Binance has agreed to enter right into a historic company settlement by paying over $4.3 billion to settle fees introduced by the US Division of Justice (DoJ). The crypto change may also remit an extra $2.85 billion to settle with the US commodities regulator.

Formally confirmed yesterday (Tuesday), $3.8 billion from the settlement with the DoJ will go to the Monetary Crimes Enforcement Community, whereas the Workplace of Overseas Asset Management will obtain $968 million.

In its separate settlement with the Commodity Futures Buying and selling Fee (CFTC), Binance Holdings will return $1.35 billion in “ill-gotten funds” and one other $1.35 billion in civil penalties. Additional, Binance’s former CEO, Changpeng Zhao, agreed to pay a $150 million civil financial penalty to the company, whereas the change’s former Chief Compliance Officer, Samuel Lim, pays an extra $1.5 million.

The DoJ unsealed the costs in opposition to Binance yesterday, and the change concurrently pled responsible to violating US anti-money laundering (AML) and sanctions legal guidelines. Zhao pled responsible to violating anti-money laundering guidelines and agreed to step down.

Revenue over Compliance

“Binance turned a blind eye to its authorized obligations within the pursuit of revenue. Its willful failures allowed cash to move to terrorists, cybercriminals, and baby abusers by its platform,” Treasury Secretary Janet Yellen mentioned.

Lawyer Common Merrick Garland commented alongside the identical traces: “From the very starting, Zhao and different Binance executives engaged in a deliberate and calculated effort to revenue from the US market with out implementing the controls required by US legislation.”

Other than the financial settlement, Binance agreed to exit the US markets utterly and can “abide by a sequence of sturdy sanctions compliance obligations.” Additional, Binance will probably be subjected to a five-year monitorship, granting US Treasury entry to the change’s books, information, and techniques. Failure to conform might “expose Binance to substantial extra penalties, together with a $150 million suspended penalty.”

Regulation enforcement and nationwide safety officers want extra authorities and sources to pursue cash laundering, sanctions evasion, & felony exercise facilitated by crypto. I’ll maintain working to move bipartisan laws to deal with this critical and harmful drawback.

— Elizabeth Warren (@SenWarren) November 21, 2023

In the meantime, the array of settlements didn’t embrace the costs introduced by the US securities regulator in opposition to Binance and Zhao. This implies the Securities and Change Fee (SEC) will proceed to struggle the change and its former CEO in court docket until a separate settlement is reached.

Because the founding of Coinbase again in 2012 we’ve taken a long-term view. I knew we would have liked to embrace compliance to develop into a generational firm that stood the check of time. We bought the licenses, employed the compliance and authorized groups, and made it clear our model was about belief…

— Brian Armstrong ?️ (@brian_armstrong) November 21, 2023

Binance’s Response

In a Tweet following the settlement announcement, Zhao admitted that he “made errors, and I need to take duty.”

In a weblog put up, Binance formally said: “Whereas Binance isn’t good, it has strived to guard customers since its early days as a small startup and has made great efforts to spend money on safety and compliance… Binance grew at an especially quick tempo globally, in a brand new and evolving business that was within the early phases of regulation, and Binance made misguided choices alongside the best way.”

Each Binance and Zhao highlighted that the change’s responsible plea with the US companies didn’t embody the allegations of person fund misappropriation and market manipulation. Apparently, the continuing SEC lawsuit fees Binance for commingling person funds with its personal.

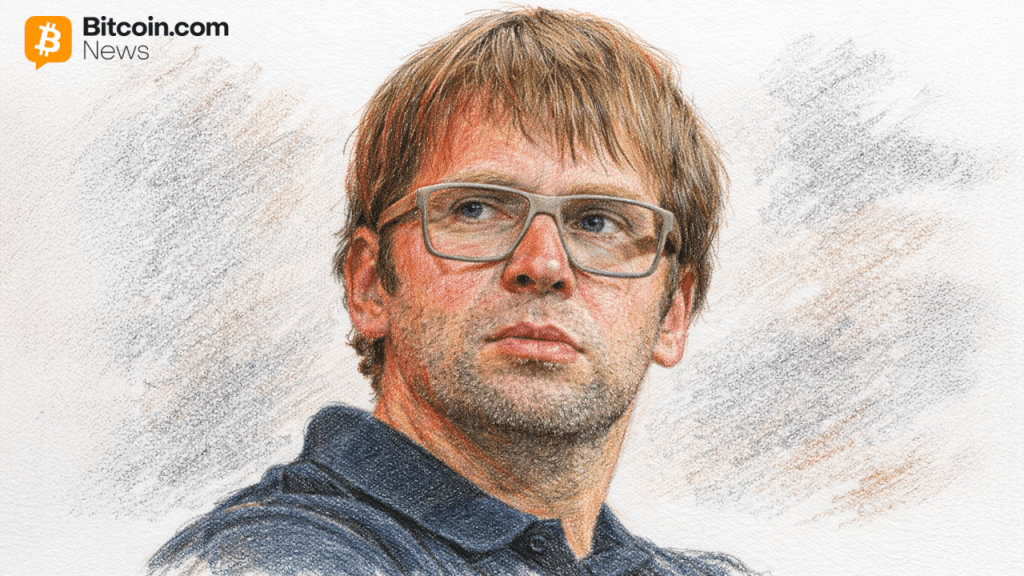

With all this commotion, Richard Teng, the previous Head of Regional Markets of Binance, has been named the brand new CEO of the crypto change big, changing Zhao.

Binance has agreed to enter right into a historic company settlement by paying over $4.3 billion to settle fees introduced by the US Division of Justice (DoJ). The crypto change may also remit an extra $2.85 billion to settle with the US commodities regulator.

Formally confirmed yesterday (Tuesday), $3.8 billion from the settlement with the DoJ will go to the Monetary Crimes Enforcement Community, whereas the Workplace of Overseas Asset Management will obtain $968 million.

In its separate settlement with the Commodity Futures Buying and selling Fee (CFTC), Binance Holdings will return $1.35 billion in “ill-gotten funds” and one other $1.35 billion in civil penalties. Additional, Binance’s former CEO, Changpeng Zhao, agreed to pay a $150 million civil financial penalty to the company, whereas the change’s former Chief Compliance Officer, Samuel Lim, pays an extra $1.5 million.

The DoJ unsealed the costs in opposition to Binance yesterday, and the change concurrently pled responsible to violating US anti-money laundering (AML) and sanctions legal guidelines. Zhao pled responsible to violating anti-money laundering guidelines and agreed to step down.

Revenue over Compliance

“Binance turned a blind eye to its authorized obligations within the pursuit of revenue. Its willful failures allowed cash to move to terrorists, cybercriminals, and baby abusers by its platform,” Treasury Secretary Janet Yellen mentioned.

Lawyer Common Merrick Garland commented alongside the identical traces: “From the very starting, Zhao and different Binance executives engaged in a deliberate and calculated effort to revenue from the US market with out implementing the controls required by US legislation.”

Other than the financial settlement, Binance agreed to exit the US markets utterly and can “abide by a sequence of sturdy sanctions compliance obligations.” Additional, Binance will probably be subjected to a five-year monitorship, granting US Treasury entry to the change’s books, information, and techniques. Failure to conform might “expose Binance to substantial extra penalties, together with a $150 million suspended penalty.”

Regulation enforcement and nationwide safety officers want extra authorities and sources to pursue cash laundering, sanctions evasion, & felony exercise facilitated by crypto. I’ll maintain working to move bipartisan laws to deal with this critical and harmful drawback.

— Elizabeth Warren (@SenWarren) November 21, 2023

In the meantime, the array of settlements didn’t embrace the costs introduced by the US securities regulator in opposition to Binance and Zhao. This implies the Securities and Change Fee (SEC) will proceed to struggle the change and its former CEO in court docket until a separate settlement is reached.

Because the founding of Coinbase again in 2012 we’ve taken a long-term view. I knew we would have liked to embrace compliance to develop into a generational firm that stood the check of time. We bought the licenses, employed the compliance and authorized groups, and made it clear our model was about belief…

— Brian Armstrong ?️ (@brian_armstrong) November 21, 2023

Binance’s Response

In a Tweet following the settlement announcement, Zhao admitted that he “made errors, and I need to take duty.”

In a weblog put up, Binance formally said: “Whereas Binance isn’t good, it has strived to guard customers since its early days as a small startup and has made great efforts to spend money on safety and compliance… Binance grew at an especially quick tempo globally, in a brand new and evolving business that was within the early phases of regulation, and Binance made misguided choices alongside the best way.”

Each Binance and Zhao highlighted that the change’s responsible plea with the US companies didn’t embody the allegations of person fund misappropriation and market manipulation. Apparently, the continuing SEC lawsuit fees Binance for commingling person funds with its personal.

With all this commotion, Richard Teng, the previous Head of Regional Markets of Binance, has been named the brand new CEO of the crypto change big, changing Zhao.