After FTX collapsed, scornful critics broadly ridiculed Caroline Ellison’s strategy to cease losses. ‘I simply do not do not suppose they’re an efficient threat administration device,’ she infamously informed an viewers throughout FTX’s heyday. However did she have a degree?

Venturing into the crypto asset administration realm presents a singular set of challenges that differ broadly from the standard fund area. On this primer piece, we’ll delve into the obstacles that aspiring fund managers face when launching a bitcoin sector fund and study the important thing variations that exist once you step exterior the world of conventional asset administration.

Volatility and Threat Administration

One of the vital vital challenges confronted by bitcoin sector funds is the acute volatility that exists throughout the cryptocurrency market. Bitcoin’s worth has witnessed sturdy bullish surges, driving pleasure amongst traders. Nevertheless, it has additionally skilled sturdy bearish declines, resulting in substantial losses for these unprepared for such worth swings. Managing threat in such a dynamic setting requires refined methods, rigorous threat frameworks and assessments, and a deep understanding of market developments.

Not like most conventional and mainstream blue chip property, which frequently expertise comparatively steady worth actions, bitcoin’s worth can change meaningfully inside a matter of hours. Consequently, bitcoin sector fund managers have to be well-equipped to deal with sudden worth fluctuations to guard their traders’ capital. Conventional cease loss buildings could not work to the extent anticipated, because the closing market order could get executed far under the preset set off worth resulting from orderbook slippage and fast worth actions, the proverbial “catching of a falling knife”. Utilizing tight cease losses as a foundational threat administration mechanism might be your enemy. For instance, in a flash crash situation, positions could also be mechanically offered at a loss despite the fact that the market reverted a couple of minutes (or seconds) later.

Whereas cease losses are an alternate, they’re not an choice! Choices are contracts you should buy that provide the proper to purchase or promote a given asset at a predetermined worth (i.e., the strike worth) at a given time (i.e., the expiration date). An choice to purchase an asset is a name and an choice to promote one is a put. Shopping for an out-of-the-money put (i.e., far under the present worth) can act as a flooring in your potential losses if the worth collapses. Consider it as a premium paid to insure your place.

Typically to defend in opposition to binary outcome occasions or notably excessive volatility timeframes you simply must flatten your positions and take no threat, residing to struggle one other day within the bitcoin market. Assume for instance of key protocol replace dates, regulatory selections or the subsequent Bitcoin halving; although notice the market strikes forward of these occasions so you could have to take motion beforehand.

Creating an efficient threat administration plan for a bitcoin sector fund could contain utilizing numerous hedging methods, product and instrument diversification (doubtlessly throughout asset lessons), buying and selling venue threat scoring and risk-adjusted allocations, dynamic commerce sizing, dynamic leverage settings, and using strong analytical instruments to watch market sentiment and potential market and operational dangers.

Custody and Safety

The custody of Bitcoin and different cryptocurrencies is a essential side that distinguishes bitcoin sector funds from their conventional counterparts. One key distinction is that not like conventional exchanges that solely match orders, bitcoin exchanges do the order matching, margining, settlement, and custody of the property. The change itself turns into the clearinghouse, concentrating counterparty threat versus assuaging it. Decentralized exchanges include a singular set of dangers as properly, from warding off miner-extracted worth to being prepared to maneuver property in case of a protocol or bridge hack.

For these causes, safeguarding digital property from theft or hacking requires strong safety measures, together with however not restricted to multi-signature protocols, chilly storage options, and threat monitoring instruments. The accountability of securely managing personal keys and selecting and monitoring dependable buying and selling venues rests completely with the fund supervisor. The burden to watch the market infrastructure itself introduces a stage of technical complexity absent in conventional fund administration the place custody and settlement are standardized and commoditized standalone techniques.

Custodial options for bitcoin sector funds have to be rigorously chosen, guaranteeing that property are protected in opposition to cyberattacks and insider threats. With the historical past of high-profile cryptocurrency change hacks, traders are notably involved concerning the security of their property; any breach in safety may result in vital monetary losses and injury the fame of the fund.

Conclusion

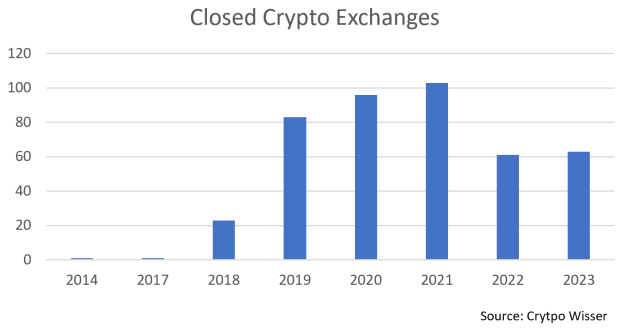

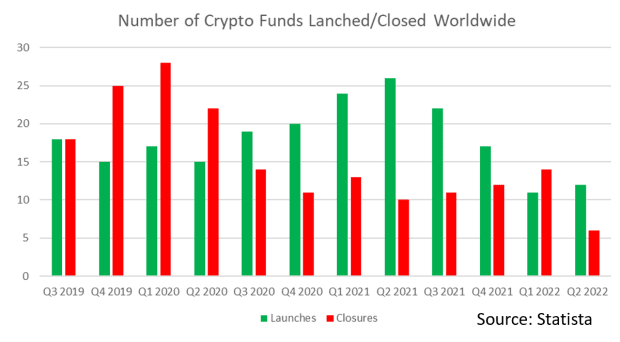

Launching a bitcoin sector fund is an exhilarating endeavor that gives unprecedented alternatives for traders looking for publicity to the fast-growing cryptocurrency market. It is crucial, nevertheless, to grasp that launching a fund is not any simple feat with pitfalls going past the success of the buying and selling technique. It’s no shock that each quarter the fund closures are in the identical vary of fund launches.

These getting into the bitcoin sector fund area ought to strategy it with a pioneering spirit, keep knowledgeable, and embrace the dynamic nature of this thrilling rising market. Whereas the street could also be difficult, the potential rewards for profitable bitcoin sector fund managers may very well be astronomical.

In the event you’re prepared to start out the fund constructing journey, already en route, or would similar to to study extra, attain out to us at advisory@satoshi.capital.

This can be a visitor publish by Daniel Truque. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.