Knowledge reveals that the Tether (USDT) market cap is sort of $90 billion. Right here’s why this development might matter for the value of Bitcoin.

Tether Market Cap Has Continued To Observe A Rise Just lately

Tether is a cryptocurrency pegged to the US Greenback, that means its value stays secure across the $1 mark. The asset is essentially the most well-known such “stablecoin” within the sector, with its market cap outstripping every other secure’s.

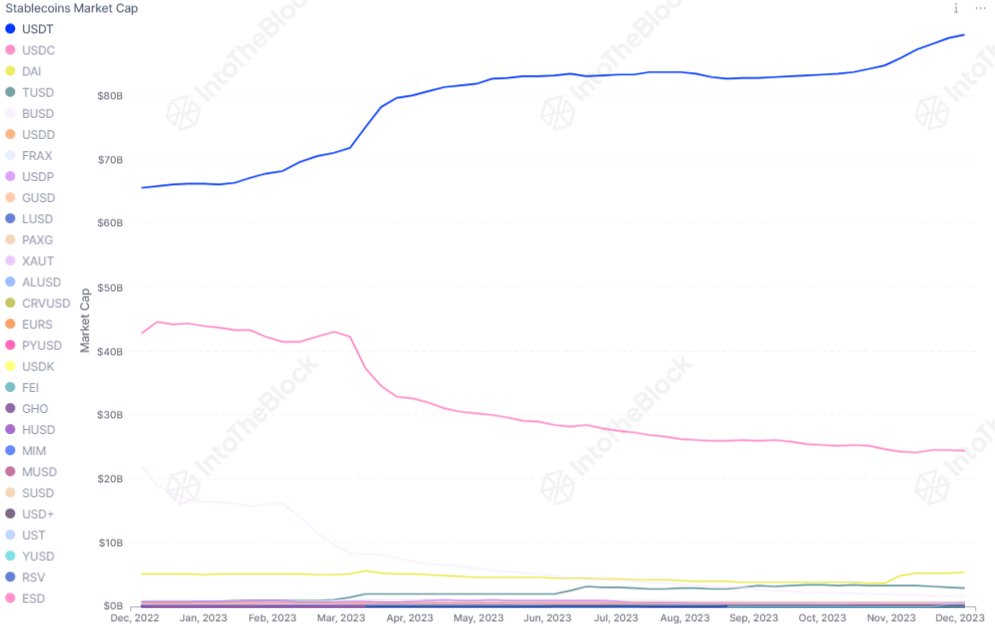

Because the market intelligence platform IntoTheBlock identified, the biggest stablecoin provide has solely continued to develop not too long ago. The chart under reveals the development out there caps of the varied stablecoins within the cryptocurrency sector over the previous yr.

Seems just like the metric has been rising for USDT in current days | Supply: IntoTheBlock on X

As displayed within the above graph, Tether has noticed an total uptrend through the previous yr, whereas USD Coin (USDC), the subsequent largest competitor, has noticed outflows as its market cap has fallen.

The chart additionally places into perspective how small the opposite stables are when in comparison with these two belongings, making them maybe insignificant for the broader market.

What relevance does a big stablecoin like Tether have for Bitcoin and different cash within the sector? The reply to that query lies in what the stablecoins symbolize.

Usually, traders make use of stables each time they wish to keep away from the volatility related to the opposite belongings within the sector. The holders protecting their capital locked in these fiat-tied tokens normally plan to return in direction of the unstable aspect, nevertheless, as they’d have gone for fiat itself in the event that they wished to stay away from cryptocurrency altogether.

When such traders lastly transfer again in direction of cash like Bitcoin, they naturally put shopping for strain on their costs. Because of this, the availability of stablecoins might be thought of the “potential shopping for provide” for BTC and others.

There are two methods the USDT market cap grows. The primary is an inflow of recent capital straight going to the asset, which is of course a bullish improvement because it means the whole capital within the sector goes up.

The second is thru a swap from one other coin like Bitcoin. On this case, the general capital current within the sector wouldn’t change, because it’s only a reshuffling, however no matter asset is being offered in favor of the stablecoin would naturally see some decline.

Essentially the most bullish state of affairs for the market is, subsequently, when each the BTC value and Tether market cap head up, because it implies, a recent inflow of capital is going on in direction of each the cash.

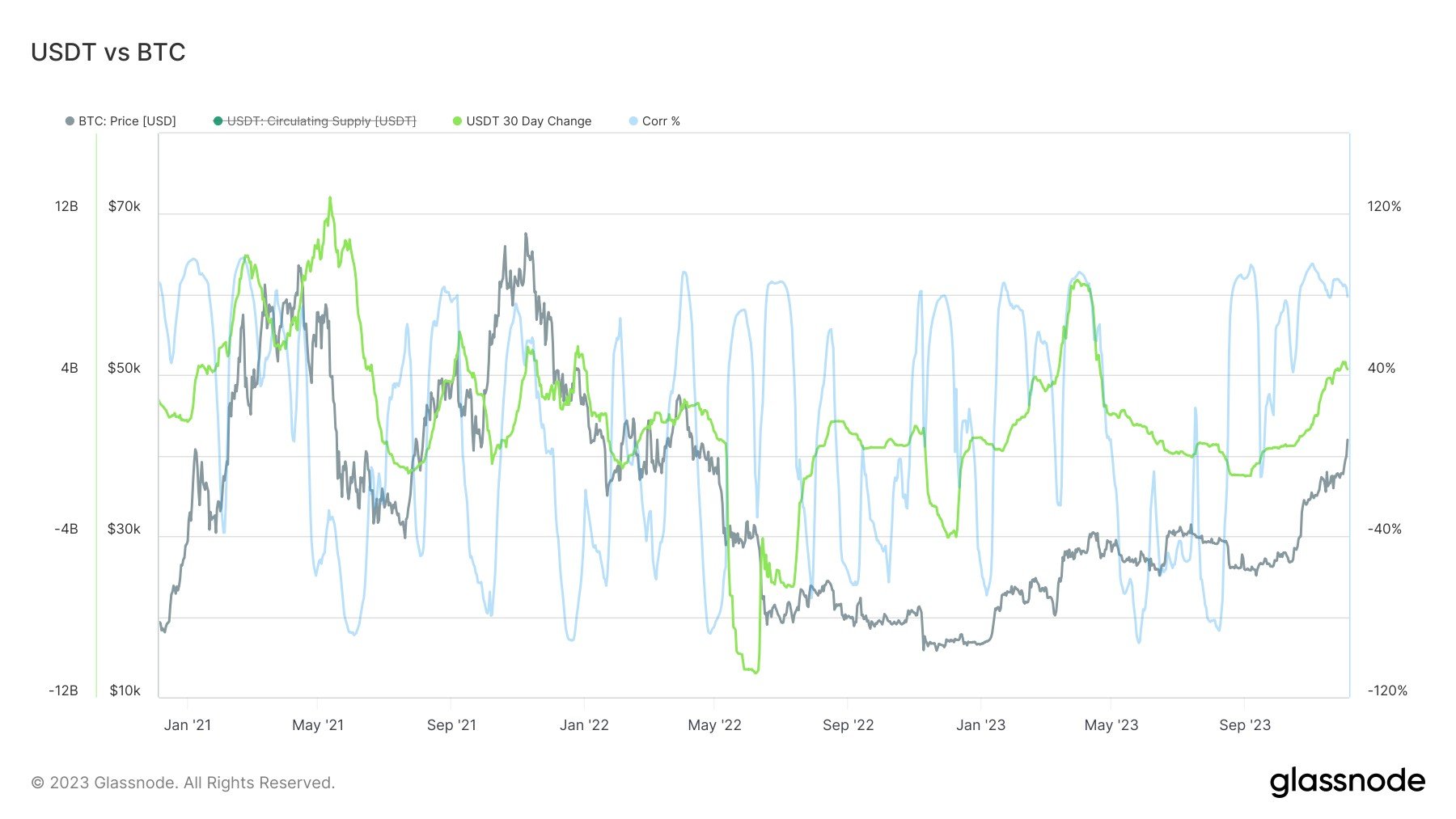

As analyst James V. Straten defined in a post on X, the correlation between the USDT market cap and BTC has nearly hit 100% throughout this newest rally, as each have shot up.

The worth of the metric appears to have been excessive not too long ago | Supply: @jimmyvs24 on X

The USDT market cap persevering with to develop in these circumstances is actually an optimistic signal for the present rally, because it signifies that all this dry powder that’s accumulating might doubtlessly be deployed into Bitcoin ought to the surge decelerate, serving to lengthen the transfer additional.

BTC Value

Bitcoin had breached the $44,000 mark earlier prior to now day, however the asset has since seen some pullback because it’s now again round $43,800.

BTC has continued to look at a powerful surge through the previous day | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com, IntoTheBlock.com