An analyst has identified how some suspicious Bitcoin shopping for exercise occurred on Bybit and Deribit within the leadup to yesterday’s flash surge.

Bitcoin Taker Purchase Promote Ratio Noticed Extraordinary Spikes On Bybit & Deribit Yesterday

In a brand new post on X, Julio Moreno, head of analysis at CryptoQuant, mentioned how the BTC taker buy-sell ratio seemed like for the totally different exchanges available in the market main as much as the shock rally yesterday.

The “taker purchase promote ratio” right here refers to an indicator that retains observe of the ratio between the taker purchase and taker promote volumes for Bitcoin on any given trade (or group of platforms).

When the worth of this metric is bigger than 1, it implies that the taker purchase quantity is greater than the promote quantity at the moment. Such a development means that the buyers are keen to pay extra to buy the asset and thus, a bullish sentiment is shared by the bulk.

Then again, a price beneath the edge implies a bearish mentality is energetic on the trade because the merchants are keen to promote the asset at a cheaper price in the meanwhile.

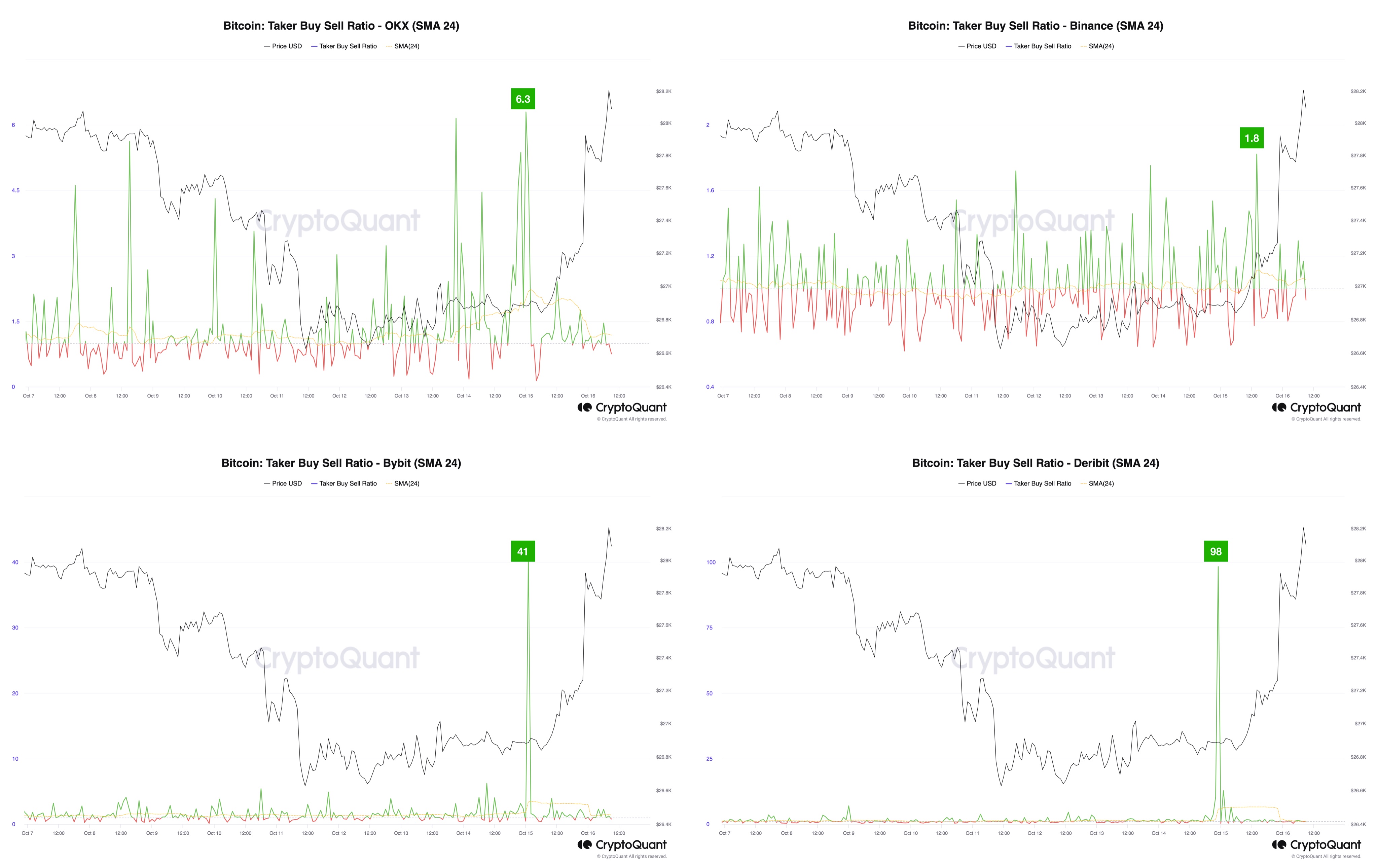

Now, here’s a chart that reveals the development within the 24-day easy shifting common (SMA) Bitcoin taker buy-sell ratio over the previous few days for 4 exchanges: Binance, OKX, Bybit, and Deribit.

Appears like the worth of the metric was fairly excessive on the underside two platforms | Supply: @jjcmoreno on X

Yesterday, Bitcoin noticed a really sharp sudden rally as false information broke out that the iShares BTC spot ETF had been authorized by the US SEC. This surge, nonetheless, retraced in as spectacular a style because it had occurred because the market shortly realized that the rumor was with none substance.

From the chart, it’s seen that every one 4 of those exchanges noticed spikes within the taker buy-sell ratio within the hours main as much as this rally. The spikes on Binance and OKX, although, have been of fairly regular ranges, as spikes of comparable scales had occurred within the previous days as nicely.

Within the case of Bybit and Deribit, nonetheless, the 24-day SMA of the ratio had hit peaks of 41 and 98, respectively, that are each extraordinarily excessive ranges. For comparability, the indicator solely hit 1.8 on Binance and 6.3 on OKX.

This might counsel that some actually excessive Bitcoin shopping for quantity was noticed on Bybit and Deribit, which was in contrast to what was seen on different exchanges within the sector.

It’s unclear what this sample means, nevertheless it’s potential that some customers on these platforms had already been tipped on the faux announcement upfront.

BTC Value

Whatever the fast rally and crash, Bitcoin has loved some upward momentum through the previous couple of days because the cryptocurrency’s worth has now climbed towards the $28,500 stage.

The asset has been going up through the previous few days | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, CryptoQuant.com

![Find out how to Purchase TVs with Bitcoin [2023] Find out how to Purchase TVs with Bitcoin [2023]](https://bitpay.com/blog/content/images/2023/10/buying-tvs-with-bitcoin-bitpay.jpg)