Arthur Hayes, the co-founder of BitMEX, has provided a daring prediction for the way forward for Bitcoin, asserting that the Federal Reserve’s potential return to cash printing may ship the main cryptocurrency on a hovering trajectory.

Hayes’ insights delve into the intricacies of the bond market, highlighting a disconcerting development that he believes might power the Fed’s hand in bolstering the US economic system.

He factors to a particular phenomenon often called the “bear steepener” as a pink flag within the bond market. This time period describes a state of affairs by which long-term bond rates of interest improve at a quicker tempo than short-term charges. Traditionally, the bear steepener has usually served as a bearish sign for each shares and different danger property.

The quicker this bear steepener rises, the quicker somebody goes stomach up, the quicker everybody recognises there isn’t any approach out aside from cash printing to save lots of govt bond markets, the quicker we get again to the crypto bull market :). The Lord is my Shepherd, I shall not need.

— Arthur Hayes (@CryptoHayes) October 4, 2023

Bitcoin’s Potential Worth Surge

Hayes observes that as this bear steepener accelerates, the probability of financial misery and insolvency looms bigger. This, in his view, will ultimately go away policymakers with no recourse however to resort to cash printing to salvage authorities bond markets. And it’s this very state of affairs that Hayes believes will reignite the crypto bull market.

Along with his prognosis for the Fed’s financial coverage, Hayes paints a remarkably bullish image for Bitcoin’s future value trajectory. He anticipates that by 2026, Bitcoin may attain a staggering worth ranging between $750,000 to $1 million. This projection stands out in stark distinction to many conservative forecasts presently circulating within the crypto house.

BTCUSD buying and selling a couple of a whole lot under the $28K degree. Chart: TradingView.com

What fuels Hayes’ optimism about Bitcoin’s potential meteoric rise? He cites a confluence of essential components that, in his estimation, may propel the cryptocurrency to those unprecedented heights. Firstly, he foresees the opportunity of a looming monetary disaster that might drive rates of interest all the way down to zero.

Alternatively, he envisions a state of affairs the place charges may rise, however not at a tempo that matches the voracious urge for food of governments’ spending. In both case, the stage could be set for Bitcoin to shine as a secure haven asset.

Bitcoin Valued At $70,000 By 2024?

Even earlier than the grandiose projections for 2026, Hayes predicts that by the top of 2024, Bitcoin may command a value of round $70,000. This forecast is rooted within the anticipation of the subsequent crypto halving occasion, a phenomenon that traditionally has had a major influence on Bitcoin’s value. If this prediction holds true, it might signify substantial development from Bitcoin’s present market value.

Hayes’ insights into the interaction between the Federal Reserve’s potential financial coverage shifts, bond market dynamics, and Bitcoin’s future worth supply a singular perspective on the cryptocurrency’s trajectory. Whereas these predictions are undeniably daring, they underscore the intricate relationship between macroeconomic components and the digital asset market.

The present value of Bitcoin on CoinGecko stands at $27,699, with a 24-hour acquire of 1.1% and a seven-day improve of 4.8%.

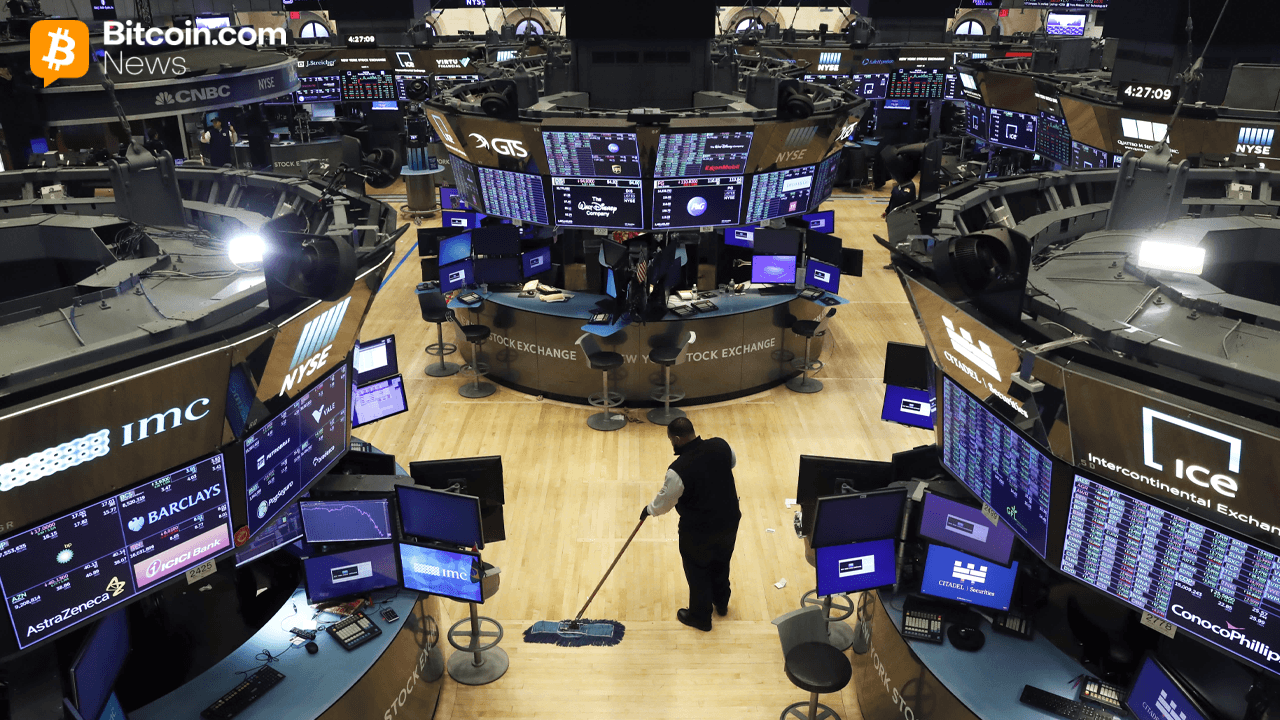

Featured picture from iStock