Don’t fear, this isn’t an article to both espouse or assault the present international local weather change agenda. Debating whether or not the earth will perish in a couple of years or not isn’t my plan. Whereas not solely being a believer and investor within the Bitcoin ecosystem, I’m additionally an avid supporter of start-ups and innovators supporting inexperienced applied sciences to offer for a extra vitality environment friendly future. Right here I merely need to focus on how Bitcoiners ought to undertake the ideas fairly successfully utilized by the worldwide local weather change motion underneath their inexperienced funding proposals to additionally promote expanded Bitcoin adoption. These are methods that I’ve seen carried out first-hand among the many local weather change posse.

Whereas there are definitely pure causes to undertake Bitcoin, particularly contemplating the world’s present turmoil in banking and financial programs, Bitcoiners can’t merely preserve relying upon these periodic bouts of disaster as the principle driving pressure to broaden adoption. Bombastic shout-outs that the disaster is right here underneath a Bitcoin lexicon are all too usually used and simply can simply hit on deaf ears. Additionally, posting that you simply paid for a latte at McDonald’s in Bitcoin or sending a stranger on the road 100 sats to their new pockets should not actions equal to the excessive stage of professionalism used underneath the coordinated symphony of the local weather change echo-system as they transfer their agenda ahead. Additional, merely saying the “different aspect is evil” will solely get us up to now and once I say “different aspect” I imply the fiat world. Bitcoiners have to implement extra state-of-the-art and systematic strategies if we need to attain the subsequent stage of adoption. We have to steer clear of the likes of dancing wizards.

To realize this, Bitcoiners can comply with and mix with different globally promoted agendas like that of local weather change to raised achieve recognition. The local weather change motion is commonly making an attempt to painting Bitcoin as a risk. If we latch onto the identical ways and approaches utilized by the local weather change motion to advertise themselves, integrating these ways into our instrument basket to assist Bitcoin adoption, we will not be ignored, belittled, or excluded.

The timing to think about how Bitcoiners can broaden our ways drawing from the local weather change agenda can’t be extra good as the present deliberate United Nations Local weather Change convention, known as COP28, might be held from 30 November to 12 December right here in Dubai.

Time Choice for Bitcoin and Inexperienced Investments

The worldwide local weather change motion makes the case that investing in inexperienced initiatives at this time, regardless that present societal prices might be giant, will end in larger future advantages for everybody. To assist this thesis, they loosely make the most of the ideas utilized in finance and economics together with low cost charges, current values, cost-benefit evaluation, and propensities to avoid wasting or spend. Bitcoin can be a pure case to use this thesis. We have to present that saving at this time by means of investing in Bitcoin will end in a bigger wealth end result sooner or later and larger societal advantages. Bitcoiners usually focus on time preferences associated to spending or financial savings as is defined within the “Bitcoin Commonplace”. To show this higher we must always apply the ideas of a Social Low cost Charge (SDR) and a “Simply Transition” as is utilized by the local weather change motion.

Making use of the Social Low cost Charge to Bitcoin Adoption

In easy phrases the SDR is the low cost fee used to calculate the current worth of future societal advantages realized from inexperienced investments at this time. For the local weather change motion, this is applicable to issues like constructing electrical automobile (EV) charging stations, putting in photo voltaic arrays, or maybe constructing bike-paths. With a lot of these societal investments there are public advantages generated that, to some extent, can’t be absolutely quantified underneath a pure numerical cost-benefit evaluation, nor match into typical for-profit worth calculations.

Governments try to low cost these future social advantages of investments utilizing the SDR. The speed is larger than conventional “risk-free” charges utilized in fundamental finance because of the added huge uncertainties current over the amount of intangible societal profit could be obtained. The SDR additionally differs relying on the extent of growth of a rustic. A extra developed nation can have extra certainty relating to the longer term societal advantages realized so the speed they apply is decrease.

The SDR is basically a fee that balances the selection of the general public to spend at this time versus make investments for tomorrow to comprehend implicit societal advantages. The propensity to avoid wasting balances the propensity to spend when the SDR is utilized. I’ll name this a wealth switch determination throughout generations. This instance reveals that the ideas usually mentioned relating to Bitcoin adoption and the ideas utilized inside the international inexperienced motion are fairly comparable. Bitcoiners frequently discuss creating generational wealth, preserving wealth towards de-basement and, within the phrases of Greg Foss to do it “for the kids”.

Bitcoin adoption at this time by a person is consideration of the present versus future trade-offs and cost-benefits. Make investments at this time for potential larger advantages sooner or later or spend at this time to fulfill current wants. The idea is most frequently offered by means of the memes posted of a HODLer’s empty one-room flat with solely a mattress on the ground and a mining rig subsequent to it, as they provide up every little thing to spend money on their future.

A ”Simply Transition” and Bitcoiners

How did the local weather change posse so successfully seize the idea of societal advantages and propensities to avoid wasting to push their agenda and why didn’t we Bitcoiners undertake and apply the identical SDR idea as it’s clearly a pure match? Effectively, earlier than I reply this query, I have to clarify a parallel idea getting used inside the local weather agenda known as a “Simply Transition”.

With local weather change plans, reminiscent of a shift away from fossil fuels to renewables or the transfer to EVs, the query arises about how regular individuals might be impacted in the course of the transition. Will the lots lose their jobs if a “soiled” trade is instantly shut? How will individuals assist their households if they cannot afford to spend money on new vitality effectivity necessities imposed on their small enterprise?

After all, to be honest, we should additionally take into account how some individuals may be adversely affected by local weather modifications if, for instance, their farms are impacted by desertification. The evaluation goes each methods.

The purpose is just not whether or not local weather, climate or pure disasters can have an effect on individuals, their livelihoods, or their wealth (or lack thereof), however the subject is that individuals who have decrease revenue, much less wealth, or fewer assets obtainable might be much less capable of mitigate life’s routine dangers and likewise the altering situations created throughout a inexperienced transition. As if individuals at this time don’t have already got sufficient to fret about, add to their considerations the affect of insurance policies imposed by governments underneath the local weather change agenda.

The idea being utilized underneath a “Simply Transition” coverage is that the detrimental, transitory impacts of these local weather change insurance policies mustn’t harm frequent individuals, particularly these on the decrease revenue ranges of society. Governments should in some way meet their international local weather change commitments underneath their Nationally Decided Contributions with out making issues just like the wealth hole and poverty worse within the interim. Principally, shield these individuals least capable of assume threat and deal with the transition in order that they will higher protect their present revenue and wealth for the longer term. Doesn’t this sound similar to the idea of Bitcoin adoption the place we try to assist individuals shield their wealth for the longer term?

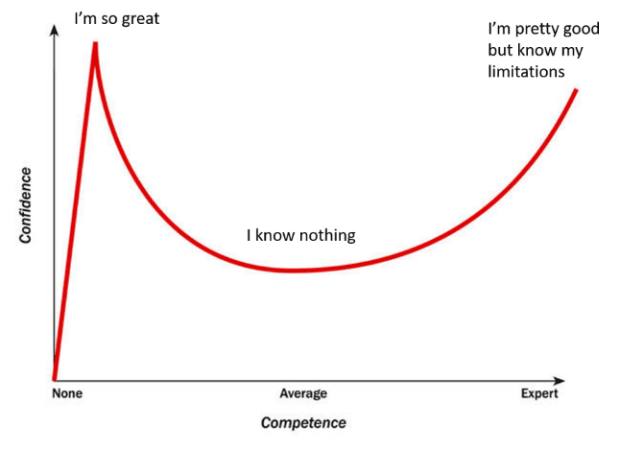

The local weather change motion believes there’s an expectation of elevated societal advantages sooner or later, and this outweighs all present prices and hardships assumed by remodeling an financial system. The advantages outweigh the prices even when the required SDR is utilized. The dilemma for an individual with decrease wealth and revenue is whether or not a greenback acquired at this time gives them with extra utility now towards in the event that they invested that greenback to realize extra wealth sooner or later. The local weather motion will say that everybody might be higher off sooner or later in the event that they sacrifice now. Nevertheless, to most individuals, present considerations and wishes will definitely predominate life. Due to this fact, they’ll place the next worth on current day spending towards investing for the longer term. Most individuals assume that that they’re glorious monetary threat managers. Are all of us poster-children for the Dunning-Kruger impact? Extra possible, easy fundamental human character applies the place individuals simply give attention to day-to-day survival. They’ve extra propensity and have to spend their wealth and revenue at this time. This contradiction impacts the extent of assist for and conformance with the local weather change agenda in addition to impacting Bitcoin adoption.

Dunning-Kruger Impact

Making use of the idea of “Simply Transition” to Bitcoiner lexicon would imply asking one thing like: “What’s the future worth of with the ability to retain your particular person sovereignty at this time?” I’m drawn right here to coin Mastercard’s lingo and easily say that it is “Priceless”. This instance reveals how exhausting it’s to really place a worth on one thing intangible and sooner or later, no matter your state of present prosperity to spend or save. Making use of pragmatic concerns, the premise for the trade-off between an individual’s current and future welfare varies relying on their present capability to handle and assume threat whether or not contemplating Bitcoin investing or their potential assist for any inexperienced societal funding.

Planning for the Societal Advantages of Bitcoin

There are lots of commonalities between what Bitcoin promotes and the marketed advantages of the local weather change agenda. Bitcoin adoption is a societal profit. Saving at this time in Bitcoin will assist construct wealth for the longer term. Bitcoin’s advantages should not just for the person, but additionally for society. The underlying ideas raised and utilized by the worldwide local weather change motion to garner assist can simply be utilized by Bitcoiners to again additional adoption. Bitcoin provides safety towards de-basement, or in different phrases preservation of your present wealth and its shopping for energy for the longer term. Everybody, no matter their wealth stage can put it to use to raised assist their future livelihood.

Bitcoiners want to raised apply the ideas of societal advantages extra successfully by means of the idea of the SDR. Via this we are able to higher specific the positives for adoption and lead extra individuals into saving and investing for the longer term defending subsequent generations, their youngsters, and grandchildren. With out efficient planning to herald the SDR and the deeper ideas of societal advantages, additional Bitcoin adoption might be a problem.

This groundwork planning helps what even Benjamin Franklin mentioned centuries in the past that “By failing to organize, you’re getting ready to fail.” So, let’s not fail future generations.

This can be a visitor put up by Enza Coin. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.