Lots of of latest cryptocurrencies be a part of the market yearly, however Bitcoin nonetheless stands above all of them. Its success may be attributed to many elements, like its mainstream recognition, pioneering standing and, after all, its meticulously designed financial ideas.

Central to this design is Bitcoin mining — a course of that permits miners to obtain rewards for validating transactions. Nonetheless, in contrast to many belongings, Bitcoin has a restricted provide. Consequently, periodically, the mining reward is halved in an occasion referred to as “halving.” I’ve seen firsthand how these halvings can create waves within the crypto trade, influencing each Bitcoin’s value and the final market sentiment. On this article, I’ll check out what Bitcoin halvings are, why they happen, and the way they will influence the remainder of the crypto trade.

What Is Bitcoin Halving?

Bitcoin, one of many world’s most well-known digital currencies, has a singular financial coverage constructed into its code. At its coronary heart is an occasion referred to as the Bitcoin halving. This occasion is basically a discount within the block rewards acquired by miners for verifying and including transactions to the blockchain.

Initially, when Bitcoin was created, miners acquired 50 BTC per block as their reward. Nonetheless, each 210,000 blocks, or roughly each 4 years, this reward is lower in half. So, after the primary halving, it dropped to 25 Bitcoins per block, to 12.5 after the following, and so forth.

What Occurs Throughout a Bitcoin Halving?

Throughout a BTC halving:

- Block rewards that miners obtain for including new transactions to the blockchain are lowered by 50%.

- Consequently, the BTC per block that miners obtain as their reward for mining decreases, making the general inflation fee of Bitcoin drop.

- Transaction charges don’t get halved. They proceed to offer an incentive for miners to maintain the community safe, particularly as block rewards lower over time.

- The crypto market usually reacts to this occasion with elevated hypothesis and discussions about Bitcoin’s future worth and position within the monetary ecosystem.

Why Do Bitcoin Halvings Happen?

Bitcoin halvings are integral to its design and have a number of functions:

- Managed Provide. In contrast to fiat currencies that may be printed in limitless portions by central banks, Bitcoin has a most provide of 21 million cash. The halving mechanism ensures that these Bitcoins are launched into the system progressively, which makes it a deflationary asset over time.

- Decreased Inflation. By lowering the rewards for miners, the inflation fee of Bitcoin is lowered. That is in stark distinction to conventional fiat currencies, the place inflation may be influenced by exterior elements corresponding to political selections or financial circumstances.

- Sustainability. The halving course of ensures that every one 21 million Bitcoins gained’t be mined too rapidly, giving the Bitcoin community extra time to develop, mature, and turn out to be extensively adopted.

- Miner Incentive. Though block rewards lower, the hope is that the growing worth of Bitcoin, coupled with transaction charges, will proceed to offer a profitable incentive for miners to take care of the community’s safety and integrity.

Basically, whereas Bitcoin and different digital belongings proceed to evolve within the ever-changing crypto market, the halving mechanism serves as a balancing act, regulating Bitcoin’s provide and, by extension, its worth in opposition to conventional belongings and currencies. It stands as a testomony to Bitcoin’s promise to problem the established order of central banks and conventional fiat currencies, providing another within the type of decentralized digital foreign money.

Bitcoin Halving Historical past

The Bitcoin halving occasion performs a pivotal position in shaping Bitcoin’s financial mannequin and market dynamics. Through the years, there have been a number of such occasions, every influencing Bitcoin miners, Bitcoin transactions, and the general crypto market in their very own distinctive methods. Diving into the Bitcoin halving dates historical past can provide us a broader understanding of its influence on the digital foreign money’s panorama.

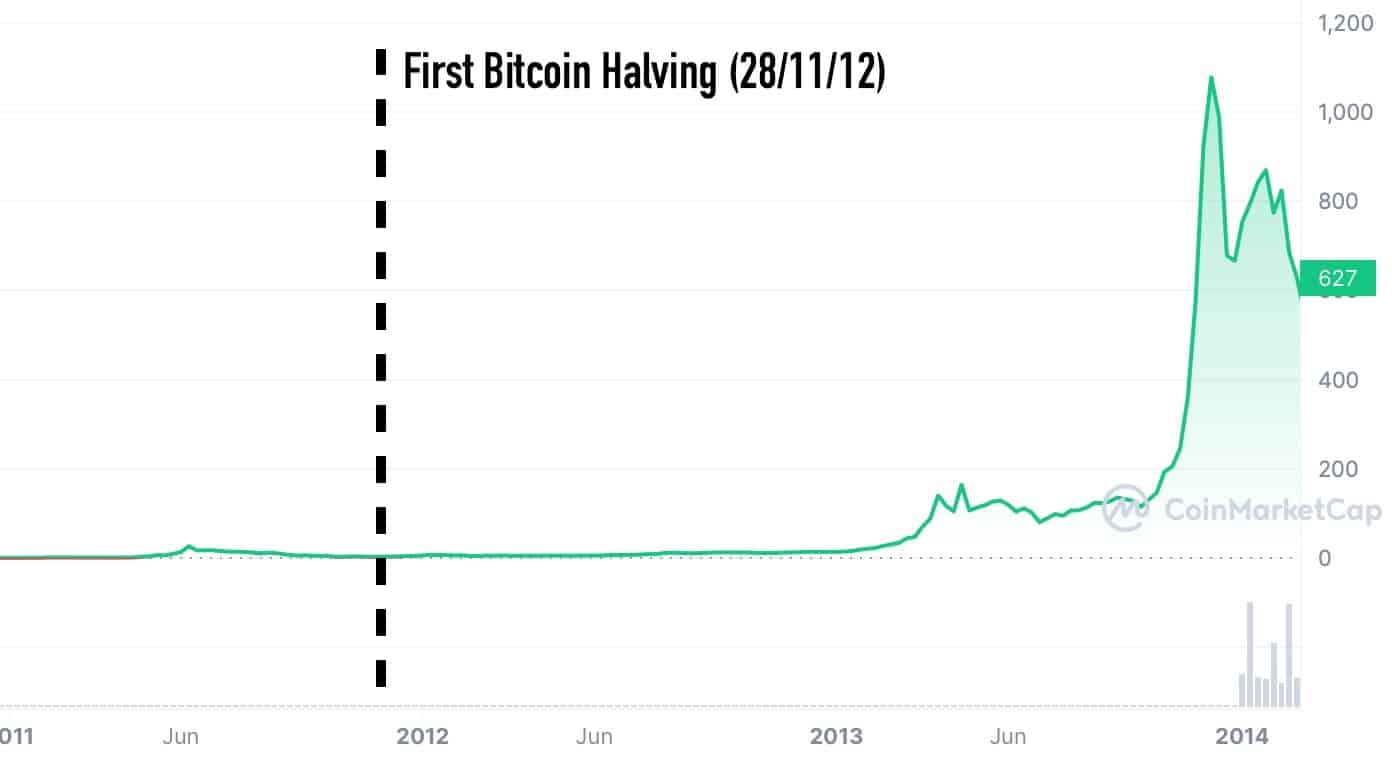

First Bitcoin Halving (2012)

Date: November 28, 2012

Block Reward Earlier than Halving: 50 BTC

Block Reward After Halving: 25 BTC

The primary Bitcoin halving was a big milestone, coming simply three years after Bitcoin’s launch. This occasion set the precedent for future halvings. Whereas it was a second of intrigue inside the crypto group, the broader world was nonetheless acquainting itself with the idea of Bitcoin. Within the aftermath of this halving, Bitcoin’s value skilled a gradual ascent, signaling the potential for future value surges.

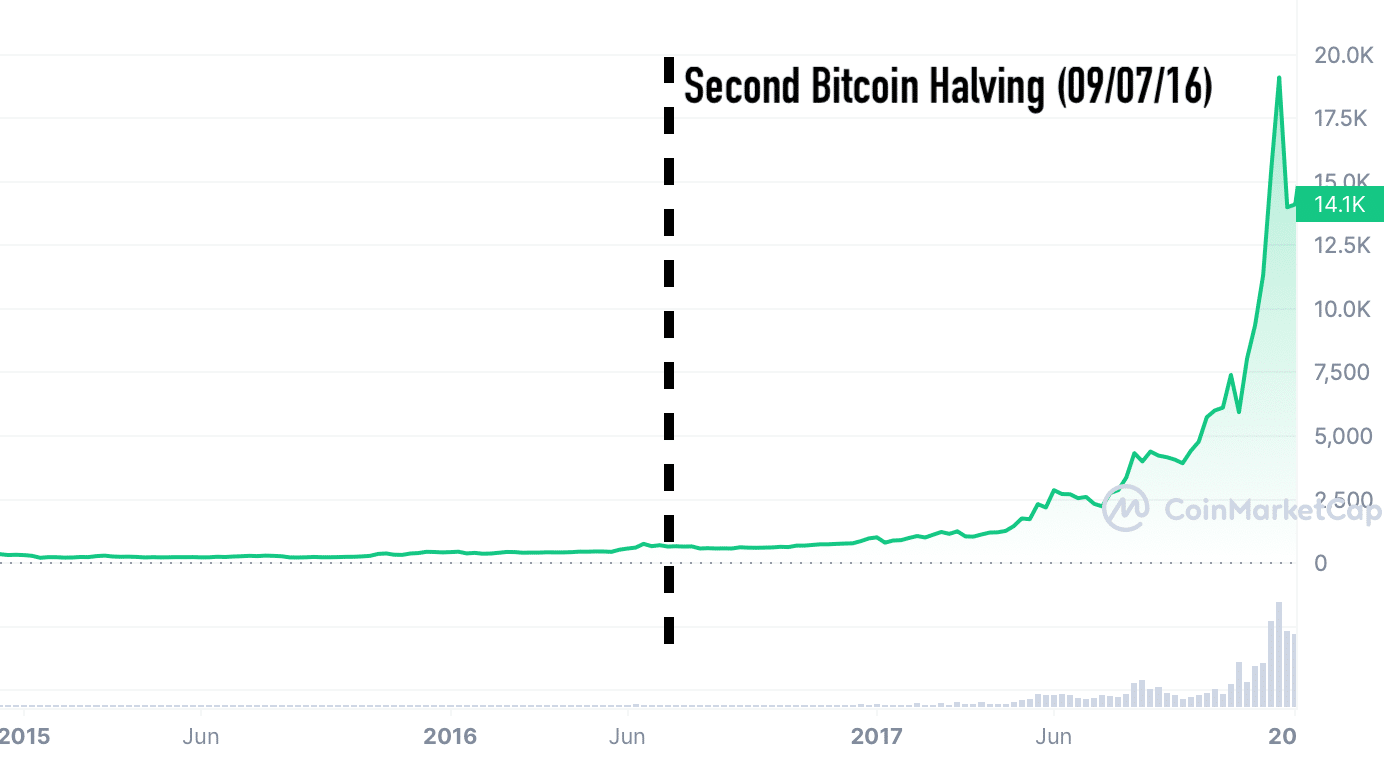

Second Bitcoin Halving (2016)

Date: July 9, 2016

Block Reward Earlier than Halving: 25 BTC

Block Reward After Halving: 12.5 BTC

By the second halving occasion, Bitcoin had garnered vital consideration. The crypto market watched eagerly, and the occasion didn’t disappoint. Within the ensuing months, Bitcoin’s worth began climbing, culminating within the exceptional bull run of 2017.

Third Bitcoin Halving (2020)

Date: Might 11, 2020

Block Reward Earlier than Halving: 12.5 BTC

Block Reward After Halving: 6.25 BTC

The third Bitcoin halving occasion was met with a lot anticipation. With a rising acknowledgment of digital currencies and their potential to reshape monetary programs, this halving drew immense consideration. Following this occasion, regardless of a number of world financial challenges, Bitcoin’s resilience shone by because it ventured into new all-time value highs.

When Is the Subsequent Bitcoin Halving?

The Bitcoin protocol specifies {that a} halving occasion happens each 210,000 blocks. Provided that the final halving occurred in Might 2020 at a block peak of 630,000, the following halving is anticipated across the 840,000th block. If we contemplate {that a} new block is added to the Bitcoin blockchain roughly each 10 minutes, the following halving is projected to happen in 2024.

FAQ

How does Bitcoin halving work?

Each 210,000 blocks, the block reward given to Bitcoin miners for processing Bitcoin transactions and including them to the Bitcoin blockchain is lowered by 50%. This occasion is hardcoded into the Bitcoin protocol, making certain that the overall Bitcoin provide doesn’t exceed its cap of 21 million.

What occurs when there aren’t any extra Bitcoins left?

Bitcoin has a capped provide of 21 million cash. As of now, nearly all of these cash have already been mined, however it would take till roughly the yr 2140 for the final Bitcoin to be mined. After the final BTC has been mined, miners will not obtain block rewards within the type of new Bitcoins.

As an alternative, their incentive to maintain validating transactions and sustaining the community’s safety will come solely from transaction charges. The Bitcoin protocol has been designed with this eventual state of affairs in thoughts, emphasizing the significance of transaction charges within the long-term sustainability of the Bitcoin blockchain.

Will Bitcoin value rise after the following halving?

Whereas previous occasions present insights, they don’t essentially dictate future outcomes. But, they undoubtedly underscore the importance of the halving mechanism in Bitcoin’s design. Traditionally, earlier halvings have been adopted by durations of great value appreciation for Bitcoin. Nonetheless, it’s important to know that quite a few elements affect the worth of Bitcoin, together with however not restricted to market demand, world financial circumstances, regulatory developments, and technological developments.

Whereas the discount within the mining reward tends to minimize the promoting stress from miners (since they’ve fewer Bitcoins to promote), there’s no assured consequence. Previous value actions post-halving function a reference, however they don’t predict future efficiency. It may be useful to review developments following earlier halvings for informational functions, however one ought to method the long run with an understanding of Bitcoin’s broader ecosystem and the myriad of things that may affect its worth.

Disclaimer: Please notice that the contents of this text usually are not monetary or investing recommendation. The data offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.