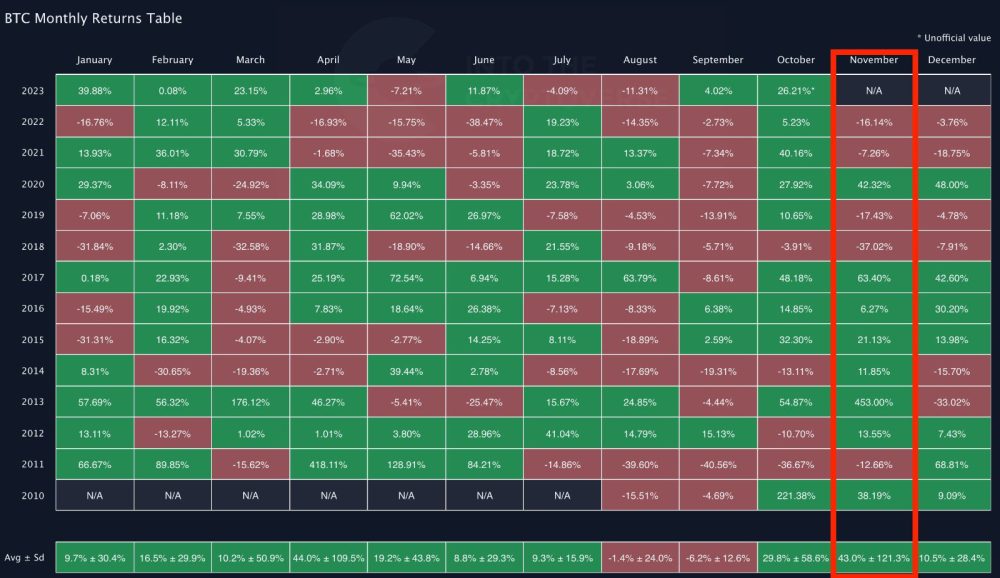

November has usually been a standout month for Bitcoin, with historic information indicating a powerful common value soar of 43%. This could propel Bitcoin to round $48,000. However with October already exhibiting a big value enhance, the query arises: Will Bitcoin proceed its bullish pattern, or is a retrace on the horizon?

November Month-to-month Returns

November has been notably bullish for Bitcoin over time, with a mean of 43% of value will increase over time. If this pattern holds true for this yr, we would see Bitcoin touching $48,000.

Associated Studying: Bitcoin Value To Attain $170,000 in 2025 – Mathematical Mannequin Predicts

Nevertheless, it’s price noting that this very excessive common is considerably influenced by the intense 453% surge in 2013. If we exclude this outlier, the typical settles round 11.54% This results in a extra conservative forecast, pointing to a possible rise to round $38,000.

Bitcoin month-to-month returns over time. Supply: intothecryptoverse

Diving deeper into historic information, 8 of the previous 13 years have proven value will increase in November, making one other enhance this month appear believable. But, a better look reveals that 4 of the final 5 instances in November there was a value dip.

In 2022, the FTX collapse performed a pivotal function and 2021 marked the height for Bitcoin, suggesting that these decreases may be outliers reasonably than indicative of a altering pattern.

For a better comparability, 2019 stands out because it too was a pre-halving yr, identical to 2023. That yr, after a promising October, Bitcoin noticed a 17% dip in November, which might equate to a worth of $28,000 if repeated this yr.

Bitcoin Value Motion In 2023

By means of 2023, Bitcoin has demonstrated a recurring conduct following vital value will increase of greater than 20%. Usually, these surges have been adopted by consolidation intervals, and subsequently, a retrace to not less than half of the preliminary enhance.

Associated Studying: Bitcoin Season: Main The Cost In The Crypto Market

Take January, for example. Bitcoin’s value elevated from $16,500 to $24,000, solely to say no to $20,000 by March – a retrace of 60% from the preliminary enhance.

One notably excessive instance was in August when Bitcoin retraced the whole lot of a previous 20% rise.

Bitcoin value motion in 2023. Supply: BTCUSD from TradingView

It’s noteworthy that these retraces haven’t all the time been speedy. After the rise in March, it wasn’t till June – a span of three months – that the value noticed a 50% retrace. On common, this yr’s value retraces have taken between 1 to three months to manifest post-rise.

Moreover, earlier than any retrace happens, there’s nonetheless room for added upside. For instance, after the aforementioned March rise, Bitcoin skilled an extra 10% enhance earlier than finally retracing the preliminary surge.

Potential Eventualities For November

Utilizing the above, potential situations for November are listed under:

- Very bullish situation: Bitcoin rises by 10-20%, probably reaching as much as $42,000.

- Bullish situation: Bitcoin rises by 1-10%, probably reaching as much as $38,000.

- Bearish situation: Bitcoin decreases by 10%, dropping to round $31,000. This could imply a 50% retrace of the surge in October.

- Very bearish situation: Bitcoin decreases by 20%, dropping to round $28,000. This could imply a 100% retrace of the surge in October.

In conclusion, given previous traits and present market conduct, November guarantees to be a pivotal month for Bitcoin.

Funding Disclaimer: The content material supplied on this article is for informational and academic functions solely. It shouldn’t be thought of funding recommendation. Please seek the advice of a monetary advisor earlier than making any funding choices. Buying and selling and investing contain substantial monetary danger. Previous efficiency just isn’t indicative of future outcomes. No content material on this website is a suggestion or solicitation to purchase or promote securities or cryptocurrencies.

Featured picture from Shutterstock, Charts from TradingView.com