Oct 26, 2023 11:07 UTC

| Up to date:

Oct 26, 2023 at 11:11 UTC

Bitcoin, the digital foreign money that has sparked numerous debates, discussions, and headlines over the previous decade, lately witnessed one other important value surge, pushing its worth previous the $35,000 mark. This latest uptrend wasn’t simply one other inexplicable rise; it was notably linked to the anticipation and subsequent developments surrounding a selected Bitcoin ETF. Right here’s an in-depth evaluation, pulling insights from numerous sources, that elucidates this surge:

BlackRock’s Involvement and the NASDAQ Itemizing proven on DTCC

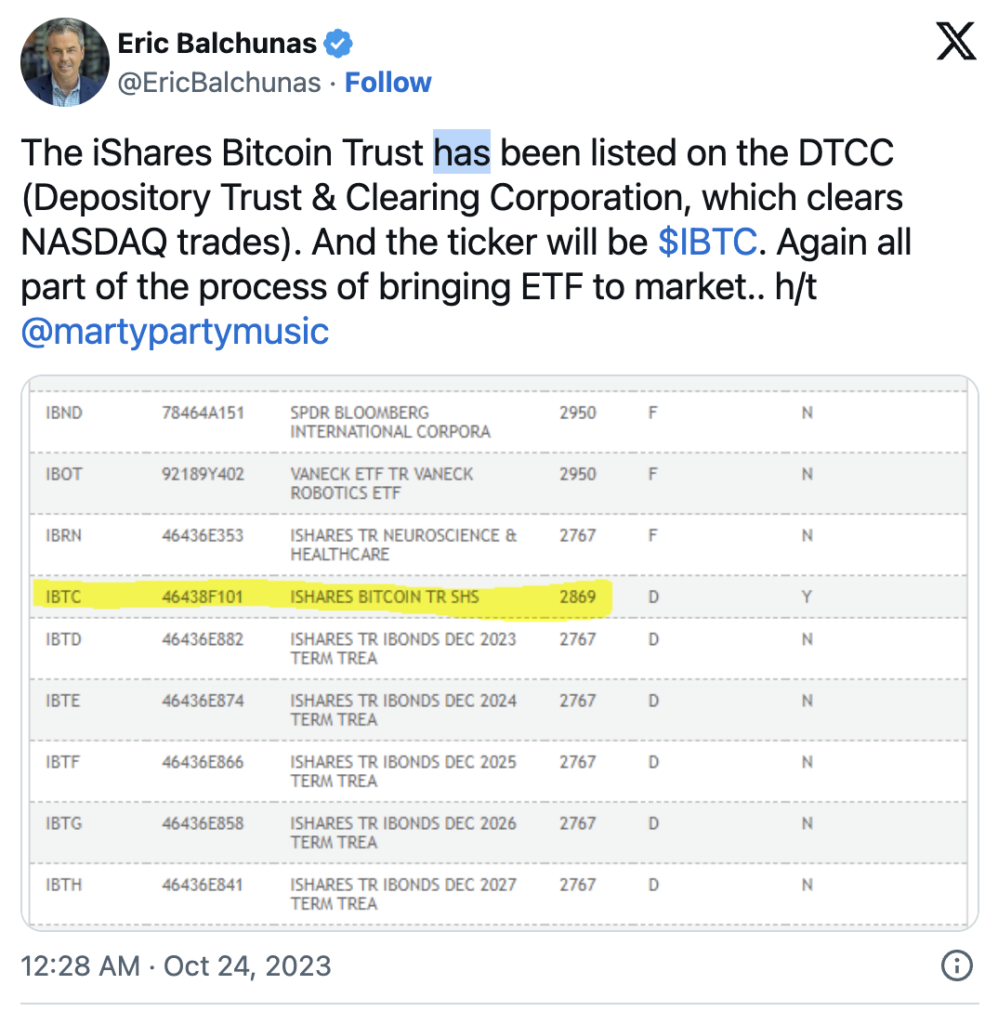

Monetary big BlackRock introduced its spot Bitcoin ETF, which was subsequently listed on NASDAQ. The participation of such a heavyweight within the monetary world alerts a rising institutional curiosity within the digital asset. Establishments usually herald giant capital inflows, which may considerably transfer the market. This itemizing not solely broadened the accessibility of Bitcoin publicity to mainstream buyers but in addition lent a contact of legitimacy to the cryptocurrency.

On October 23, Bloomberg ETF knowledgeable Eric Balchunas commented on an X (beforehand often known as Twitter) thread, stating that the DTCC itemizing is a step ahead in introducing a cryptocurrency ETF to the market. The potential iShares spot Bitcoin ETF, denoted as IBTC, is eyed for a potential Nasdaq inventory change itemizing, having made its utility for itemizing and buying and selling shares in June.

Balchunas highlighted that that is the inaugural spot ETF to be listed on DTCC, with no others at present listed there. He emphasised the importance of BlackRock’s proactive position in dealing with preliminary steps, corresponding to seeding, ticker setup, and DTCC logistics, which normally precede a launch. He inferred from this that BlackRock may need acquired indications of an impending or particular approval.

He additional mused that BlackRock may have both secured the SEC’s nod for the ETF itemizing or is making preparations on that assumption. As per BlackRock’s utility timeline, the SEC has time till January 10, 2024, to finalize its stance on approving or rejecting the ETF.

As per latest updates and knowledge is exhibits that this itemizing was there on DTCC from August 2023 however was highlighted on twenty fourth October 2024 by Balchunas.

The ETF Pleasure

ETFs or Trade Traded Funds are funding funds which are traded on inventory exchanges, much like shares. A Bitcoin ETF would permit buyers to achieve publicity to Bitcoin with out the necessity to personal the underlying asset instantly. Which means conventional buyers can spend money on Bitcoin in a fashion they’re extra acquainted with, with out coping with the technicalities of proudly owning and storing the digital foreign money.

The sudden spike in Bitcoin’s value, which briefly touched $35.2K as quickly because the DTCC itemizing of IBTC i.e. identify of Blackrock’s Bitcoin ETF.

The joy stems from the idea that the launch of such ETFs would bridge the hole between the normal finance world and the cryptocurrency ecosystem. The anticipation of upper liquidity, broader adoption, and the potential for extra institutional buyers to become involved typically results in bullish sentiments available in the market.

Different monetary establishments together with GreyScale, ARK Make investments,Valkyrie, International X, WisdomTree, Invesco, Franklin Templeton, Hashdex, Bitwise and VanEck have additionally utilized for Bitcoin ETF’s.

The DTCC Controversy

An article from DL Information identified an fascinating improvement the place BlackRock’s Bitcoin ETF was momentarily pulled from the DTCC website. The DTCC or The Depository Belief & Clearing Company is a vital participant within the clearing and settlement of securities. Though the precise causes for this non permanent removing stay a topic of hypothesis, such occasions typically generate buzz within the crypto group. Whereas some might view it with skepticism, others would possibly interpret it as a sign of the excessive demand and the necessity for higher infrastructure to accommodate the brand new ETF.

What it means for Bitcoin and different CryptoCurrencies

The latest surge in Bitcoin’s value above $35,000 might be largely attributed to the mixture of institutional curiosity, the perceived bridging of conventional and crypto finance via ETFs, and the excitement generated from market actions and speculations. Because the cryptocurrency panorama continues to evolve, such pivotal moments reiterate the significance of staying up to date with market developments and understanding the underlying elements driving value actions.

The surge of Bitcoin’s value to the $35,000 mark was additionally accompanied by a whirlwind of exercise throughout the cryptocurrency market. Numerous important developments and reactions had been noticed because the premier digital foreign money reached this value milestone. To color a clearer image, let’s dive deep into the occasions defined beneath:

BlackRock and the SEC

BlackRock, the world’s largest asset supervisor, was amidst settling costs of $2.5 million with the U.S. Securities and Trade Fee (SEC). Whereas this was ongoing, the cryptocurrency group eagerly awaited a call on Bitcoin ETFs. BlackRock’s involvement within the house was seen as a optimistic signal, probably paving the way in which for broader institutional acceptance.

Influx into Bitcoin Funds

As Bitcoin continued its upward trajectory, funds associated to the digital foreign money noticed inflows of roughly $57 million. This was largely attributed to the rising pleasure round potential Bitcoin ETFs. Such substantial inflows underscored the rising curiosity and confidence from each retail and institutional buyers available in the market.

Germany and Canada had been the first contributors to those investments, with ETC Group from Germany garnering $24.3 million and Objective Investments from Canada securing $10.9 million. Moreover, 21Shares AG amassed roughly $11.8 million. Concurrently, the U.S. Courtroom of Appeals has instructed the SEC to re-evaluate the Bitcoin ETF utility from Grayscale, intensifying the rivalry between main corporations aspiring to introduce a spot Bitcoin ETF.

CFTC’s Tackle Spot Bitcoin ETFs

Additional fueling the thrill round Bitcoin ETFs, a commissioner from the Commodity Futures Buying and selling Fee (CFTC) expressed the sentiment that the market was prepared for spot Bitcoin ETFs. These affirmations from regulatory our bodies usually function sturdy indicators for potential favorable outcomes and future developments.

Crypto Market Sentiment

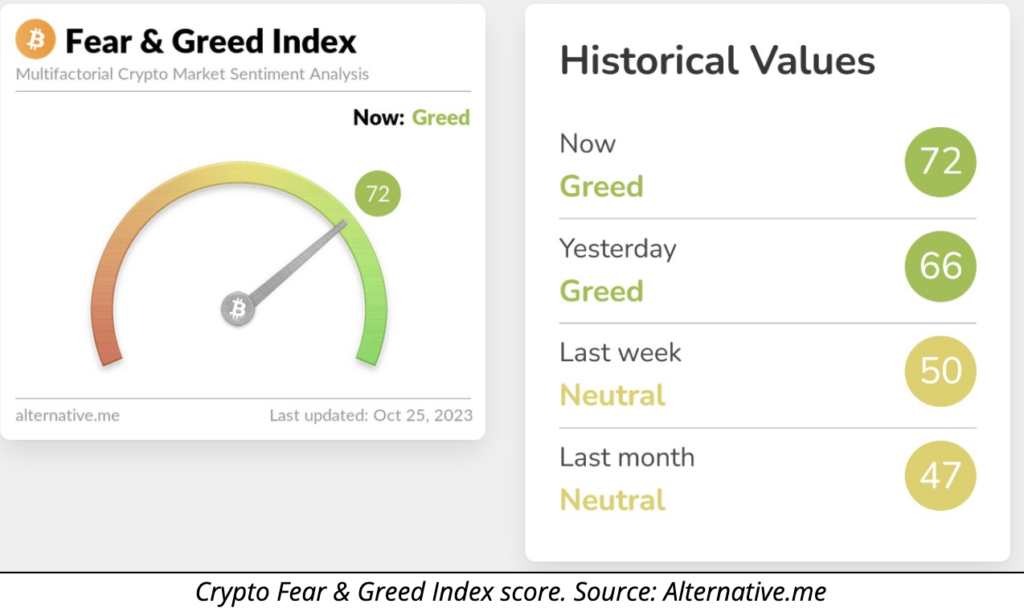

As Bitcoin approached its noteworthy value level, the general sentiment within the crypto market soared. This enthusiasm wasn’t simply confined to Bitcoin; it had a ripple impact, boosting optimism throughout numerous digital property. Such highs in sentiment typically drive extra buyers into the market, perpetuating a optimistic suggestions loop.

The index for now could be at 72 out of 100, inserting it inside a very good greed rating , which is a 6 pt. improve from Oct. 24 2023 and a 16 pt. bounce from its 50 pt. impartial rating on Oct. 18 2023.

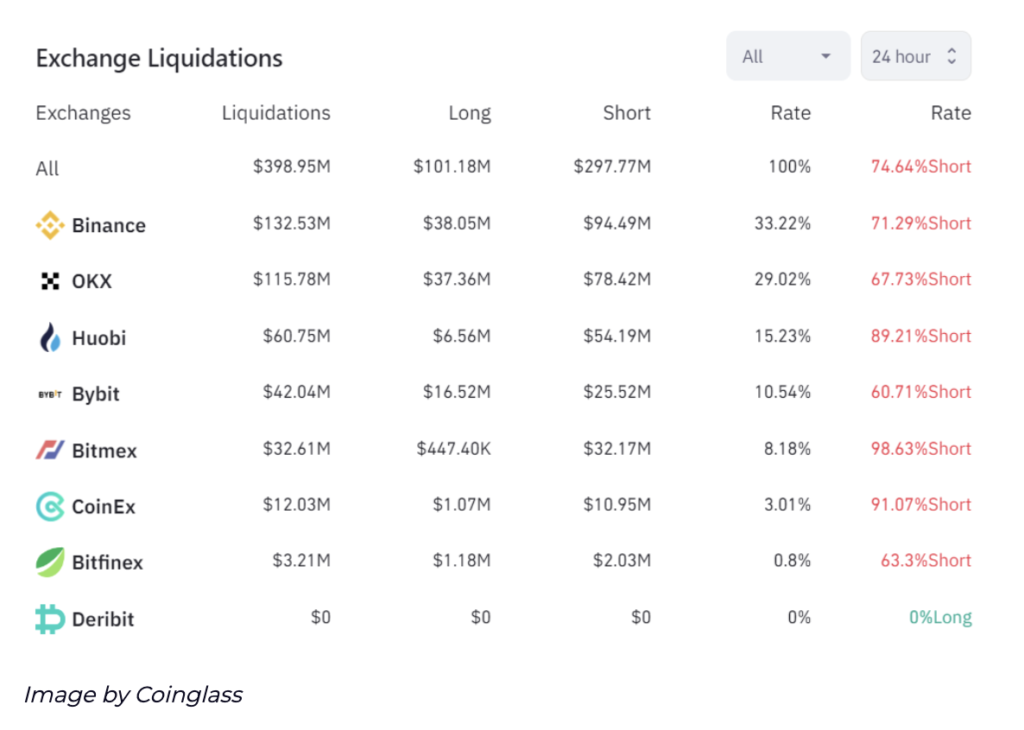

Liquidations Publish the Surge

Bitcoin’s fast ascent to $35,000 triggered important market actions, significantly within the derivatives house. Over $221 million in liquidations had been reported as the worth climbed. Moreover, roughly $300 million in crypto shorts had been liquidated as Bitcoin jumped to its new mark as per Coinglass Liquidations information, with 74.6% of merchants liquidated on the quick aspect. These liquidations can speed up value actions as merchants are compelled to exit their positions.

The meteoric rise of Bitcoin to $35,000 wasn’t a solitary occasion however moderately the end result of a confluence of things, starting from regulatory developments and institutional maneuvers to shifts in market sentiment and important buying and selling upheavals. Such episodes underline the multifaceted nature of the crypto market, reminding us that beneath each value motion lies a tapestry of interwoven occasions and narratives.

What’s going to it imply for Bitcoin and Crypto Business if the Bitcoin ETF is Authorised

The analysis findings from Galaxy Digital, a significant funding agency, on the potential market impacts if Bitcoin ETFs are accredited exhibits that Bitcoin ETFs will draw $14 billion, pump bitcoin value by 74% primarily based on the evaluation of the hyperlink, right here’s a novel and complete understanding of the potential aftermath:

1. Potential Capital Inflows:

In line with the analysis by Galaxy Digital, a Bitcoin ETF may set off important capital inflows into the crypto market. The researchers estimate an astounding potential influx of as much as $450 billion. Such capital inflow can be an unprecedented occasion for the crypto business, probably resulting in substantial value appreciation for Bitcoin and probably different digital property as effectively.

2. Bridging Conventional and Crypto Markets:

The approval of a Bitcoin ETF would signify a harmonization between the normal monetary ecosystem and the nascent cryptocurrency world. ETFs, being well-understood monetary devices traded on standard inventory exchanges, may act as gateways for conventional buyers to entry the crypto realm with no need to navigate the complexities of direct cryptocurrency possession.

3. Enhanced Credibility and Legitimacy:

Regulatory approval for a Bitcoin ETF would function a tacit endorsement from authorities, imbuing the cryptocurrency house with enhanced credibility. Such regulatory inexperienced lights may result in a good broader institutional and retail acceptance of cryptocurrencies, making them extra mainstream.

4. Liquidity Increase:

With the arrival of Bitcoin ETFs, there might be a noticeable improve within the liquidity of the Bitcoin market. Greater liquidity usually results in decreased volatility and tighter bid-ask spreads, which may make the market extra interesting and fewer dangerous for each institutional and retail contributors.

5. Paving the Method for Different Crypto ETFs:

Whereas Bitcoin is the flagship cryptocurrency, its ETF approval would possibly set a precedent for different digital property. This might result in a cascade of purposes and potential approvals for ETFs linked to different main cryptocurrencies, additional increasing the combination of the crypto market into conventional monetary programs.

6. Value Implications:

Though it’s speculative, the approval of a Bitcoin ETF, mixed with the projected capital inflows, may act as a potent catalyst for Bitcoin’s value surge. Whereas the market will inevitably consider numerous different influences, such an institutional shift can present substantial upward value strain.

7. Elevated Scrutiny and Regulation:

On the flip aspect, the combination of Bitcoin into the normal monetary ecosystem via ETFs may convey alongside elevated regulatory scrutiny. Regulatory our bodies would possibly introduce new pointers or tighten present ones to make sure investor safety and market stability.

To Summarise

The consultants projected {that a} spot bitcoin ETF may entice $14 billion in investments throughout its inaugural yr, rising to $27 billion within the second yr, and reaching $39 billion within the third yr. Moreover, they anticipated a 74% surge within the bitcoin value within the yr following its endorsement.

The potential approval of a Bitcoin ETF stands as a watershed second for the cryptocurrency business. Past simply the quick monetary implications, it represents a confluence of the evolving views on digital property, regulatory stances, and market maturity. Whereas the exact future stays unsure, such a transfer would undeniably be a monumental step within the crypto narrative.