Information reveals the present Bitcoin cycle is lining up towards the historic ones by way of the returns that the asset has seen since hitting its backside.

Earlier Bitcoin Cycles Had Related Returns At This Stage

As identified by CryptoQuant Netherlands neighborhood supervisor Maartunn in a post on X, there appears to be a outstanding similarity between the present cycle and the earlier ones.

Beneath is the chart shared by the analyst, which compares the value efficiency of every Bitcoin cycle, beginning with the bottoms of the respective bear phases.

How the totally different cycles line up towards one another | Supply: @JA_Maartun on X

This chart naturally makes use of the idea that the low noticed after the FTX collapse again in November 2022 was the underside for the present Bitcoin cycle.

From the graph, it’s seen that each one three cycles noticed comparatively shut worth motion for the primary 100 or so days after the formation of the respective cyclical lows.

After this level, the cycles confirmed some divergence. The final cycle, particularly, displayed worth motion that was considerably indifferent from that of the present cycle or the cycle earlier than that one.

The final two cycles began to converge 300 days after the underside and efficiently did so by the 350th mark. Not too long ago, the present cycle has reached the identical milestone, and curiously, it has converged with the others.

With the newest rally within the worth in direction of the $35,000 degree, BTC is up roughly 120% for the reason that backside, much like the returns seen within the final two cycles.

As is obvious from the chart, following this level of convergence, the cryptocurrency moved sideways in each of the earlier two cycles. If that is something to go by, BTC may additionally be going by way of the same section of consolidation quickly within the present cycle as nicely.

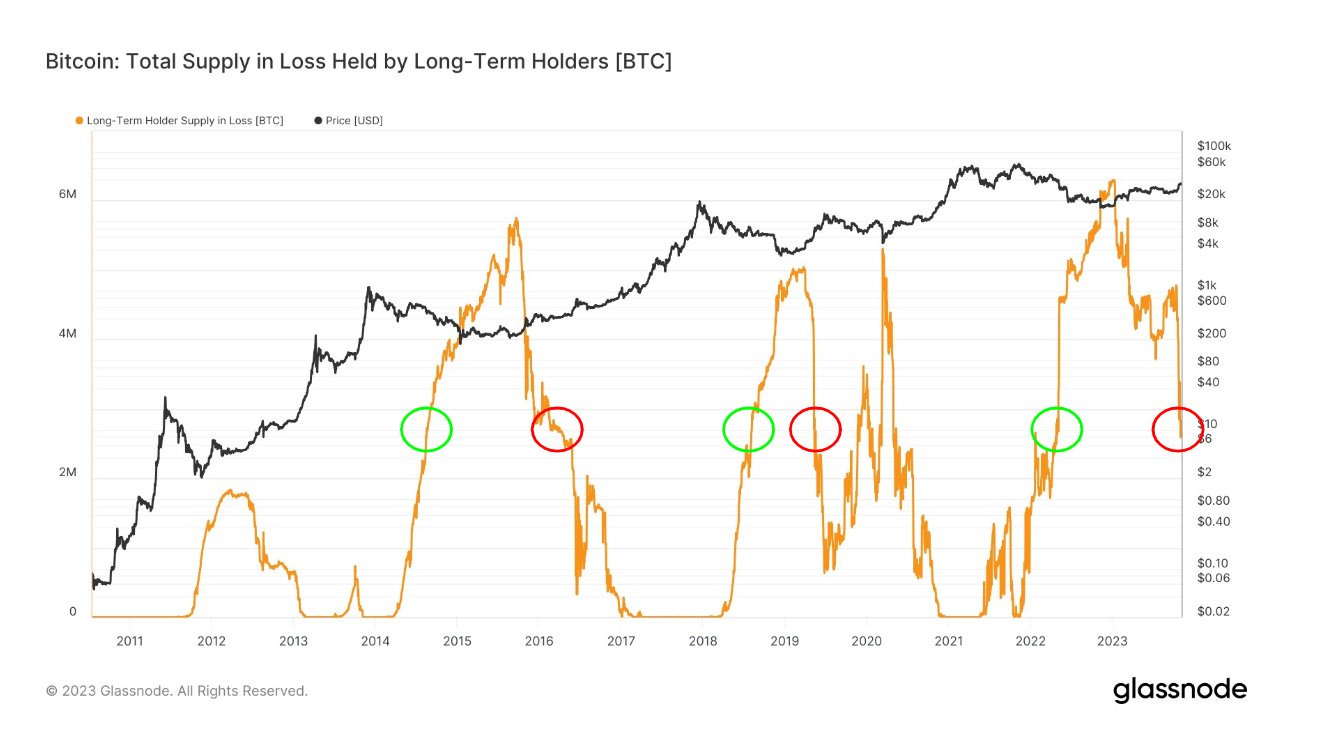

One other analyst, James V. Straten, posted on X in the present day discussing the similarity between the totally different Bitcoin cycles from one other perspective. Particularly, the analyst has talked about how the chart of the loss provide of the BTC long-term holders seems comparable for every cycle.

The “long-term holders” (LTHs) consult with the buyers holding onto their cash since not less than 155 days in the past. The chart under reveals the development within the complete provide in loss held by these HODLers all through the asset’s historical past.

The worth of the metric appears to have sharply gone down not too long ago | Supply: @jimmyvs24 on X

At current, the Bitcoin long-term holders are carrying 2.6 million BTC in loss. As Straten has highlighted within the chart, this degree is according to what the indicator’s worth was when the cryptocurrency was exiting the bear market in earlier cycles.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $34,800, up 1% up to now week.

Appears like the value of the asset been caught in consolidation in the course of the previous two weeks | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com