Chainlink has seen lengthy contracts pile up on Binance throughout the previous day, which can lead towards a prime for the cryptocurrency.

Chainlink Funding Charge On Binance Has Turned Extremely Optimistic

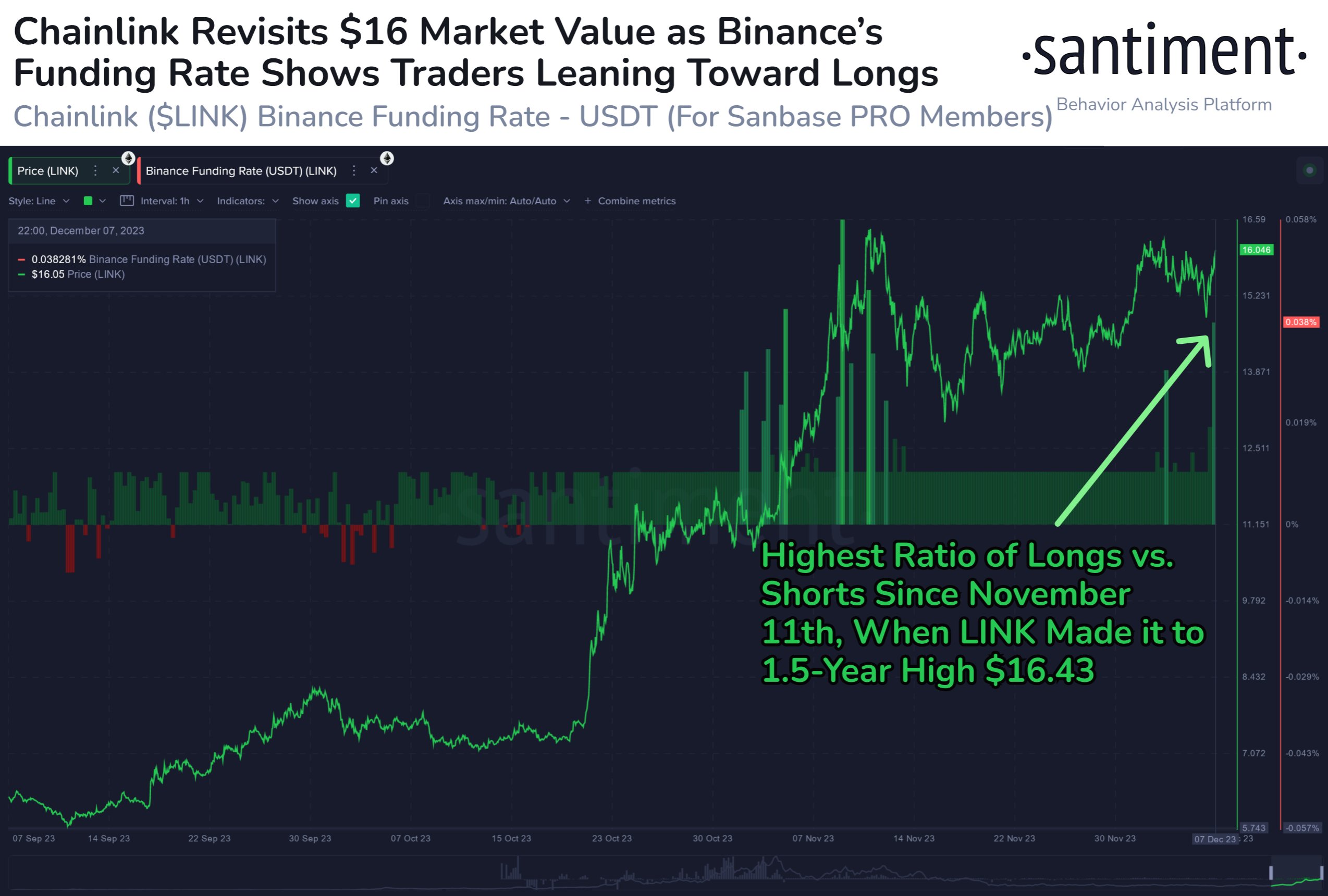

In response to information from the on-chain analytics agency Santiment, the Chainlink funding charge on Binance has now reached the best stage in about 4 weeks. The “funding charge” refers back to the periodic charge that spinoff merchants on any given platform are exchanging with one another proper now.

When the worth of this metric is optimistic, it signifies that the lengthy holders are at present paying a charge to the brief buyers in an effort to maintain onto their positions. Such a development suggests a bullish mentality is dominant on the platform.

However, damaging values suggest a bearish sentiment is shared by most LINK merchants on the alternate because the shorts outweigh the longs.

Now, here’s a chart that reveals the development within the Chainlink funding charge on cryptocurrency alternate Binance over the previous few months:

The worth of the metric seems to have seen a big spike just lately | Supply: Santiment on X

As displayed within the above graph, the Chainlink funding charge on Binance has assumed considerably optimistic values following the asset’s surge past the $16 mark.

Longs at present outweigh the shorts by the best ratio since November eleventh, when the cryptocurrency’s value set its then-yearly excessive, which the coin has now surpassed.

Traditionally, longs piling up on the derivatives market have typically been damaging for the value. It’s because a mass liquidation occasion referred to as a “squeeze” is normally extra more likely to have an effect on the aspect with probably the most positions.

In a squeeze, a sudden swing within the value triggers a considerable amount of liquidations, which solely feed into the swing additional and find yourself resulting in a cascade of extra liquidations.

Because the Chainlink funding charge is considerably optimistic, a protracted squeeze may very well be extra more likely to occur than a brief squeeze. Final month, the asset hit its native prime in these situations, so the identical may additionally repeat this time.

If LINK does observe a drawdown shortly, although, the decline will not be too prolonged. It’s because there seems to be some sturdy on-chain help current between the $14.4 and $14.8, as analyst Ali identified in an X post yesterday.

Seems to be like LINK has little resistance forward | Supply: @ali_charts on X

In on-chain evaluation, ranges are outlined as resistance and help primarily based on the whole variety of buyers who acquired their cash at mentioned ranges. From the chart, it’s seen that 17,000 addresses have their value foundation contained in the $14.4 to $14.8 vary, which suggests it’s presumably a zone of sturdy help.

Quite the opposite, the degrees above the present one are skinny with buyers, that means that they shouldn’t pose an excessive amount of resistance ought to the rally proceed.

“As $LINK has regained the $16 threshold, watch if a little bit of FOMO kinds a neighborhood prime, or if costs proceed surging towards $20 with little resistance,” notes Santiment.

LINK Worth

LINK had earlier damaged previous the $17 mark, however the asset has since seen some pullback because it’s now buying and selling beneath the extent as soon as extra.

LINK has shot up throughout the previous day | Supply: LINKUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, IntoTheBlock.com, Santiment.internet