Actual-world property (RWAs) are rising as one of many subsequent mega tendencies within the crypto area, and in line with a current research by K33 Analysis, Chainlink might revenue in an enormous method from this development. In a current research, the analysis agency projected that LINK could be the “most secure guess” to capitalize on this impending growth. This sentiment displays the broader business outlook, particularly given BlackRock CEO Larry Fink’s earlier feedback in Could the place he famous the potential of tokenization in securities.

“The following technology for markets, the subsequent technology for securities, will likely be tokenization of securities,” remarked Larry Fink throughout a New York Occasions DealBook occasion. He additional elucidated that tokenization, which is the creation of a digital illustration of an asset on a blockchain, would facilitate “instantaneous settlement” and notably cut back transactional charges.

What Makes Chainlink The Go-To Selection?

The rising curiosity within the tokenization of RWAs, which incorporates conventional monetary devices like personal fairness, credit score, and bonds, has paved the way in which for the growing valuation of LINK. Tokenization is now not a buzzword however a mechanism to optimize monetary transactions by lowering prices, streamlining operations, and enhancing transparency and accessibility.

David Zimmerman, an analyst at K33 Analysis, talked about, “If we want to have publicity to the RWA narrative and keep away from being sidelined when it takes off, LINK is the most secure guess.”

World monetary establishments and rising cryptocurrency platforms are gearing as much as leverage this development. A testomony to that is JPMorgan’s current announcement about its first reside blockchain-based collateral settlement transaction, which concerned business giants BlackRock and Barclays.

Chainlink, as a undertaking, has strategically positioned itself on this area, appearing as a bridge between blockchains and the exterior world. The undertaking’s distinctive system of oracles and an expansive record of partnerships emphasize its pivotal function.

“Chainlink, with its system of oracles and broad partnerships, is well-positioned to attach blockchains with real-world knowledge, making it a robust participant within the RWA narrative,” stated famend crypto analyst Scott Melker, echoing Zimmerman’s insights.

Zimmerman additional opined that whereas Chainlink may not report the very best beneficial properties on this RWA motion, its strong infrastructure and pivotal function within the ecosystem make it probably the most well-placed initiatives to harness the potential advantages.

Regardless of the plain potential and traction that RWAs have gained, Zimmerman highlighted potential challenges in realizing their full potential. But, the prevailing narrative’s attract is so compelling that we’d witness “an remoted RWA crypto bubble” even earlier than its tangible real-world impacts turn out to be ubiquitous.

Zimmerman’s recommendation to potential traders is to be affected person. The advice is to attend for the token to hit the long-term help degree of round $5.70 earlier than diving into lengthy positions.

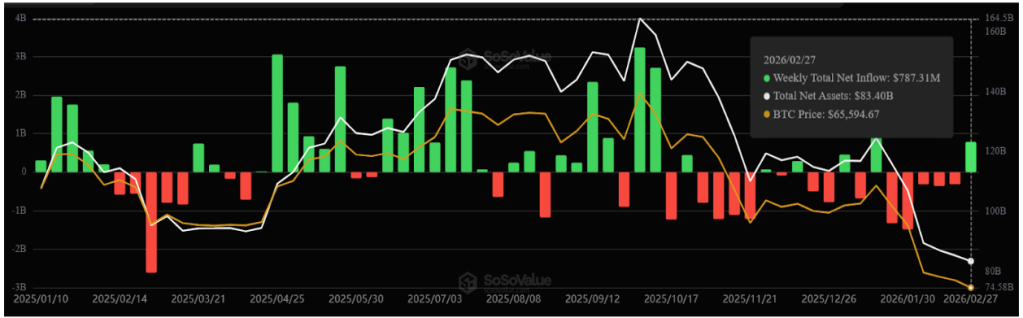

LINK Value Stays Trapped In Development Channel

The Chainlink worth has been buying and selling inside a descending development channel since June final yr. Even the current hype across the partnership with Swift and the SmartCon was not sufficient to push LINK out of the development channel. In complete, LINK has been rejected on the higher trendline six instances, final on October 1.

A bullish signal for the time being is that Chainlink is holding above the 50% Fibonacci retracement at $7.19 regardless of the sharp correction within the broader crypto market. If this holds over the subsequent few days, LINK might try a retest in direction of the higher resistance line.

If the help breaks, K33 Analysis’s state of affairs might come true and Chainlink might fall under the $6 worth once more. Thus, the help is instrumental in figuring out whether or not Chainlink is at the moment a purchase or promote.

Featured picture from Shutterstock, chart from TradingView.com