In an in-depth analysis shared on X (previously Twitter), Bitcoin skilled Dylan LeClair has pulled again the curtain on a purported “internet of deception” attributed to Justin Solar, Tron’s founder. LeClair’s detailed examination touches on a number of nuanced actions throughout the crypto-sphere, and the findings current doubtlessly alarming implications for the broader ecosystem.

Bitcoin Pundit Raises Grave Accusations

LeClair meticulously unveils what he believes to be a collection of opaque transactions, significantly involving USDT and its alleged alternative, stUSDT, on the crypto change Huobi, rebranded as HTX after its acquisition by Solar in late 2022.

Beginning his investigation, the Bitcoin skilled remarked, “In late 2022, Justin Solar reportedly acquired a controlling stake in Huobi, now named HTX, which had over $1.5b USDT deposits on the time. Over the summer season, deposited USDT funds began getting changed by stUSDT. This substitution has been largely unnoticed by Huobi customers.” The emphasis on the covert alternative underlines the first concern, hinting at an try to surreptitiously exchange a well-accepted stablecoin with a lesser-known counterpart.

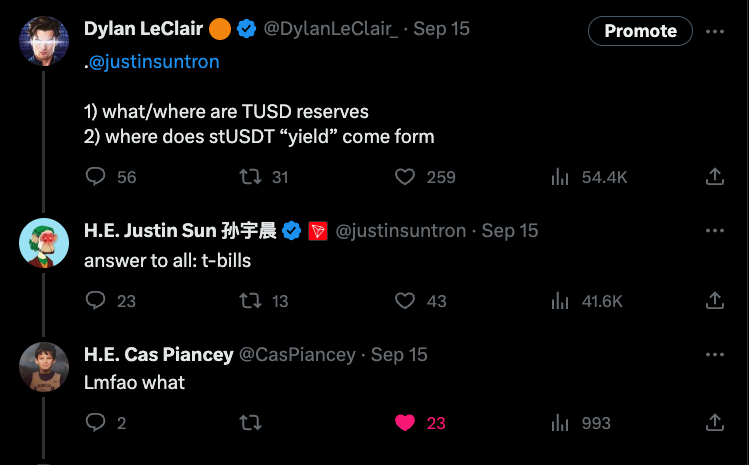

Diving deeper into the murky waters of stUSDT, LeClair questioned its legitimacy. “What’s stUSDT? stUSDT, managed by Justin Solar, claims to offer a yield by investing in ‘Actual World Belongings’ comparable to Treasury payments.” But, utilizing on-chain evaluation and knowledge monitoring, he contends, “the precise stream of funds from Huobi’s USDT to stUSDT after which to JustLendDAO signifies that no such funding into RWAs happens.” This assertion underscores the core of LeClair’s allegation: a possible diversion of funds below the guise of funding.

Corroborating his findings, the Bitcoin skilled cites Patrick Tan from ChainArgos: “We’ve seen this one earlier than — a carefully related ecosystem managed and run by one in all crypto’s largest personalities and a ‘staking’ system that doesn’t ship the stablecoins the place they’re marketed.”

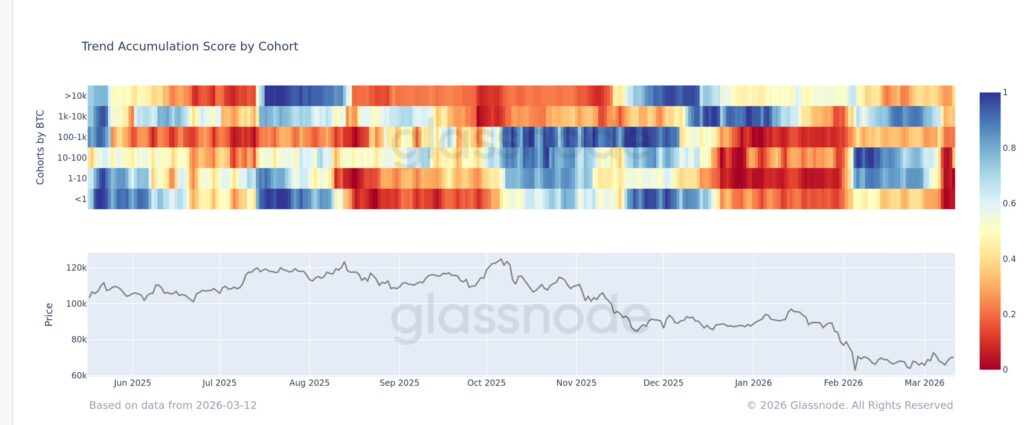

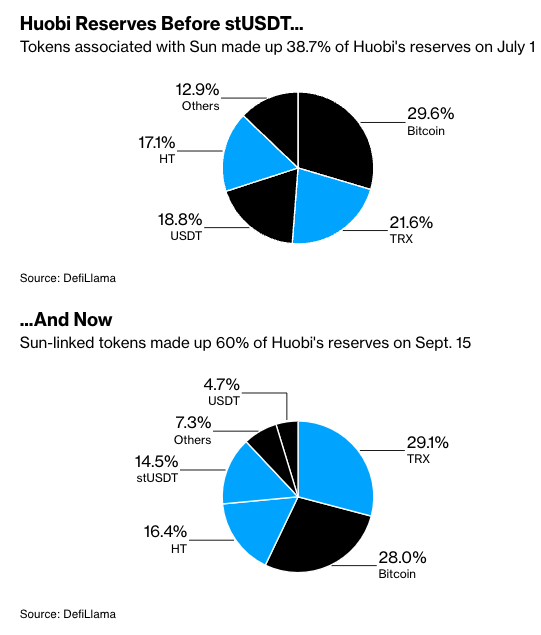

Remarkably, stUSDT and USDT are thought-about the identical asset natively on Huobi, as evidenced by their lack of stUSDT buying and selling pairs. The timeline of Huobi’s reserves, as detailed by LeClair, additional strengthens his argument.

“As seen in Bloomberg, you possibly can see a shift in Huobi’s reserves from July 1 to September 15. On July 1, USDT made up 18.8% of reserves, however by September 15, this had dwindled to simply 4.7%, whereas Solar’s stUSDT grew to characterize 14.5% of reserves.”

Drawing upon these shifts, he elaborates on the potential modus operandi: “Huobi’s USDT will get ‘staked’ for stUSDT, which then strikes to JustLend, a platform Solar controls. The USDT by no means invests in RWAs, however simply sits in JustLend, whereas Huobi customers find yourself with stUSDT as an alternative of the USDT they thought they owned.”

The Function Of TUSD

TUSD’s involvement not solely complicates the alleged technique by Solar however additional broadens the scope of LeClair’s investigation. Prior to now half-year, a big share of TUSD burnings may be traced again to 2 particular wallets, each linked to Solar.

“So isn’t it handy that you could now ‘stake’ TUSD, to mint stUSDT,” LeClair remarks, including that in idea TUSD/USDT is burned, in order that the availability decreases and the supposed money backing it invests in t-bills that earn a yield that’s handed onto the holders of stUSDT.

Nevertheless, on-chain knowledge offered by the specialists contradicts this. The Bitcoin pundit discovered a fancy transaction sample. One instance: “500m of TUSD is minted > despatched to Huobi > then despatched to Solar’s wallets > parked in JustLend, mints stUSDT > stUSDT to Huobi > TUSD will get burned, stUSDT on Huobi stays.”

Underscoring the potential motivations behind such an online, LeClair alleges that Solar is utilizing the USDT model and its status to swap it for pretend stUSDT whereas it seems as common USDT within the UI/UX on Huobi. “After which what? What’s the tip objective? Why create an IOU of one other steady and trick your customers behind the person interface?” the analyst questions.

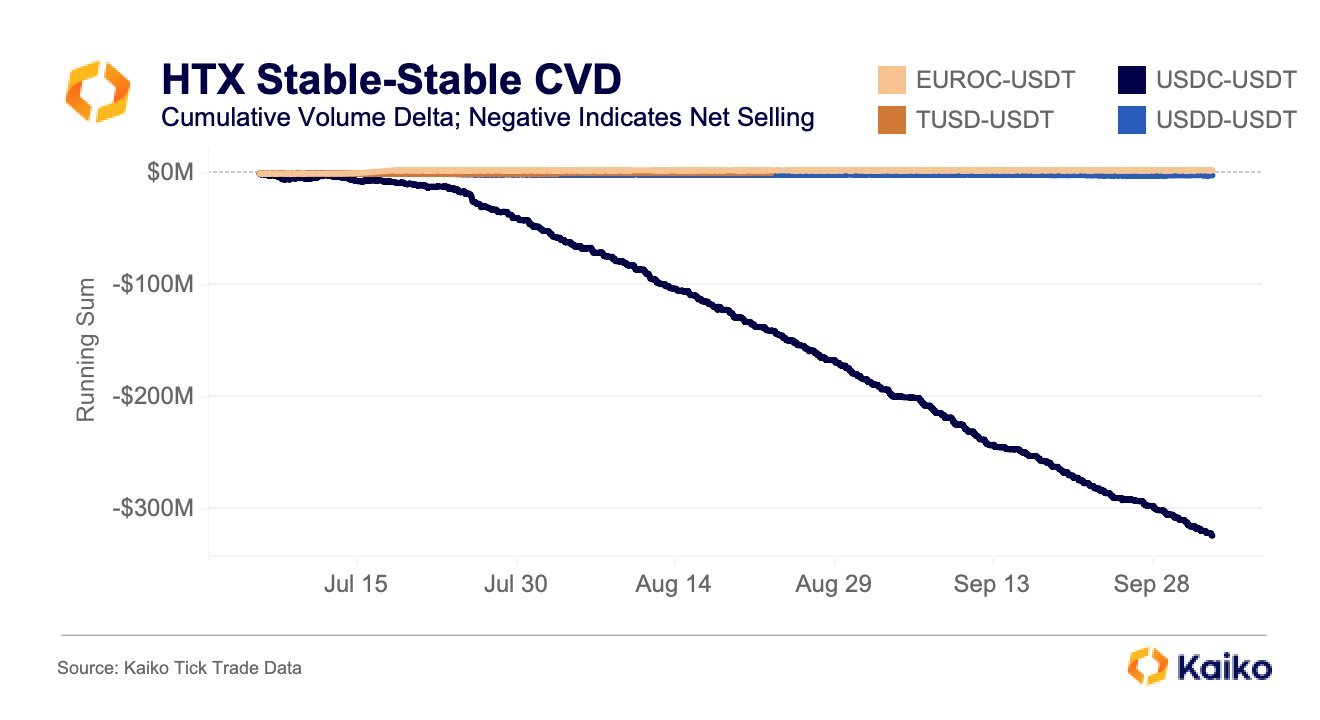

Analyzing buying and selling knowledge, LeClair presents proof of a broader pattern. Solar is allegedly draining USD liquidity from the Bitcoin and crypto ecosystem by means of Circle’s USDC. “Knowledge from Kaiko exhibits this clearly by means of the USDC-USDT Cumulative Quantity Delta (CVD) on Huobi, with $325 million USDT has been offered off for USDC in simply over 2 months.”

Binance Concerned?

Moreover, the Bitcoin pundit additionally brings Binance into the highlight, highlighting its dealings with TUSD. He states, “The actual attention-grabbing chart is a have a look at the TUSD excellent provide, and the timing of its largest mints. Handy timing for billion-dollar will increase within the stablecoin, despatched on to Binance at a time the place zero payment buying and selling is enabled.”

Additional including suspicion to Binance’s actions, he continues, “By no means-mind that TUSD attestations are blatantly unreliable/shady, and its largest mints are coincidentally timed completely w/ market selloffs.”

Wrapping up his deep dive, LeClair delivers a stark warning and an assertive conclusion. He implores, “Huobi customers, get out of USDT, into one other asset, and withdraw instantly,” earlier than including, “It’s no marvel the Chief Technique Officer for Circle is saying that the crypto ecosystem is blatantly counterfeiting USD.”

Leaving no room for ambiguity, LeClair’s ultimate take is: “Solar is creating an online of deception in an effort to siphon USD liquidity out of crypto utilizing a mess of faux stablecoins. He’s a fraud.”

At press time, Bitcoin traded at $27,711.

Featured picture from The New York Instances, chart from TradingView.com