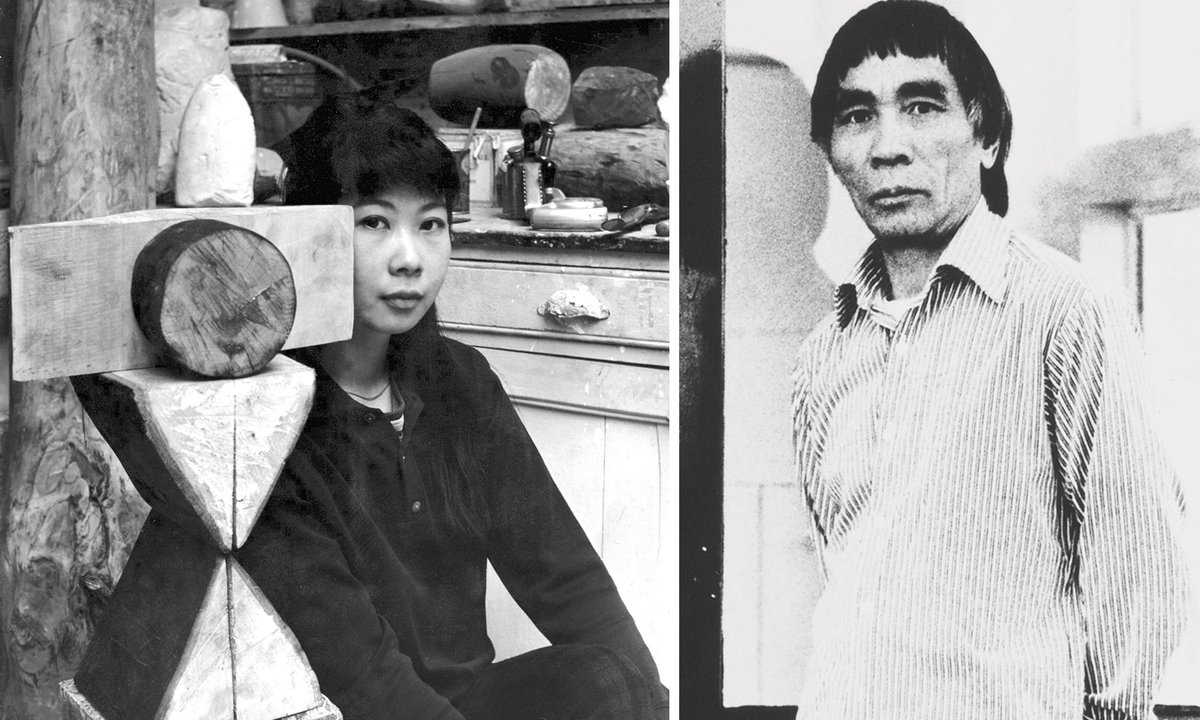

- SafeMoon founders arrested; Kyle Nagy at massive.

- The fees embrace wire fraud and cash laundering.

- There are additionally accusations of misappropriation and investor deception.

In a major growth, the founders of SafeMoon, a decentralized finance digital asset, are dealing with prison costs in the US.

Braden John Karony and Thomas Smith have been arrested, whereas Kyle Nagy stays at massive. The US Legal professional’s Workplace for the Japanese District of New York has charged them with conspiracy to commit wire fraud and cash laundering.

The arrests and allegations

Braden John Karony and Thomas Smith, two of the people behind SafeMoon LLC, have been apprehended in Provo, Utah, and Bethlehem, New Hampshire, respectively. They’re accused of taking part in a scheme to defraud traders in SafeMoon. This cryptocurrency, issued by SafeMoon LLC, gained immense recognition, with its market capitalization exceeding $8 billion.

The fees revolve round allegations that the defendants misled SafeMoon traders. They misrepresented the accessibility of “locked” liquidity, which was supposedly past their attain. Moreover, they’re accused of diverting and misappropriating thousands and thousands of {dollars} from the liquidity pool for private acquire.

A background on SafeMoon

SafeMoon tokens (SFM) have been launched in March 2021 by SafeMoon LLC on a public blockchain.

A novel characteristic of SFM transactions was the imposition of a ten% tax, with 5% allotted to learn SFM holders and the opposite 5% to designated liquidity swimming pools.

The bigger the liquidity pool, the better the liquidity available in the market for SFM. It rapidly gained multiple million holders and a market capitalization of over $8 billion.

SafeMoon founders’ fraudulent scheme

The indictment as per the US Legal professional’s Workplace Japanese District of New York, alleges that the defendants made false representations to traders, together with the usage of “locked” liquidity swimming pools to stop rug-pulling.

Additionally they claimed that tokens within the liquidity pool wouldn’t be used for private enrichment. Nevertheless, it’s alleged that the defendants maintained entry to the liquidity swimming pools and deliberately diverted and misappropriated thousands and thousands of {dollars}’ price of tokens for his or her private profit.

Furthermore, they’re accused of participating in SFM buying and selling for their very own acquire, even on the peak of SFM’s market worth, leading to substantial income. The defendants hid the motion of those funds via varied strategies, together with personal un-hosted crypto wallets and pseudonymous centralized change accounts. The misappropriated funds have been allegedly used to buy luxurious automobiles and actual property in several states.

The fees within the indictment are allegations, and the defendants are presumed harmless till confirmed responsible in a courtroom of regulation. The case is being dealt with by the US Legal professional’s Workplace’s Enterprise and Securities Fraud Part.

This case highlights the significance of regulatory oversight within the cryptocurrency trade to guard traders and keep belief in digital belongings. Because the authorized proceedings unfold, extra particulars will emerge, and the accused people may have their day in courtroom to handle these severe allegations.