In a latest analysis shared on X (previously Twitter), crypto analyst Michaël van de Poppe supplied an insightful perspective on the present state of the altcoin market. His evaluation attracts parallels with historic traits, suggesting that the present corrections in altcoins could current robust shopping for alternatives for traders.

Purchase The Altcoin Dips Now?

Van de Poppe’s evaluation started by noting the continuing corrections within the altcoin sector, which he interprets as a part of a sustained uptrend. “Altcoins have a number of days/weeks correction whereas nonetheless in an uptrend,” he said, indicating that these intervals aren’t solely pure but in addition helpful for the market’s total well being.

He additional defined the dynamics of those corrections, emphasizing their historic significance. “This [current] interval may be very closely akin to the interval we skilled on the finish of 2015, or on the finish of 2019,” van de Poppe talked about. He drew particular consideration to Ethereum’s outstanding run from $1 to $14 in late 2015, which ultimately led to a peak of $1,400 in 2017, demonstrating the potential for enormous returns.

Van de Poppe’s evaluation additionally touched upon the idea of upper timeframe help zones. He elucidated that in preliminary upward runs, corrections to those help zones supply very best re-entry factors for traders. “Throughout the run in 2020, we’ve seen the DeFi summer time happening, which has a excessive probability of coming again to the floor in 2024,” he added, hinting at a possible bull run within the coming months.

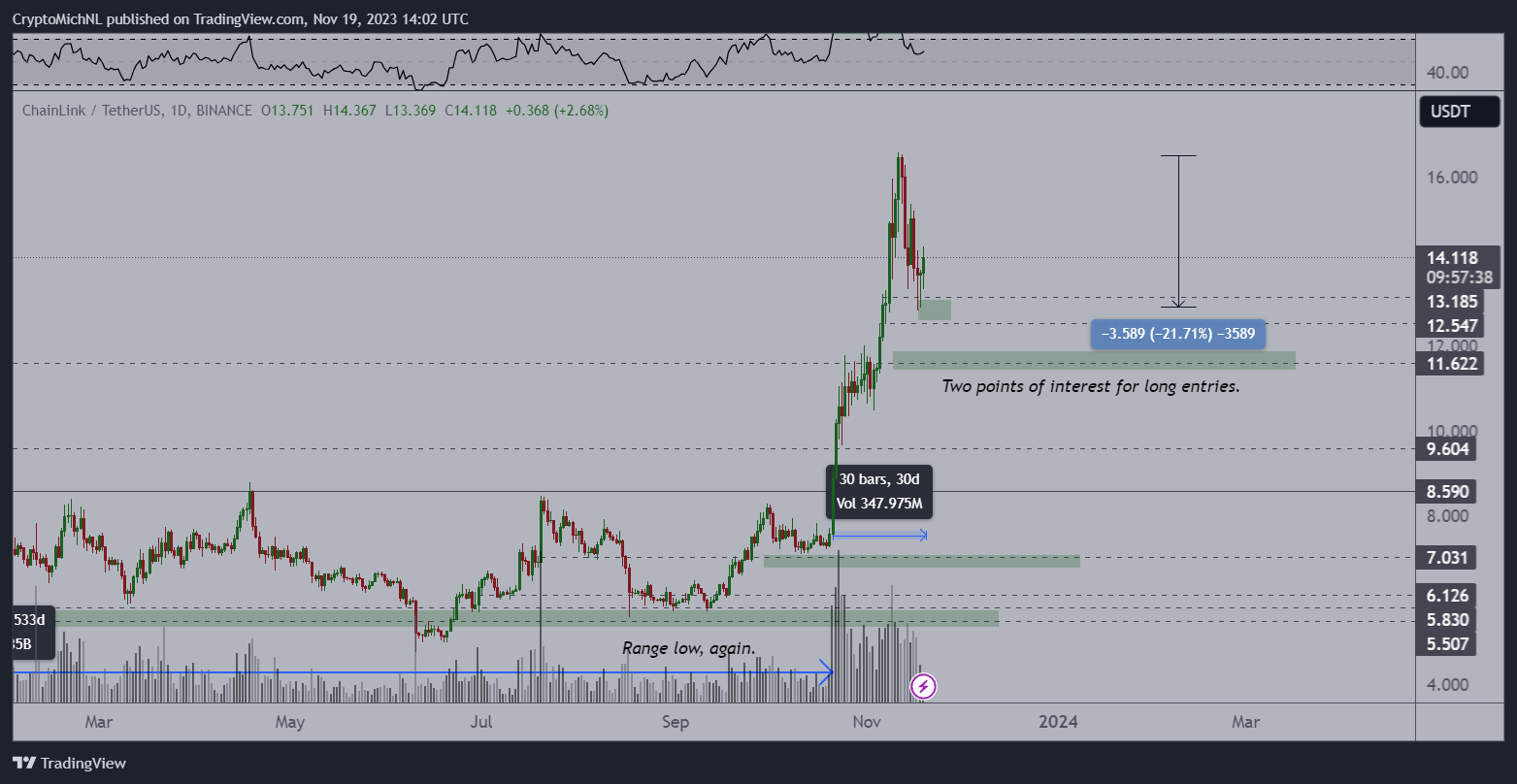

A major a part of his evaluation concerned an in depth comparability between Ethereum’s worth motion and that of different altcoins like Chainlink and Arbitrum. He famous, “In case you examine the value motion of Ethereum with the present worth motion of Chainlink, you’ll see that it’s simply barely having a correction of 20%.” He advised that additional corrections might present even clearer traits and entry factors for traders.

Van de Poppe additionally emphasised the significance of time frames in analyzing these traits. “In case you begin to zoom in on the 1h, or 4h, or 15m timeframe, you’ll spot these traits as effectively. It’s only a matter of timeframe,” he defined.

Chainlink And Arbitrum Entry Zones

Wanting on the LINK/USD 1-day chart, van der Poppe remarked, “Arguments will be made that we’re barely at the beginning of this primary upwards wave of the cycle as this rally of Chainlink lasted lower than 5 weeks.”

Because the crypto analyst reveals, Chainlink has already undergone a correction of -21.7%. In accordance with him, there are two factors of curiosity for a attainable entry, within the vary from $12.54 to $13.18 and round $11.62.

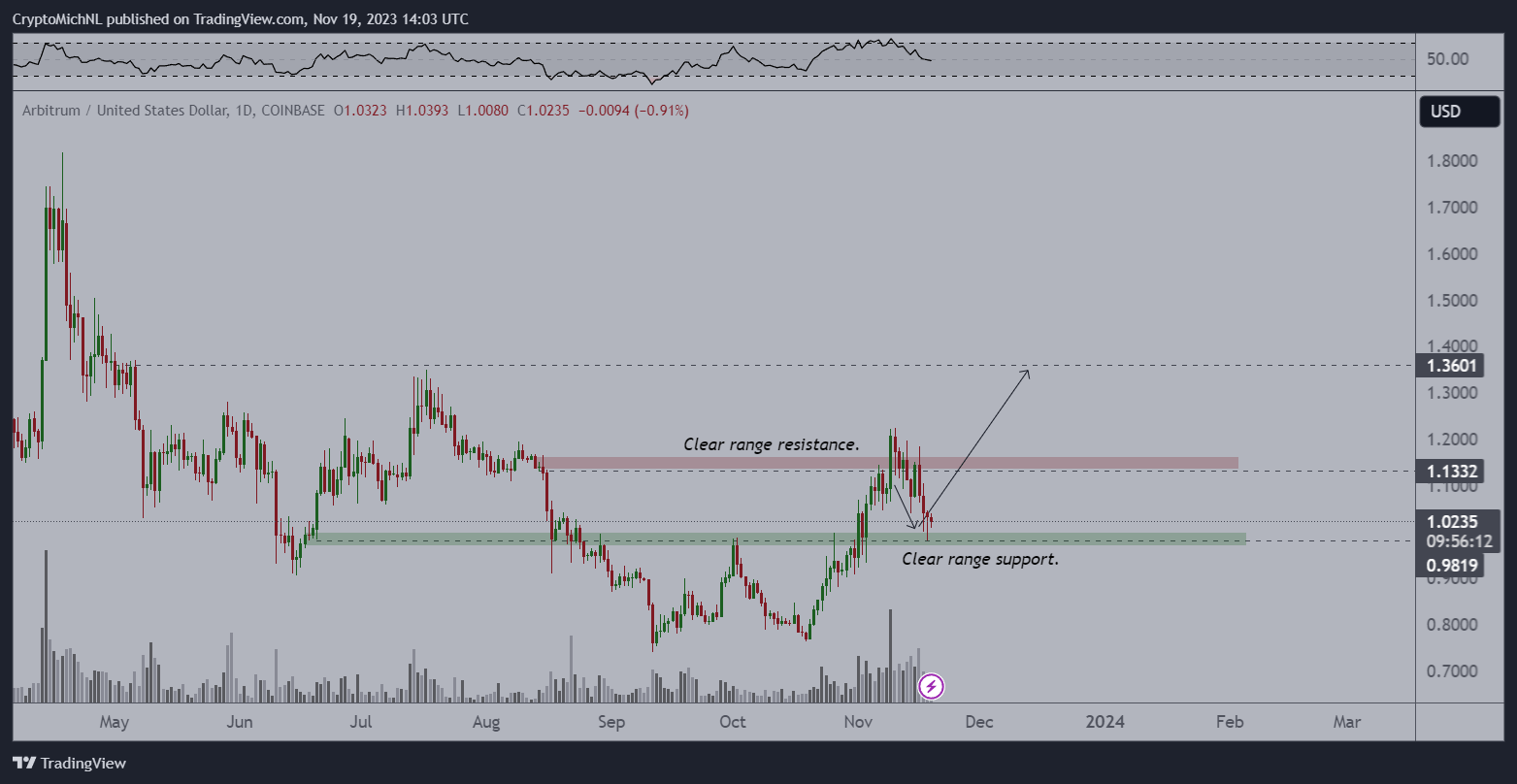

“One other instance is Arbitrum, which is presently resting on help and, similar to the remainder of the markets, is offering a corrective transfer,” said van der Poppe. The analyst identifies a “clear vary help” at $0.98 within the 1-day chart of ARB/USD.

In conclusion, Michaël van de Poppe’s evaluation presents a compelling case for contemplating altcoin corrections as potential alternatives for funding. His concluding recommendation to traders is “Don’t be afraid, if an altcoin drops between 30-50% at this stage of the cycle, time to search for your entries.”

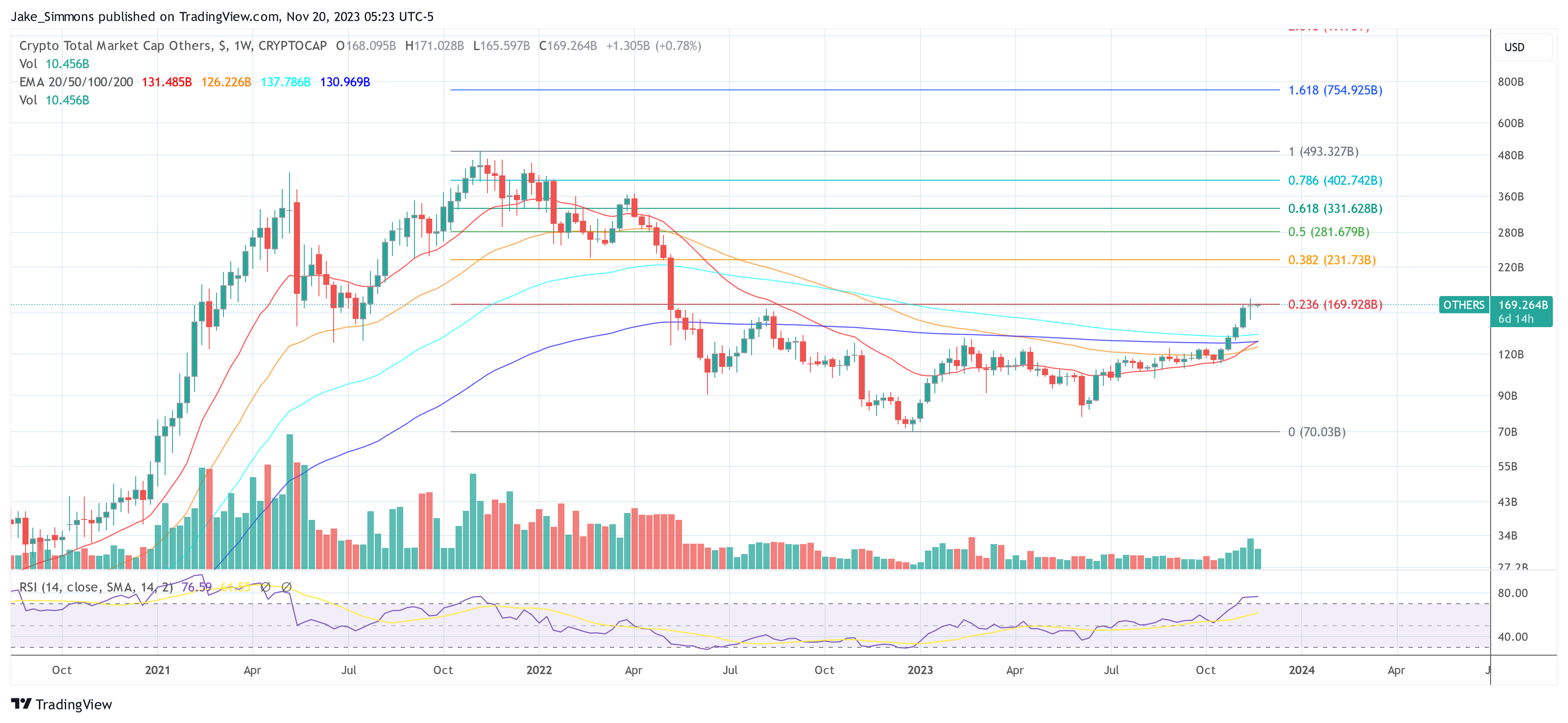

At press time, the whole altcoin market cap stood at $169.264 billion, slightly below the essential 0.236 Fibonacci retracement degree of $169.928 billion. A break above this resistance may very well be a serious bullish sign.

Featured picture from Shutterstock, chart from TradingView.com