Fast Take

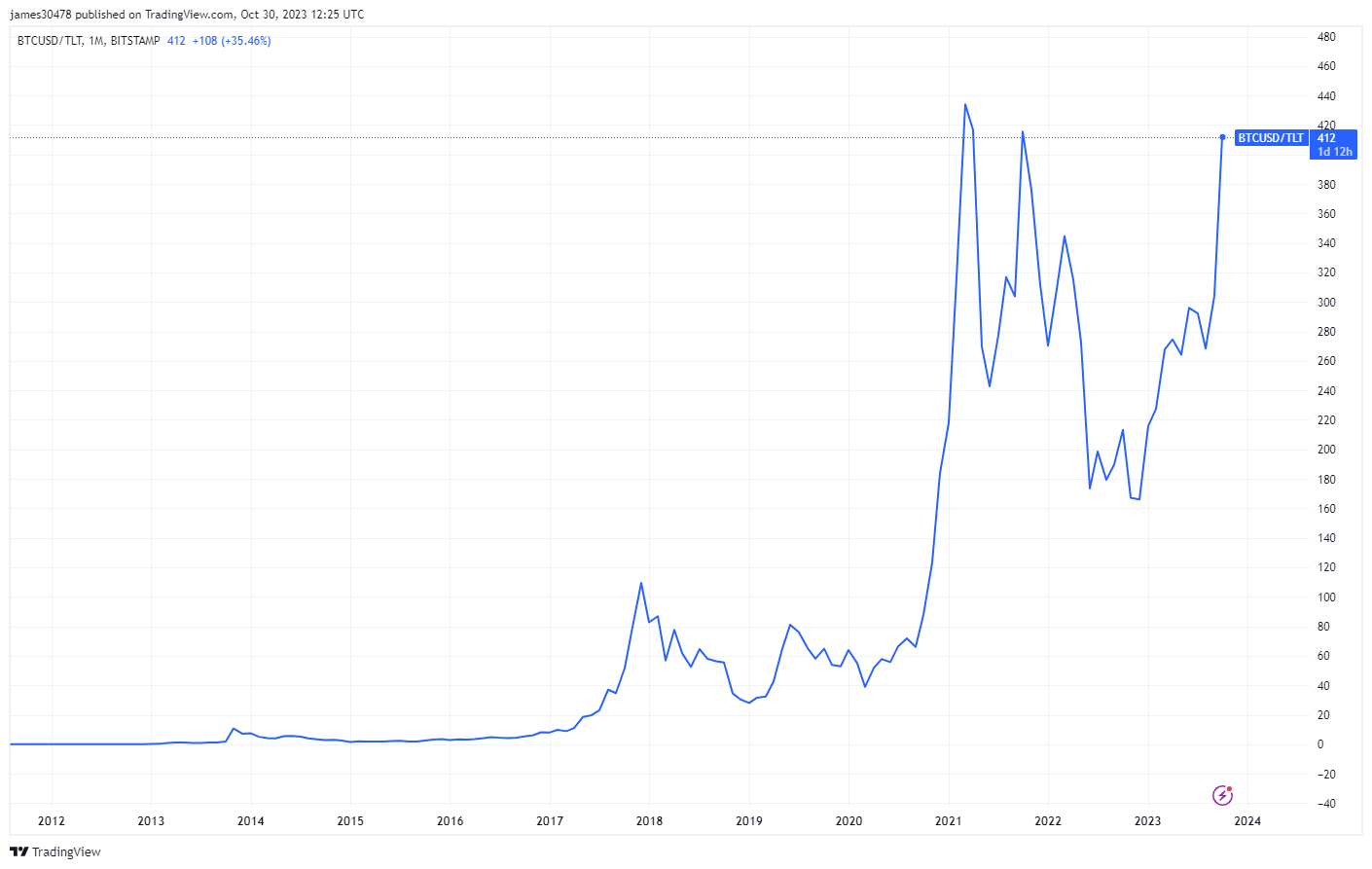

The U.S. greenback, reigning as the worldwide reserve forex, has been the usual benchmark for valuing all property. Nevertheless, an intriguing shift happens after we begin benchmarking monetary property towards Bitcoin as a substitute of the normal USD.

Take the U.S. lengthy bond (TLT) for example, which is presently buying and selling at roughly $84. It could require a hefty sum of 411 TLT to match the worth of a single Bitcoin, buying and selling round $34,500. This ratio underscores a big drawdown for TLT in comparison with Bitcoin, much more so when contemplating that within the 2021 bull run, the ratio was 432 TLT to 1 Bitcoin.

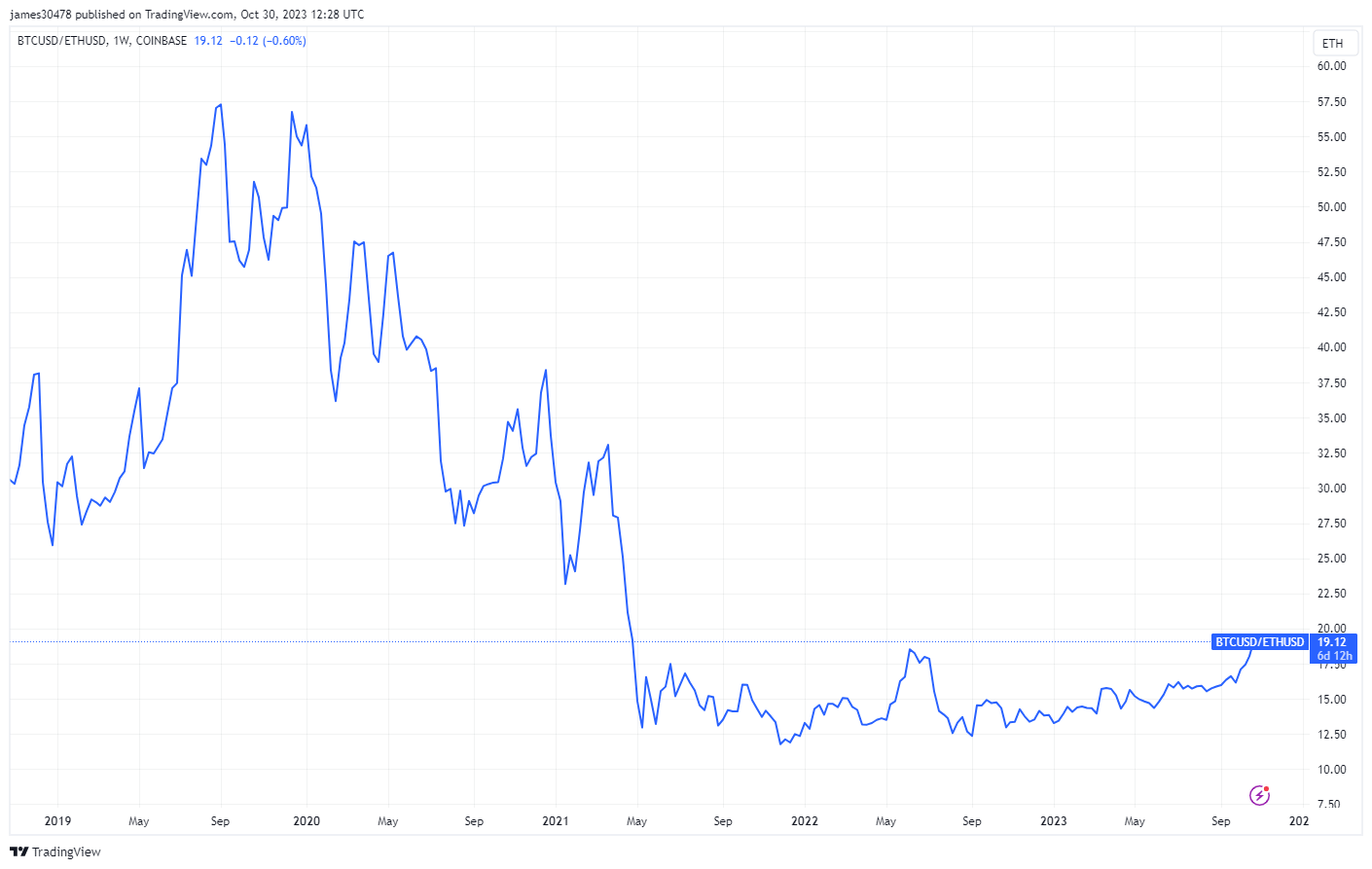

Equally, when dissecting the Ethereum-Bitcoin relationship, it’s evident that the dynamics are altering. With Ethereum presently buying and selling at simply over $1,800, it will take a little bit over 19 Ethereum to equate to 1 Bitcoin. This ETH/BTC ratio continues to development downwards, signaling a possible shift within the crypto hierarchy.

This unconventional methodology of asset denomination reveals a distinct perspective on the worth of monetary property and could also be a presage of a broader transformation within the monetary realm sparked by the rise of cryptocurrency.

The publish Bitcoin’s ratio to the U.S. lengthy bond is nearing all-time highs appeared first on CryptoSlate.