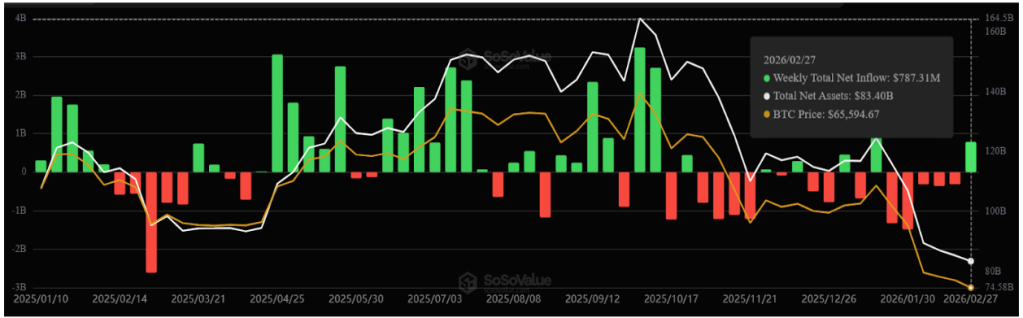

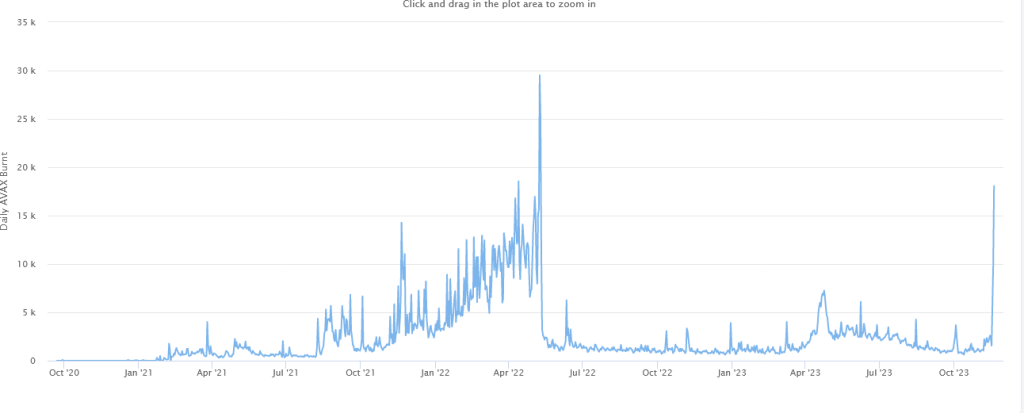

Taking to X on November 22, one consumer, @kevinsekniqi, notes that the Avalanche C-Chain is burning roughly $12.65 of AVAX each second, a improvement that may very well be an enormous enhance for AVAX in the long run.

The surge in AVAX burning on the C-Chain is primarily as a result of launch of inscriptions, which enable storing knowledge on the Avalanche’s C-Chain, pushing the variety of AVAX being taken out of circulation.

Avalanche Burning AVAX At File Tempo

@kevinsekniqi estimates that if the burn price is maintained at spot charges, it may see roughly $400 million of the coin taken away from circulation. This may very well be a major determine supporting AVAX bulls long-term since lowering provide at fixed demand would naturally result in worth features.

The heightened exercise in current days stems from the over 2.3 million each day transactions tied to customers creating and transferring “ASC-20” tokens to inscribe knowledge completely onto Avalanche’s C-Chain. On common, the Avalanche C-Chain processes round 450,000 transactions each day. Nonetheless, this determine has been altering in current days, studying from on-chain knowledge.

On-chain exercise is up roughly 4X on account of inscriptions, driving the community’s income as gauged by gasoline charges collected.

By means of inscriptions, new use circumstances, as demonstrated in Bitcoin, round provable possession and id have emerged. Since Avalanche is a public ledger maintained by distributed validators working nodes, gasoline charges have to be paid. A part of the gasoline is burnt as a part of Avalanche’s construction.

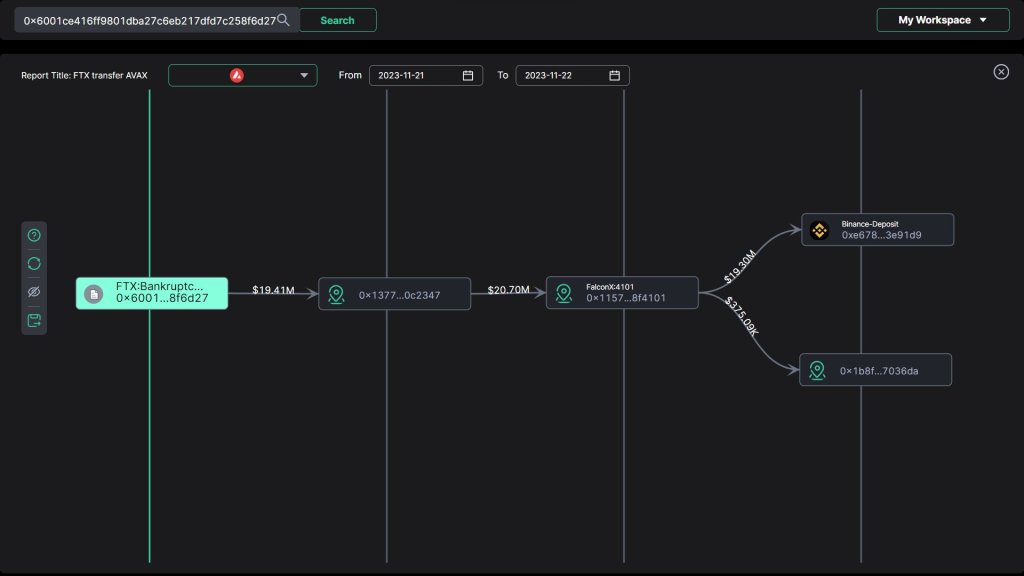

FTX Group Promoting AVAX, Bulls Dominant

It isn’t instantly clear how the spike within the variety of inscriptions on the C-Chain will affect costs. Although extra inscriptions may help bulls, different exterior market elements needs to be thought-about.

In line with Scopescan data, FTX Group, a staff tasked with managing FTX property, lately despatched 916,780 AVAX value $20.7 million to Binance. Transfers to centralized exchanges are sometimes interpreted as bearish. Following this, AVAX costs fell by 13% on November 21.

Costs stay secure, and AVAX maintains an uptrend regardless of costs contracting this week. Wanting on the developments within the each day chart, the coin roared 190% from October 2023 lows. It peaked at round $16 in November.

At current, costs have cooled off, dropping by roughly 18%. Nonetheless, the uptrend stays. Any break above $16 may spur extra exercise, even lifting the coin in the direction of August 2022 highs of round $30.

Characteristic picture from Canva, chart from TradingView