The crypto market is poised for yet one more eventful week, as a number of developments are set to unfold, from the anticipated approval of a spot Bitcoin ETF within the US to macro occasions which have implications on the broader monetary markets.

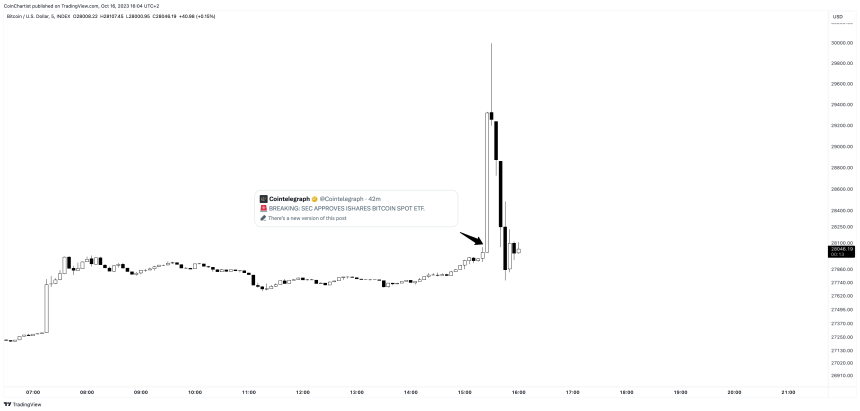

Undoubtedly, the most important level of rivalry throughout the Bitcoin and crypto markets stays the potential approval of a spot Bitcoin ETF within the US, as Bitcoinist reported earlier as we speak. However there’s extra to come back this week.

Macro Occasions Impacting Bitcoin And Crypto

Whereas main macro occasions are sparse this week, they’re removed from insignificant. Key occasions embody:

- Tuesday: US retail gross sales

- Wednesday: US constructing permits, housing gross sales knowledge, Tesla earnings report (change within the Bitcoin steadiness sheet?)

- Thursday: US jobless claims, current dwelling gross sales, and notably, Fed chair Powell’s speech.

The monetary neighborhood is on excessive alert relating to Powell’s upcoming speech. After a latest rise in US inflation above expectations in each CPI and PPI and the tense scenario within the bond market, the market will likely be very eager to listen to what Powell has to say. Is he signaling that there might need to be one other charge hike to beat inflation, or is Powell emphasizing the tight scenario within the bond market, which might make additional charge hikes out of date? A number of Fed Audio system highlighted this in latest speeches.

A prevalent sentiment means that the surge in bond yields has been inherently serving to constrict monetary situations. But, an ironic twist is clear: the dovish narratives by Fed officers asserting the absence of a necessity for tighter insurance policies appeared to counteract these constraints, resulting in a leisure of the initially tightened situations. Powell’s opinion on these circumstances might additionally have an effect on the Bitcoin and crypto market.

Remarkably, that is the final week of Fed audio system earlier than a two-week blackout interval earlier than the following FOMC assembly from October 31 to November 1. The importance might due to this fact be significantly excessive.

Remarkably, amidst this uncertainty, Gold is up 5.6% over the previous six days, pushed by a mix of macro occasions reminiscent of central financial institution insurance policies and the Israel-Hamas warfare. In accordance with some analysts, like MacroScope, this can be a bullish signal for Bitcoin. He explained that “primarily based on the historic lead/lag relationship between gold and BTC (gold leads, then BTC catches up), BTC must be watched intently for a transfer [up].”

Noteworthy Crypto Occasions

Within the altcoin universe, notable occasions encompass Axie Infinity’s (AXS) impending unlock of $64 million value of tokens on October 20, marking a considerable 11.5% of its circulating provide. The highlight additionally rests on the Arbitrum ecosystem, recent from its grant voting section. The ramifications of those grants, significantly regarding ecosystem incentives, could possibly be notable. Protocols like GMX, MUX, and Camelot have emerged as frontrunners in grant allocation.

Elgorand’s (EGLD) xDay Convention by MultiversX, set for October 19, can also be poised to generate buzz, given the historic significance and revelations from its previous conferences. Lastly, ApeCoin’s (APE) forthcoming unlock of $16.7 million in APE on October 17, predominantly directed in the direction of its founding staff and early contributors, has analysts anticipating potential value fluctuations.

Whereas this week may not be as jam-packed because the earlier ones, the ramifications of those occasions might form the trajectory of the crypto market within the weeks to come back.

At press time, Bitcoin traded at $27,844, up 3.5% within the final 24 hours.

Featured picture from Shutterstock, chart from TradingView.com