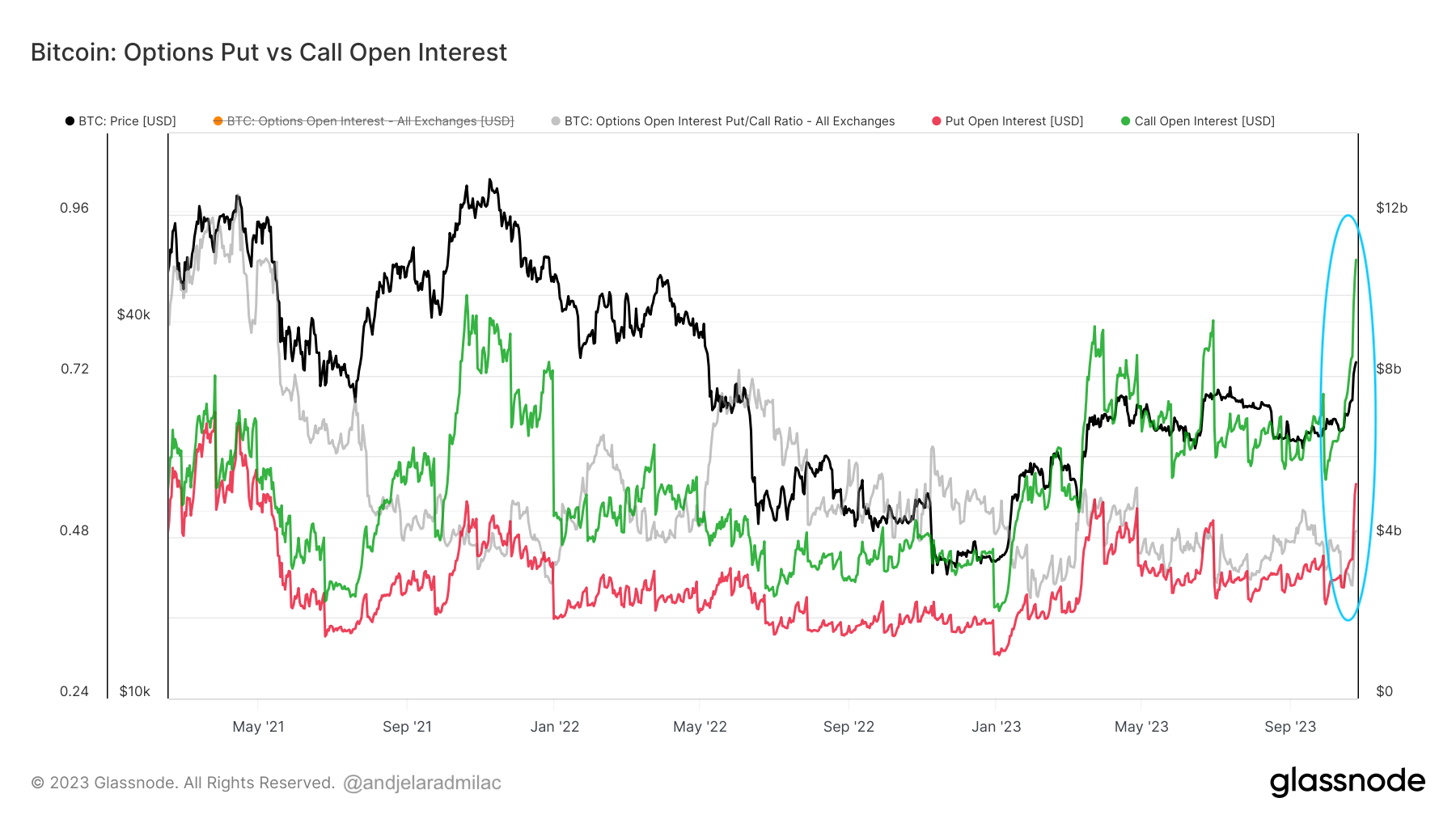

Over the previous week, Bitcoin (BTC) ‘s value has witnessed a notable surge, sparking heightened exercise within the cryptocurrency market. One space that gives distinctive insights into merchants’ sentiments and expectations about this value motion is the choices market. We will gauge how merchants are positioning themselves in anticipation of future value actions by means of metrics like open curiosity, quantity, and strike costs.

Choices are monetary derivatives that give the holder the best, however not the duty, to purchase or promote an underlying asset (on this case, Bitcoin) at a predetermined value on or earlier than a selected date.

Choices are available two major types: name choices, which give the holder the best to purchase the underlying asset, and put choices, which give the holder the best to promote the underlying asset.

Choices open curiosity represents the whole variety of excellent (not but settled) possibility contracts out there. A excessive OI signifies vital curiosity in a specific possibility, suggesting sturdy sentiment (both bullish or bearish) in direction of the underlying asset. It supplies a way of the whole market publicity or dedication merchants have.

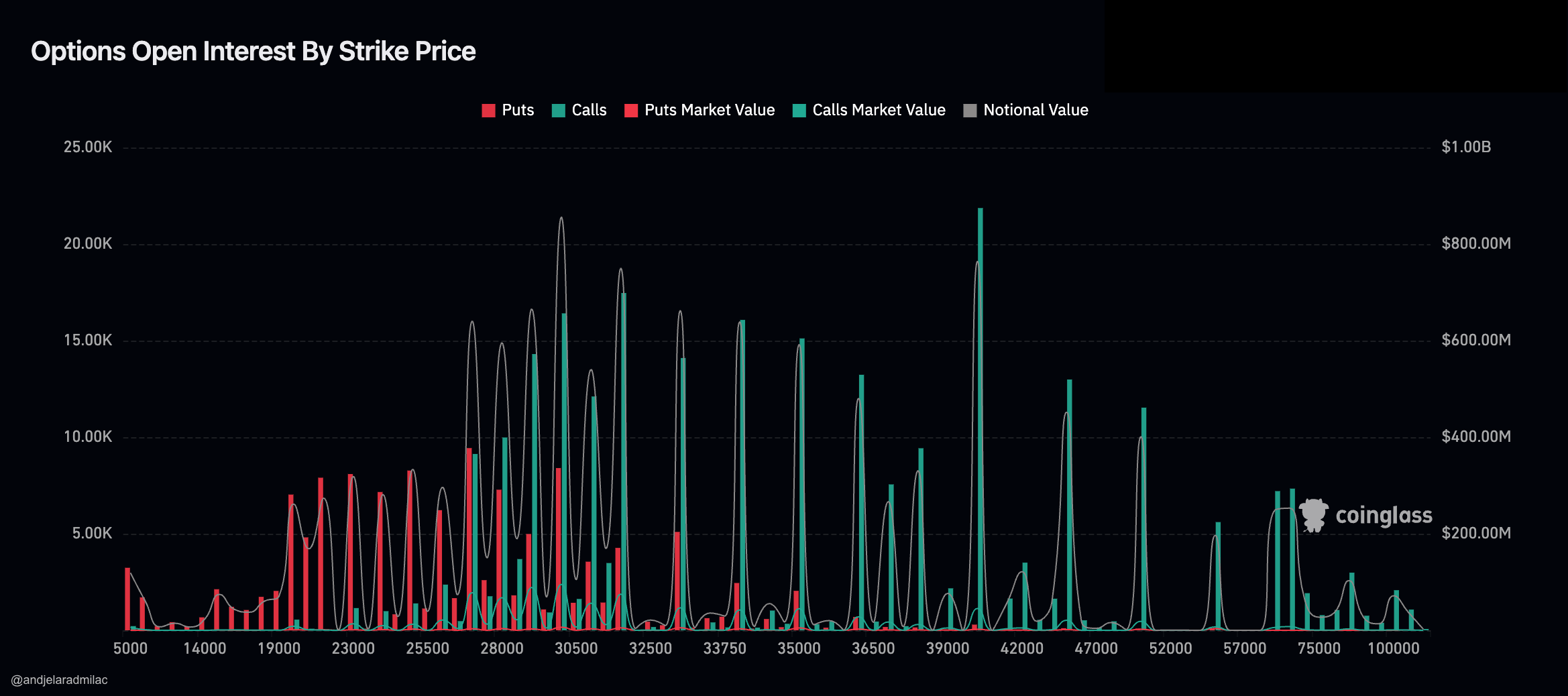

The open curiosity on calls reached an all-time excessive of $10.86 billion on Oct. 25, rising from $7.58 billion on Oct. 18. Throughout the identical interval, open curiosity on places elevated from $3.34 billion to $5.31 billion.

The bullish development in Bitcoin’s value from Oct. 18 to Oct. 25 was accompanied by elevated put and name open pursuits. This means that merchants actively participated out there, with a traditionally unprecedented bullish expectation and a wholesome bearish hedge. This could possibly be attributable to numerous causes, corresponding to anticipated information occasions and elevated volatility, more than likely in regards to the upcoming Bitcoin ETF within the U.S.

The put/name ratio is used to gauge market sentiment because it exhibits the proportion of places to calls. A ratio above 1 signifies bearish sentiment (extra places than calls), whereas a ratio under 1 signifies bullish sentiment (extra calls than places). The rise within the ratio from 0.425 to 0.489 between Oct. 15 and Oct. 25 means that whereas the market remained bullish (for the reason that ratio continues to be under 1), there was a relative improve in bearish sentiment or hedging exercise in comparison with bullish sentiment.

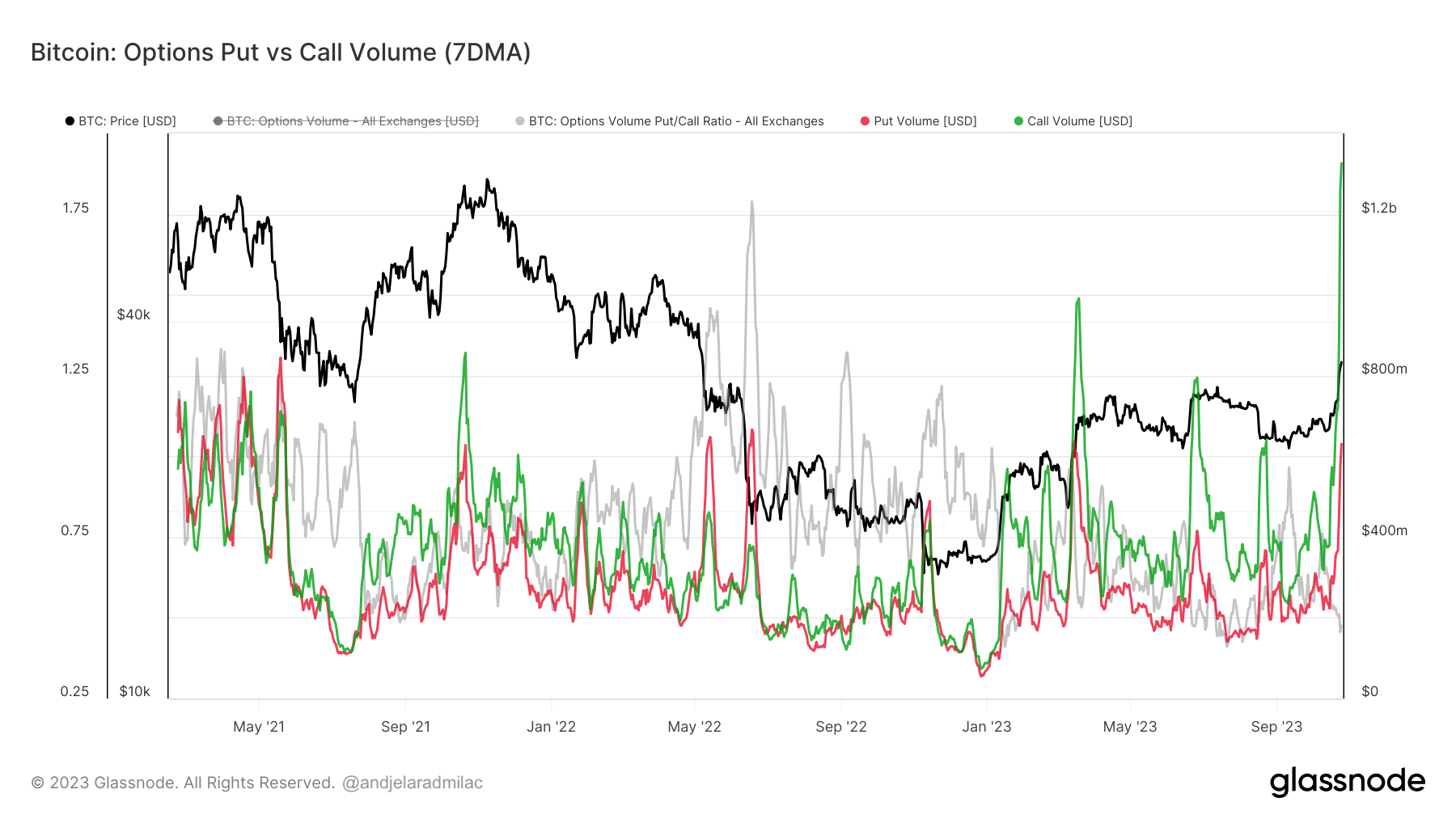

An analogous improve was additionally seen within the choices quantity. Whereas open curiosity represents the cumulative positions merchants maintain, the quantity exhibits the present exercise and liquidity out there. A sudden spike in quantity, particularly when accompanied by vital value strikes, can point out sturdy sentiment and momentum.

From Oct. 18 to Oct. 25, the put/name ratio decreased from 0.538 to 0.475. This means a shift in direction of much more bullish sentiment over this era. The quantity of each places and calls elevated considerably, however the name quantity noticed a extra pronounced improve, reaching the biggest in Bitcoin’s historical past, identical to the decision open curiosity. The document name quantity on Oct. 25 suggests a very lively and bullish day within the Bitcoin choices market.

The excessive open curiosity on the $40,000 strike value additional helps this bullish sentiment. It signifies that many merchants anticipate or hope that Bitcoin will attain or surpass $40,000 by the expiration date of those choices. Whereas the excessive open curiosity for the $40,000 strike value exhibits optimism, the rising put/name ratio we mentioned earlier means that merchants are additionally hedging towards potential draw back dangers. Which means that whereas many are optimistic about Bitcoin reaching $40,000, they’re additionally getting ready for situations the place it may not. That is evident within the spike of put choices at strike costs under $27,000.

The rise in each open curiosity and quantity signifies that the choices marketplace for Bitcoin is changing into extra lively and liquid. It additionally exhibits a notable rise in curiosity from institutional and complicated merchants, as most retail merchants not often stray from spot markets.

The publish Bitcoin choices market exhibits document name open curiosity and quantity appeared first on CryptoSlate.