Crypto whales bought off hundreds of thousands of {dollars} value of yearn.finance on Saturday previous to YFI sharply correcting by over 40%, based on on-chain information.

Noticed by blockchain-tracking agency Lookonchain, one pockets deposited the higher a part of $5.8 million value of YFI to crypto exchanges, more likely to be bought off on the open market.

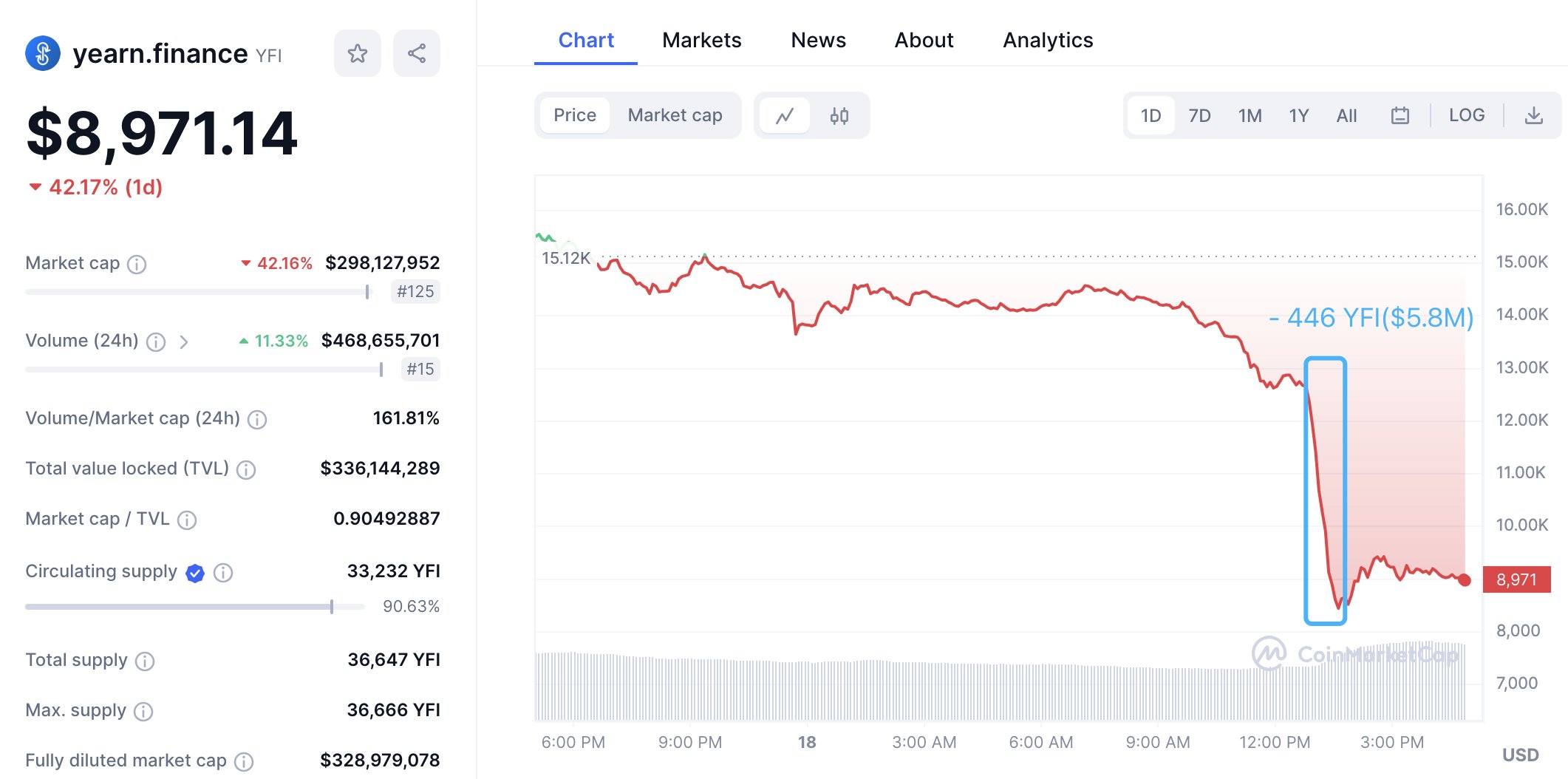

“Why did YFI immediately plummet greater than 40%?

Pockets ‘0x48f9’ transferred 446 YFI ($5.8 million) out, most of which was deposited to exchanges…

And a whale was very fortunate and bought 96 YFI for 636 ETH ($1.23 million) at a value of $12,893 earlier than YFI plummeted.”

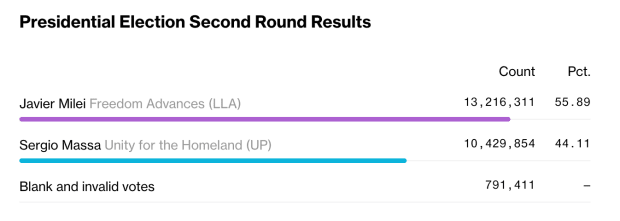

Primarily based on Lookonchain’s chart, YFI dropped to a low of $8,971 because the whales unloaded their holdings. The native asset of the yield-farming protocol has since bounced and is buying and selling for $9,408 at time of writing, up over 2% within the final 24 hours.

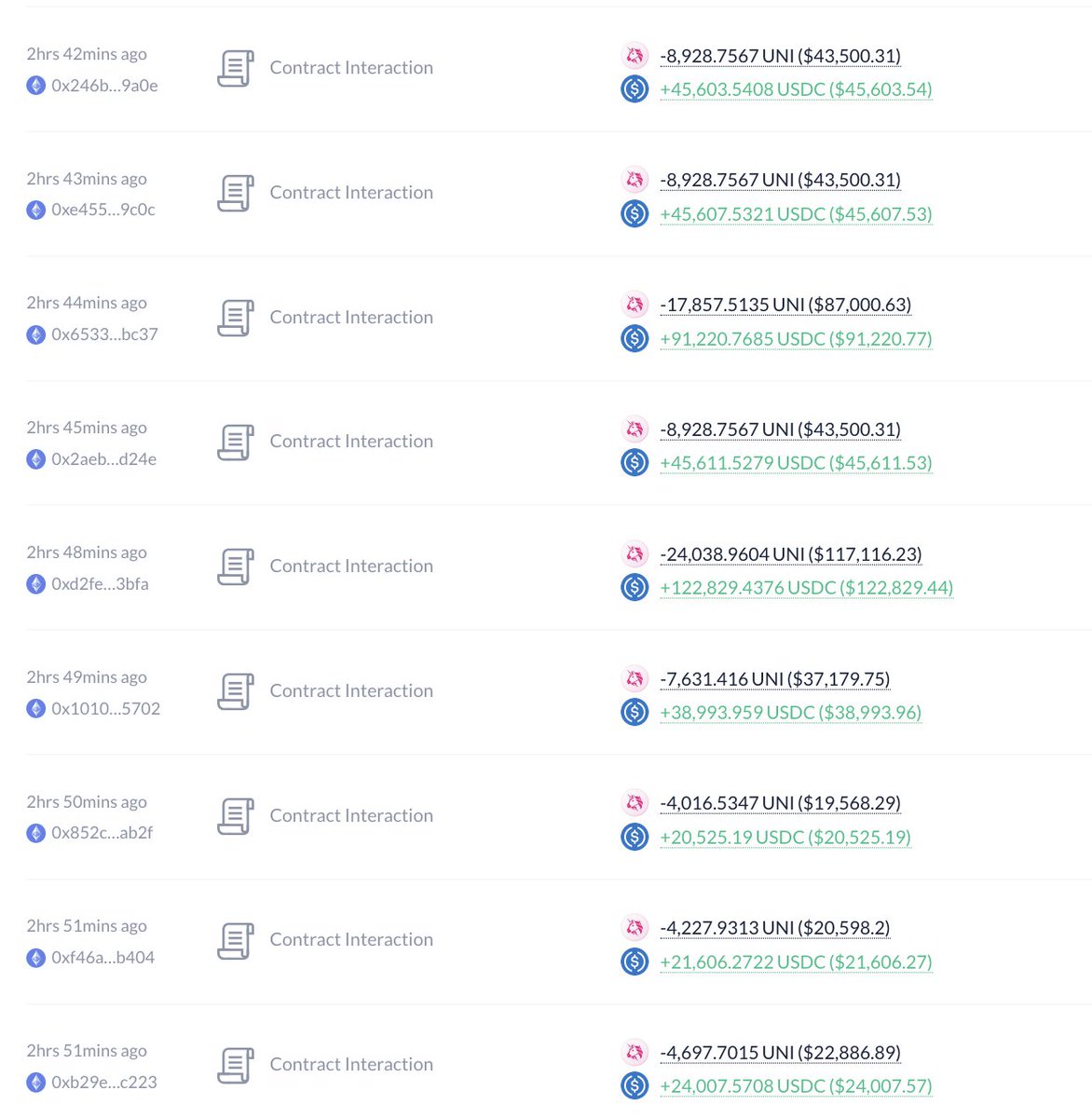

Lookonchain additionally noticed a pockets related to the funding fund behind the decentralized trade (DEX) aggregator 1inch (1INCH) promoting the current rallies in Uniswap to dump its UNI tokens for $2.13 million.

In keeping with Lookonchain, the 1Inch Funding Fund bought its UNI tokens at a loss,

“The 1inch Crew Funding Fund pockets bought all 416,924 UNI for two.13 million USDC at a value of $5.11…

1inch spent 2 million USDC to purchase 299,849 UNI at $6.67 on Feb 10, then supplied liquidity on Uniswap.

It appears 1inch dumped all UNI at a loss!”

At time of writing, UNI is buying and selling for $5.09, almost the identical value as when the 1inch Funding Fund bought its holdings.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you might incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney