On-chain information reveals there may be main resistance forward for Chainlink, an indication that might be troubling for the rally’s sustainability.

Solely 55% Of Chainlink Traders Are In Revenue So Far

As defined by an analyst in a post on X, Chainlink continues to be behind Bitcoin when it comes to investor profitability regardless of the LINK worth outperforming BTC within the 12 months thus far.

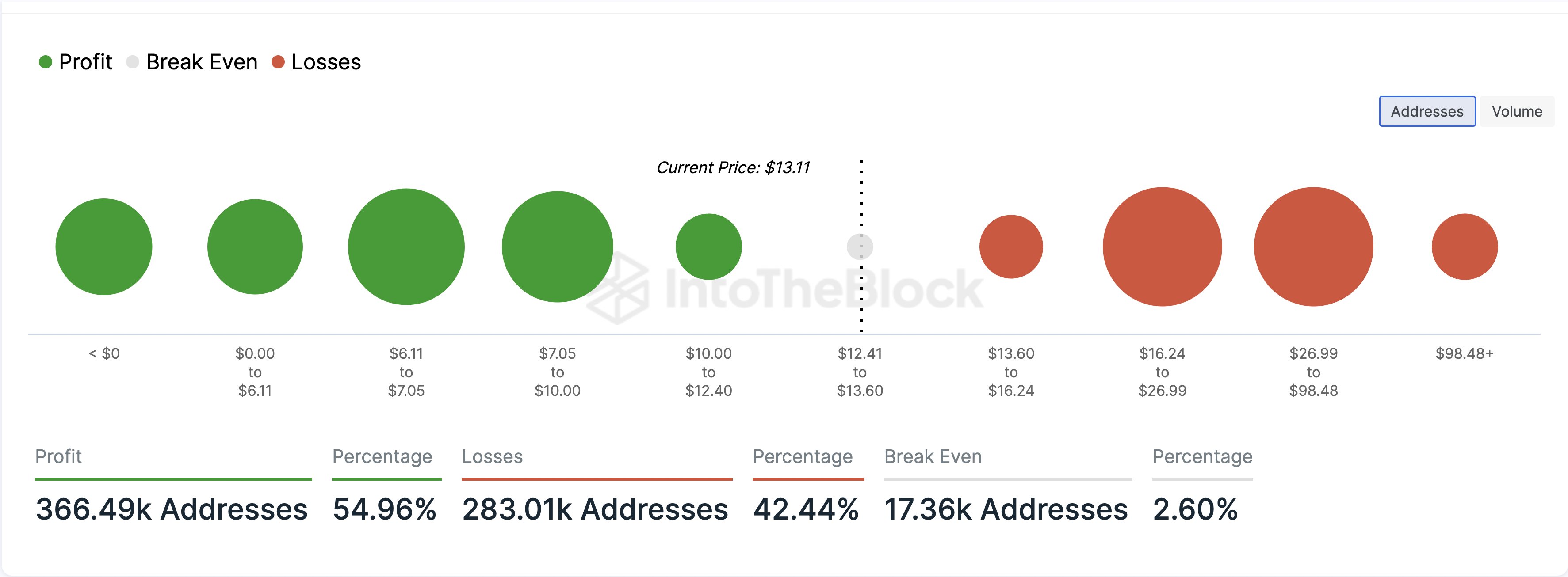

The beneath chart reveals what the LINK deal with focus seems like on the totally different worth ranges that the asset has beforehand visited:

The totally different on-chain resistance and help ranges of the asset | Supply: @hmalviya9 on X

Right here, the dimensions of the dot represents the variety of buyers or addresses who bought their cash inside the actual worth vary. It could seem that the ranges beneath $10 are host to the fee foundation of a hefty variety of holders.

For the reason that LINK worth is above these ranges proper now, these buyers would naturally be in a state of revenue. These addresses solely make for about 55% of the community whole, nonetheless, implying {that a} important variety of them are nonetheless sitting at a loss. From the chart, it’s seen that the $16 to $27 vary specifically has a substantial density of buyers.

In on-chain evaluation, main help and resistance ranges are outlined on the premise of the variety of buyers which are at a specific vary. That is due to the truth that at any time when the spot worth interacts with the fee foundation of an investor, they turn into extra prone to present a transfer.

When the worth retests the fee foundation from above, the holder might resolve to purchase extra. The explanation behind that is that they may are likely to imagine that the extent, which had been worthwhile for them earlier, would possibly produce good points sooner or later once more, so it will seem like a great level of accumulation for them.

However, the crimson holders would possibly see the break-even level as an honest exit level, as they may concern that the cryptocurrency would return down within the close to future, so going out right here at the least means they’ll keep away from taking any losses.

Such shopping for or promoting from just some buyers when the worth retests their frequent price foundation doesn’t produce any results on the macro scale, but when numerous buyers purchased on the identical stage, the response could be extra pronounced.

Thus, the Chainlink ranges forward till the $27 mark would possibly show to be a supply of some heavy resistance, making the rally laborious to maintain by means of them.

The analyst notes, nonetheless, “once LINK breaks the $27 mark, the following rally is predicted to be substantial. Alongside this, the pockets profitability ratio is projected to surpass 80%.”

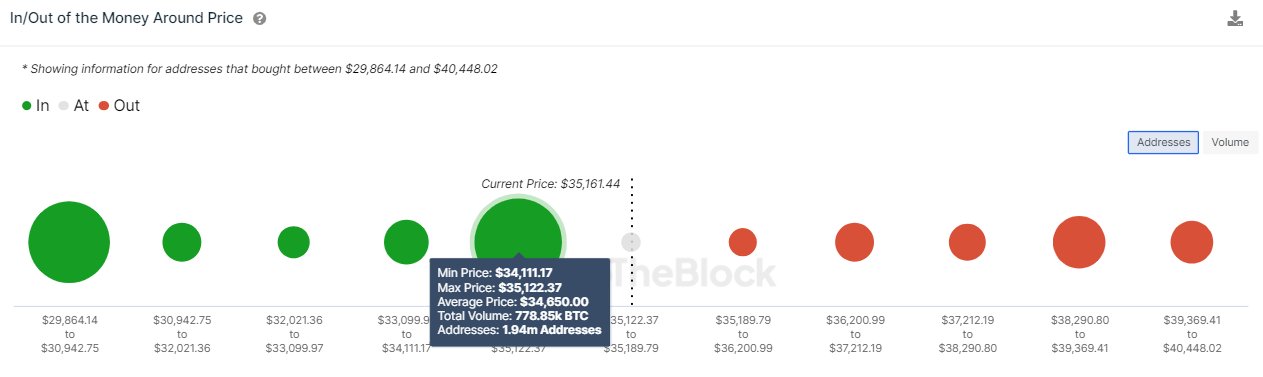

As talked about earlier than, Bitcoin’s investor profitability distribution is wanting significantly better thus far, because the beneath chart from IntoTheBlock reveals:

Appears to be like like the present worth ranges have a considerable quantity of buyers | Supply: IntoTheBlock on X

Bitcoin is at present battling in opposition to the resistance supplied by the present investor-packed $34,100 to $35,100 vary. As soon as BTC is thru these ranges, nonetheless, the highway in the direction of $40,000 would possibly show to be comparatively straightforward.

LINK Worth

Following its 12% rally previously week, Chainlink is now sitting slightly below the $12.9 mark.

LINK has exploded greater than 67% previously month | Supply: LINKUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com

![[LIVE]BTC’s Post-High Bull Trap, $12B BlackRock Bet Rattles ETH Supply: Best Crypto To Buy Now? [LIVE]BTC’s Post-High Bull Trap, $12B BlackRock Bet Rattles ETH Supply: Best Crypto To Buy Now?](https://sbcryptogurunews.com/wp-content/themes/jnews/assets/img/jeg-empty.png)