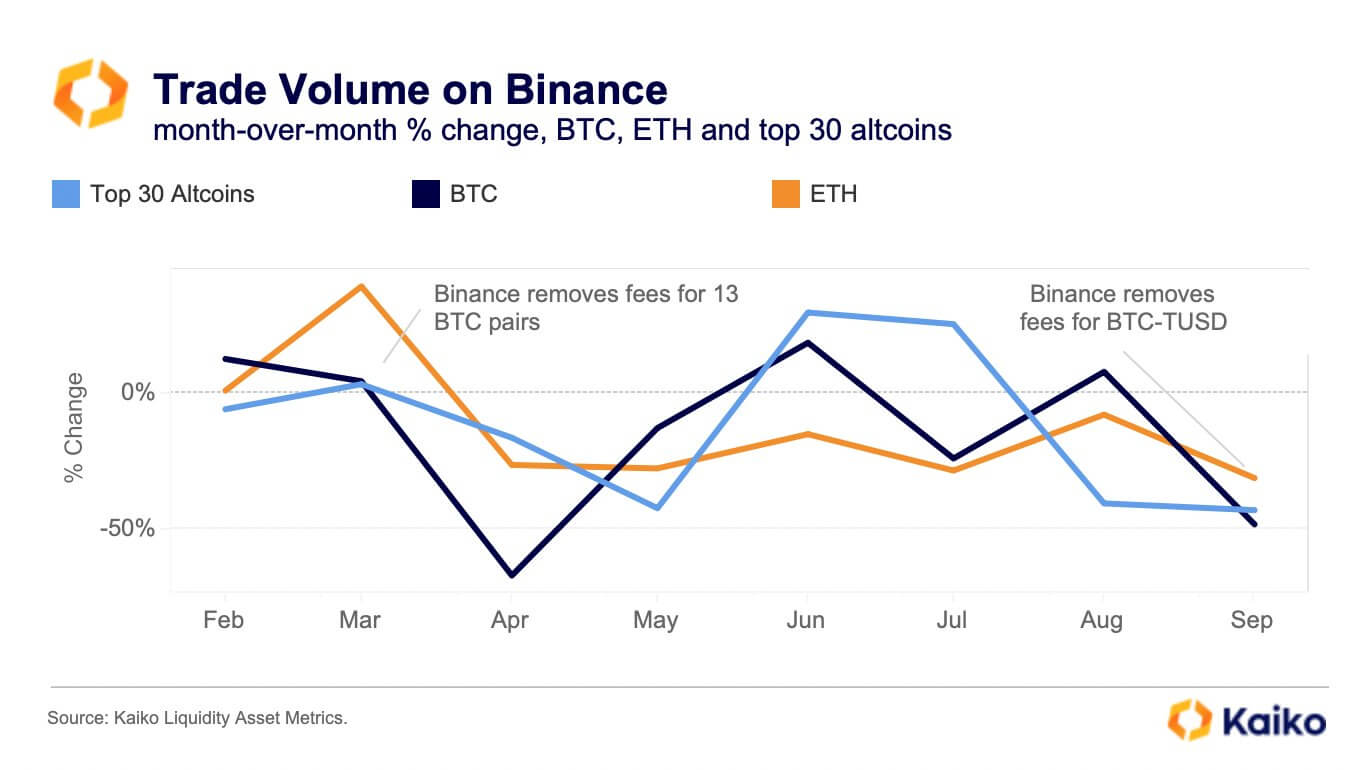

Binance’s Bitcoin buying and selling quantity took a major hit this month, falling 48% after the change reintroduced charges for its most liquid BTC buying and selling pairs.

In a Sept. 29 publish on X (previously Twitter), Kaiko analysis analyst Dessislava Ianeva pointed out that the recorded fall is the second-largest month-to-month decline since April, including that “each drops coincided with the removing of zero charges for the biggest BTC buying and selling pairs.”

In April, the change’s customers left the platform after it canceled the buying and selling incentives connected to its Binance USD (BUSD) because of the regulatory challenges going through the stablecoin. On the time, the change’s buying and selling quantity fell by almost 70% through the second quarter.

The same scenario occurred this month after the change deserted the zero-trading price incentives for its TrueUSD (TUSD) and BTC buying and selling pair, ensuing within the migration of merchants to different platforms.

Binance’s regulatory struggles

Whereas the removing of the free buying and selling incentives has performed an element in Binance’s falling quantity, the change has confronted elevated regulatory troubles throughout varied jurisdictions, together with the U.S. and Europe, which has negatively impacted its total market share.

In the USA, monetary regulators, together with the Securities and Trade Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC), have introduced authorized motion in opposition to it because of its failure to adjust to native legal guidelines. Moreover, there are stories that the change and its CEO, Changpeng Zhao, are below investigation by the U.S. Division of Justice (DOJ).

On the opposite facet of the Atlantic, the platform has needed to voluntarily withdraw its license purposes from some nations, akin to Germany, whereas it has been outrightly denied in some locations.

Amid these points, the change has needed to cope with the latest exits of a number of high executives, together with Binance U.S. CEO Brian Shroder, Normal Counsel Han Ng, Chief Technique Officer Patrick Hillmann, and SVP for Compliance Steven Christie, amongst others.

Nevertheless, Binance co-founder He Yi has tried to downplay all these incidences, saying the change confronted much more difficult conditions in 2019 however emerged out of them stronger. She mentioned the agency “will win this time as effectively.”

The publish Binance’s Bitcoin buying and selling quantity falls amid reintroduced charges and swelling regulatory woes appeared first on CryptoSlate.