Information exhibits Bitfinex merchants have closed 12,000 Bitcoin longs up to now week. Right here’s what occurred the final time the whales confirmed this habits.

Bitcoin Longs On Bitfinex Are Now Down To 80,000 BTC

In a brand new post on X, analyst James V. Straten has identified an fascinating sample within the by-product positions of the Bitcoin whales on cryptocurrency alternate Bitfinex.

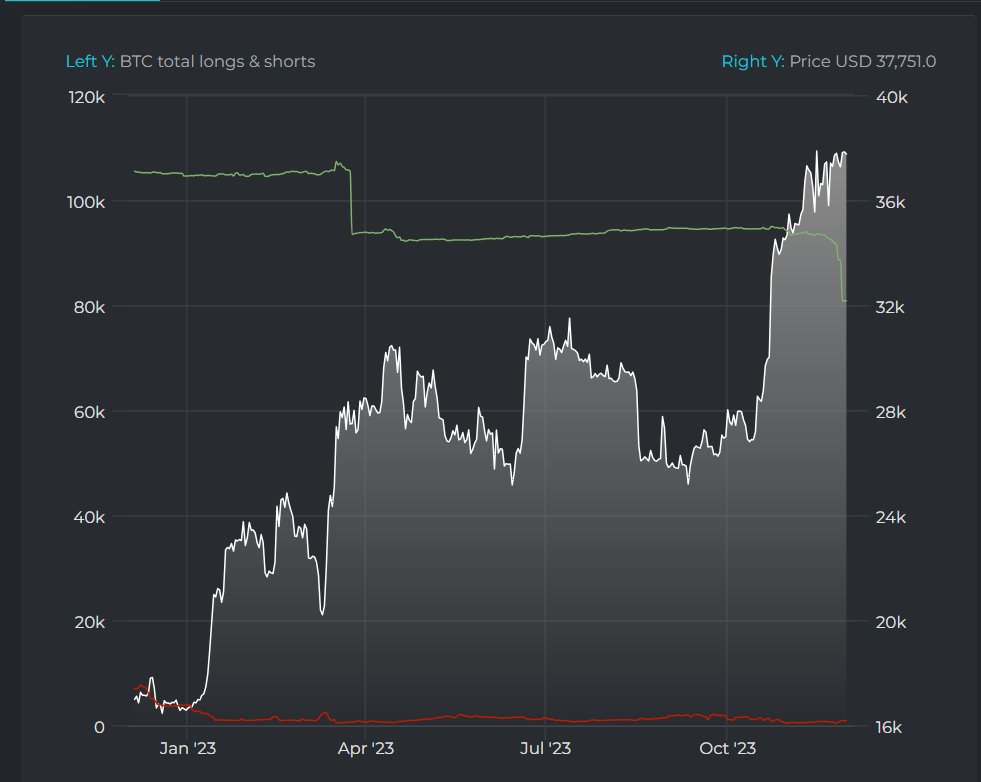

The under chart exhibits how the lengthy and quick positions (in BTC) on the platform have modified over the previous yr:

Appears to be like like the worth of the metric has plunged in latest days | Supply: @jimmyvs24 on X

As displayed within the above graph, the Bitfinex alternate has had a comparatively small variety of quick positions all year long. The lengthy positions, however, have been fairly sizeable.

In the beginning of the yr, these Bitcoin lengthy positions amounted to greater than 100,000 BTC, however it could seem that the indicator has gone by means of two notable drawdowns since then.

The primary of those plunges got here proper after the sharp rally that Bitcoin noticed again in the midst of March, following its lows under the $20,000 stage. Given the timing of this large-scale lengthy closure, it could appear as if an inexpensive chance that these whales made a transfer to lock of their earnings.

Bitcoin would go on to see some extra uptrend not too lengthy after this decline within the indicator, however this surge was a lot smaller in scale than the earlier rally, as BTC hit a prime quickly after.

Following this prime, BTC registered some important decline. Thus, the Bitfinex whales, though not fully exact, nonetheless exited the market at a extremely worthwhile alternative near the highest.

The second drawdown within the metric for the yr has occurred inside the previous week, as is seen within the chart. Throughout this plunge, the whales on the alternate have closed longs price 12,000 BTC, taking the full lengthy positions to about 80,000 BTC.

It’s doable that a number of the whales suppose that the present Bitcoin surge has come far sufficient now, in order that they have determined to exit right here whereas their earnings are nonetheless excessive.

Since these merchants have closed the lengthy positions, although, the value of the cryptocurrency has truly registered some surge because it has damaged again above the $38,000 stage.

Nevertheless, provided that these humongous holders did miss the mark a bit when closing their lengthy positions earlier within the yr, it’s doable an identical sample will repeat this time as nicely, with a prime arriving for the cryptocurrency with some delay.

Whereas the short-term view could also be bearish for Bitcoin attributable to this, the truth that about 80,000 BTC in lengthy positions remains to be up on Bitfinex ought to imply plenty of whales nonetheless proceed to be bullish on the asset, so it would nonetheless be capable to flip it round within the long-term.

BTC Worth

Bitcoin had gone as excessive as above $38,800 throughout its surge up to now day, however the coin has since registered some pullback, because it’s now floating below $38,400.

The worth of the coin appears to have loved an increase within the final 24 hours | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Datamish.com