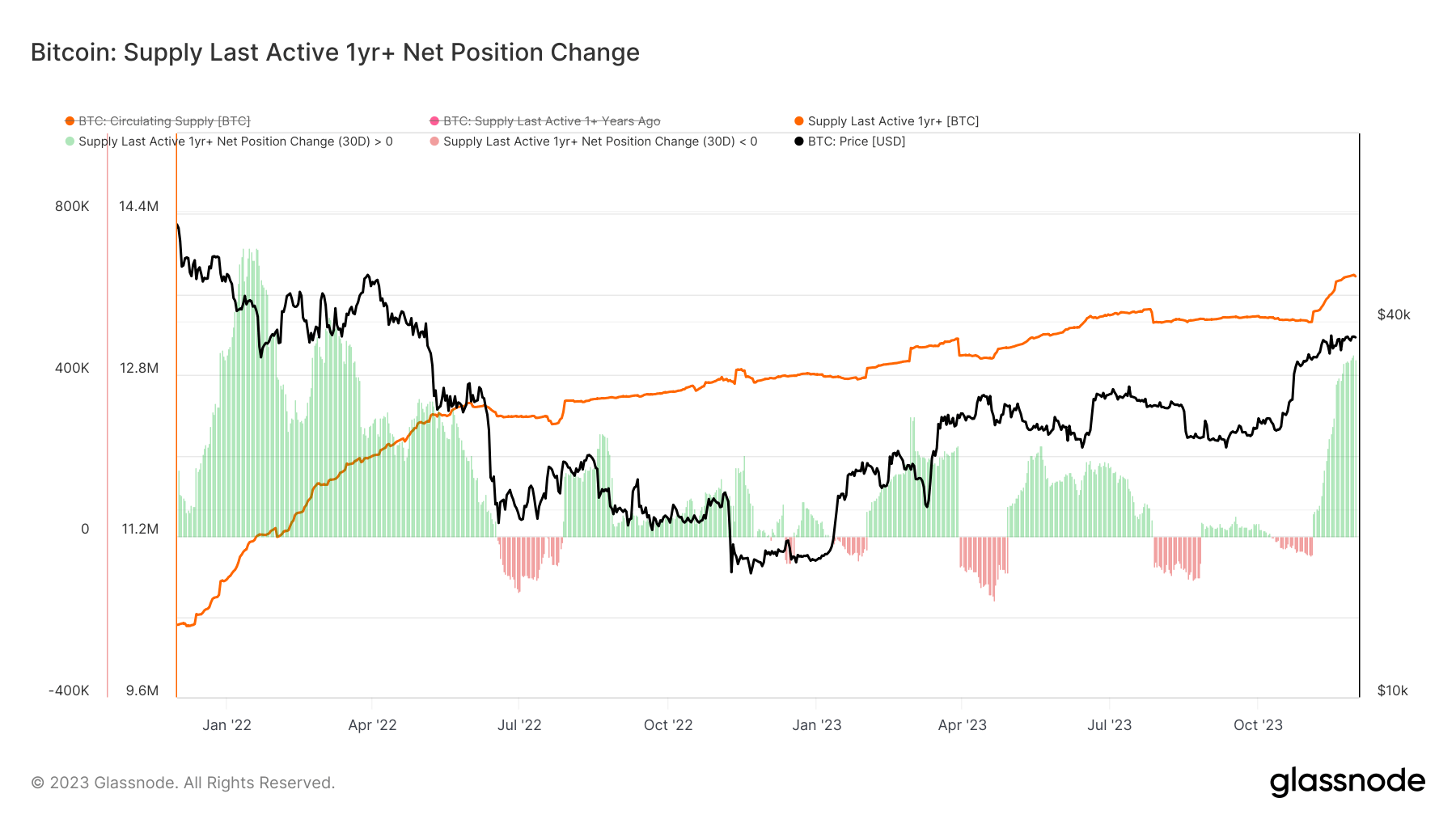

Bitcoin’s ‘provide final lively over a yr in the past’ is a barometer for long-term holding traits and market liquidity. This metric displays the amount of Bitcoin that has remained dormant, with out transactions or actions, for over a yr. Its significance lies in revealing the propensity of traders to carry their belongings for prolonged intervals, a conduct that immediately impacts the liquidity obtainable available in the market.

A excessive variety of long-term holdings usually signifies a discount within the lively provide of Bitcoin for buying and selling, thereby influencing the liquidity and, consequently, the volatility available in the market.

On Nov. 30, the quantity of Bitcoin that hadn’t been moved or transacted for over a yr soared to an all-time excessive of 13.78 million BTC. This milestone is not only a statistical anomaly however a big indicator of the altering contours within the Bitcoin market.

To contextualize this growth, it’s important to contemplate the info factors over the yr. On Nov. 9, 2022, through the collapse of FTX and the following market frenzy, the availability final lively over a yr in the past was recorded at 12.73 million BTC. This quantity noticed a marginal enhance to 12.8 million BTC by Jan. 1, 2023, as merchants slowly stopped transferring their cash and the market cooled.

Nonetheless, by Nov. 3, 2023, it had escalated to 13.32 million BTC, setting the stage for the record-breaking determine noticed on the finish of November. This constant enhance underscores a rising propensity amongst Bitcoin holders to undertake a long-term funding strategy.

The implication of this development is manifold. Primarily, it indicators a robust inclination amongst a good portion of Bitcoin traders to carry onto their belongings, probably as a consequence of a perception within the long-term appreciation of Bitcoin or as a technique to make use of Bitcoin as a retailer of worth. This inclination in the direction of holding reduces the lively buying and selling provide, probably resulting in decreased liquidity available in the market. Decrease liquidity, in flip, may end up in elevated value volatility, as every transaction carries extra weight in figuring out market costs.

A notable facet of this development is the 30-day internet place change as of Nov. 30, 2023, the place an addition of +447,228 BTC to the availability final lively over a yr. This was the best 30-day change since Could 19, 2022, which starkly contrasts with the -43,417 BTC change recorded on Nov. 3, 2023. Such fluctuations spotlight intervals of investor indecision and different responses to market occasions.

Some could interpret the rise in long-term holding as a bullish indicator, suggesting a sturdy perception in Bitcoin’s future regardless of market fluctuations. Alternatively, it might be seen as a sign of lowered curiosity amongst short-term merchants, however Bitcoin’s rising value defies this development.

As we glance forward, the continual rise within the Bitcoin provide, final lively over a yr in the past, may point out a maturation available in the market’s strategy to Bitcoin, transferring away from speculative short-term buying and selling in the direction of a extra investment-focused mindset. This shift may result in a extra steady market in the long run, albeit with the trade-off of lowered liquidity and better volatility within the brief time period.

The publish Bitcoin’s provide final lively over a yr in the past reached ATH appeared first on CryptoSlate.