Bitcoin has risen above $36,000 and is at present focusing on $37,000 as Bloomberg analysts Eric Balchunas and James Seyffart have revived hopes {that a} Spot Bitcoin ETF might be authorised this 12 months. The analysts preserve their perception of a 90% likelihood that any of those funds get authorised by January 2024.

An Approval Order “May” Happen This November

In a put up shared on his X (previously Twitter) platform, Seyffart highlighted a brand new analysis notice that he and Balchunas had simply labored on. From their analysis, they famous that there’s a “temporary window” that enables the US Securities and Trade Fee (SEC) to approve all 12 Spot Bitcoin ETF functions directly.

This temporary window (which opens up on November 9) will final for at the very least eight days, earlier than which it’s virtually attainable for the SEC to approve all functions directly till subsequent 12 months. The explanation for his or her assertion is that the SEC can’t approve an utility that’s within the remark stage. It so occurs that the remark stage of the final functions that the SEC delayed ends on November 8, which is why they highlighted the window that begins from November 9.

As to why the window is barely going to final for about eight days, the SEC is anticipated to resolve on Hashdex and Franklin’s utility on November 17, which might put each candidates within the remark stage. It’s because it’s anticipated that the SEC will decide to delay its selections on these funds and ask most of the people for feedback on them.

In the meantime, the analysts famous that this window solely applies to the SEC approving all 12 functions directly. They clarify that “theoretically,” the Fee might resolve on the opposite functions from now till January 10, 2024, even when it chooses to delay its resolution on Hashdex and Franklin’s utility on November 17. No matter occurs, they nonetheless consider that there’s a 90% likelihood that any of those funds get authorised by January 10 subsequent 12 months.

A Spot Bitcoin ETF Launch Isn’t So Easy

When quizzed about how lengthy it should take for these funds to launch after approval, Balchunas talked about in an X put up that he guessed that the “19b-4s” functions could be authorised within the “not so distant future.” Then it should additional take some time for the SEC to approve the “S-1s” after which it “would probably be days until launch.”

Seyffart additionally echoed related sentiments as he said that there are “two paths” that must be accomplished earlier than an ETF launches. One is the 19b-4 approval, after which the division of Company Finance on the SEC will nonetheless must log out on the S-1s. Nonetheless, there isn’t any signal that any of that has been completed but. As such, it might take “weeks and even months” between approval and launch.

No matter that, Bitcoin has picked up on the chance that Spot Bitcoin ETFs might be authorised this month and has ridden on that wave to above $36,000. On the time of writing, the foremost cryptocurrency is buying and selling at round $36,700, up over 4% within the final 24 hours, in line with knowledge from CoinMarketCap.

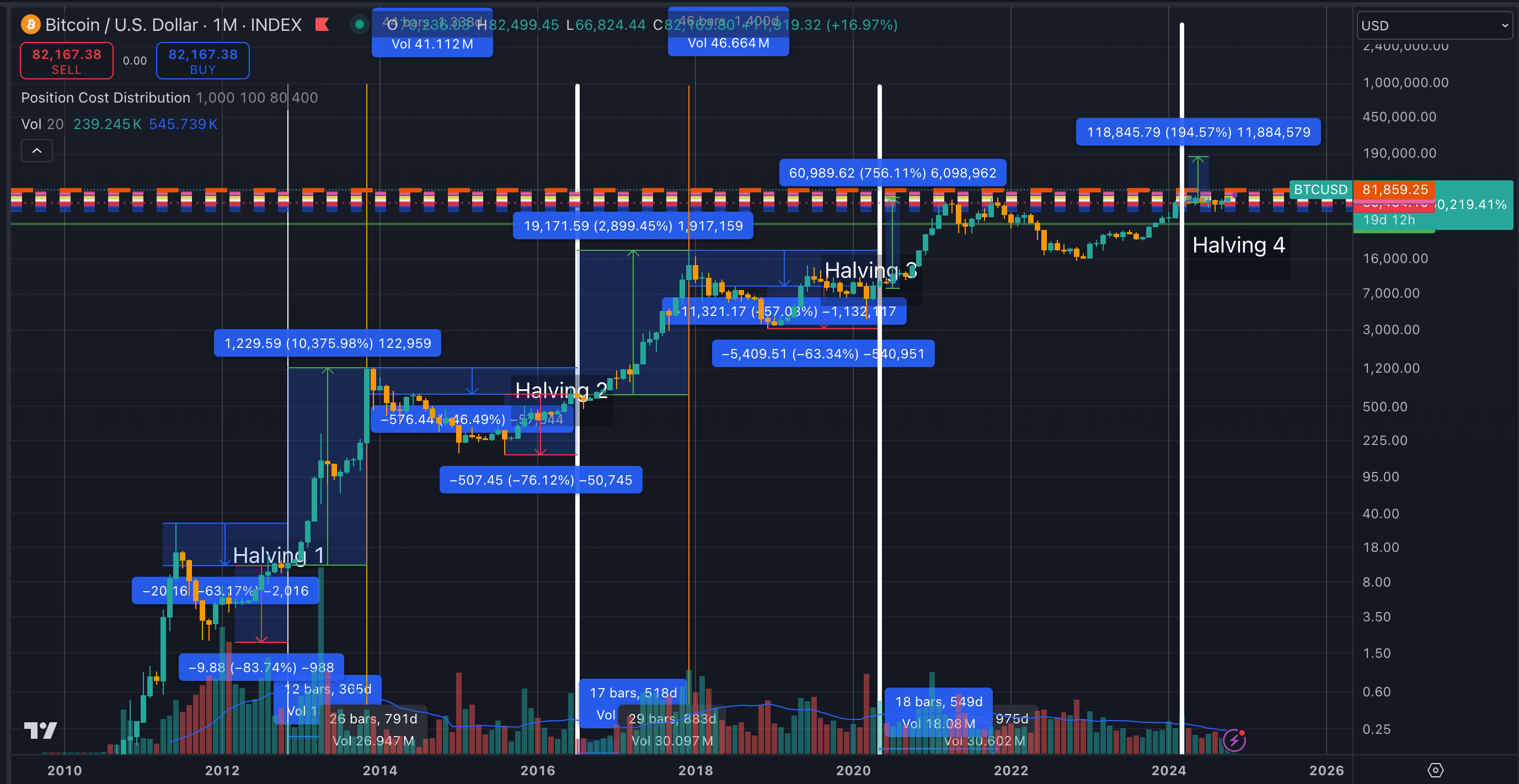

BTC worth above $36,600 | Supply: BTCUSD on Tradingview.com

Featured picture from The Financial Instances, chart from Tradingview.com