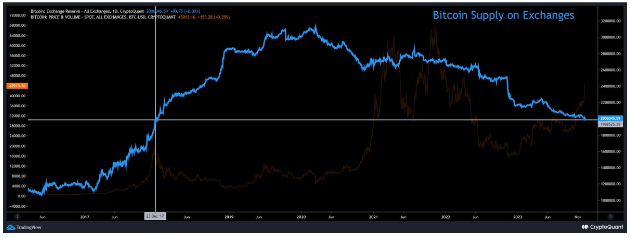

On-chain information has revealed an rising sentiment of holding Bitcoin amongst buyers. Bitcoin has been on a roll for the reason that begin of the month, pushing its worth to new yearly highs. On the identical time, change information from CryptoQuant reveals that the crypto is perhaps gearing up for a sustained bull run. In line with the on-chain analytics platform, Bitcoin’s change provide, the quantity accessible for buy on exchanges, has dropped to its lowest ranges since 2017

Trade Provide Drops To Lowest Stage In Six Years

The Bitcoin market is flashing a bull sign that correlates with anticipation of spot Bitcoin ETF functions. CryptoQuant’s change reserve chart demonstrates that the provision of Bitcoin has been steadily lowering from centralized exchanges since 2020 when it reached a excessive of over 3.2 million BTC. The outflow was significantly aggravated within the final quarter of 2022, when the collapse of crypto change FTX led to panic and buyers began to go for self-custody in chilly wallets. Throughout this era, change reserves dropped from 2.512 million BTC to 2.158 million BTC in a month.

https://x.com/cryptoquant_com/standing/1733005131216744749?s=20

Lowest Provide of #Bitcoin in Six Years

“We’re within the forty fifth month of diminishing provide. For the primary time, provide returned to 2017 ranges. ”

by @1MrPapiHyperlink ?https://t.co/dY6QyFNit4

— CryptoQuant.com (@cryptoquant_com) December 8, 2023

Reserve on exchanges began to extend slowly within the early months of 2023, climbing again as much as 2.240 million in Might. Nonetheless, issues began to alter in June, as filings by BlackRock and different funding firms for spot Bitcoin ETF buying and selling within the US led to the beginning of a bullish sentiment.

Bitcoin barely beneath the $44K stage at this time. Chart: TradingView.com

The reserve on centralized exchanges has been on a gradual drop since then. On the time of writing, the change reserve has now crossed beneath 2 million BTC, a stage it has but to succeed in since December 2017. This metric’s six-year low is especially fascinating, contemplating Bitcoin’s whole circulating provide has elevated since 2017. Bitcoin’s whole provide now stands at 19,564,812 BTC, a 16% improve from December 2017’s provide of 16.78 million BTC.

Outlook For Bitcoin Value: Bull Sign?

Though there are technically extra bitcoins now accessible to go round, the improve in adoption is making it more and more tougher for merchants to come up with the asset. Dropping change provide is a bullish sign for crypto property and intervals of low change provide have traditionally been related to the start of great Bitcoin bull runs. The final time Bitcoin had a drastic drop in change reserve was in 2020, and the crypto would later go on to succeed in its all-time excessive the yr after.

Bitcoin is at present spearheading new inflows into the crypto business, with Coinmarketcap’s Worry and Greed Index now pointing to an excessive greed of 82. The business’s main asset just lately broke over $44,000 for the second time this week and is now up by 14% in a 7-day timeframe. Bitcoin is poised for excessive beneficial properties in 2024, and plenty of analysts have predicted a worth goal above $100,000.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing entails threat. Once you make investments, your capital is topic to threat).

Featured picture from Freepik