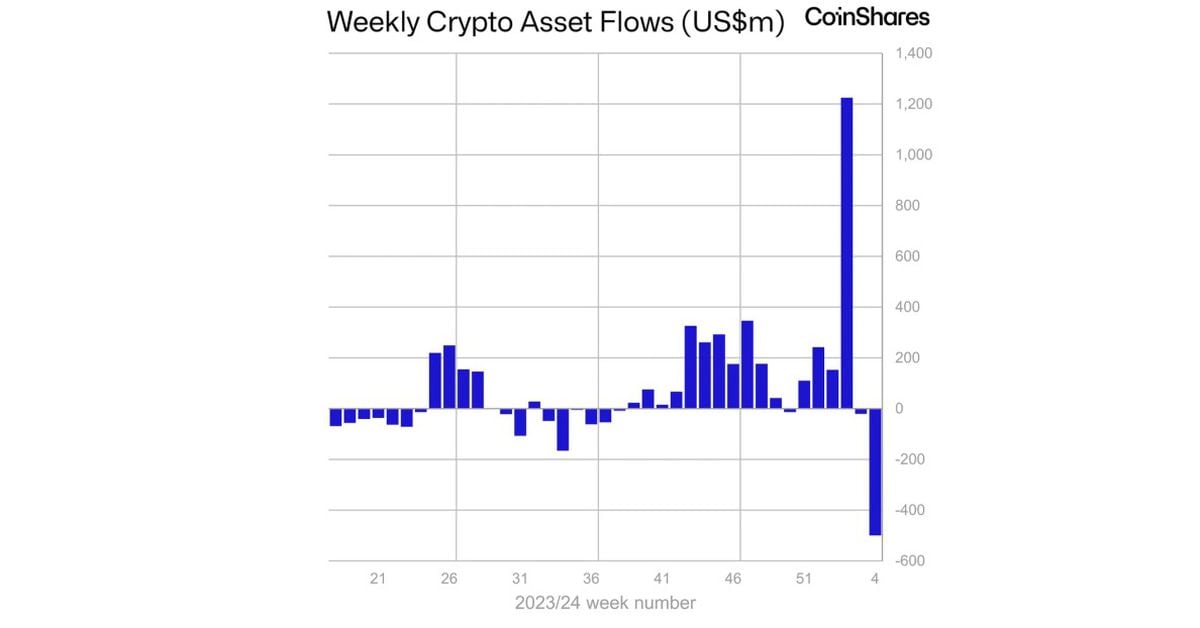

Crypto funding merchandise noticed their second consecutive week of outflow this 12 months, with $500 million leaving the funds, in response to CoinShares’ newest weekly report.

Bitcoin dominate

Bitcoin funding merchandise skilled vital outflows final week, with a complete withdrawal of $479 million.

The highest cryptocurrency has confronted vital headwinds because the U.S. Securities and Alternate Fee (SEC) authorised spot exchange-traded funds (ETF) within the nation. Its worth has declined by greater than 12% to round $42,500 as of press time.

This downturn has spurred bearish buyers to show to brief BTC merchandise, leading to almost $11 million in inflows final week.

Conversely, outstanding different digital property like Ethereum, Polkadot, and Chainlink additionally noticed outflows, with $39 million, $700,000, and $600,000, respectively. Nevertheless, Solana defied this pattern by recording a modest influx of $3 million.

Throughout areas, U.S.-based funds dominated the scene, experiencing internet outflows of $409 million. Switzerland and Germany adopted with outflows of $60 million and $32 million, respectively. Brazil emerged because the exception, with probably the most vital internet inflows of $10.3 million.

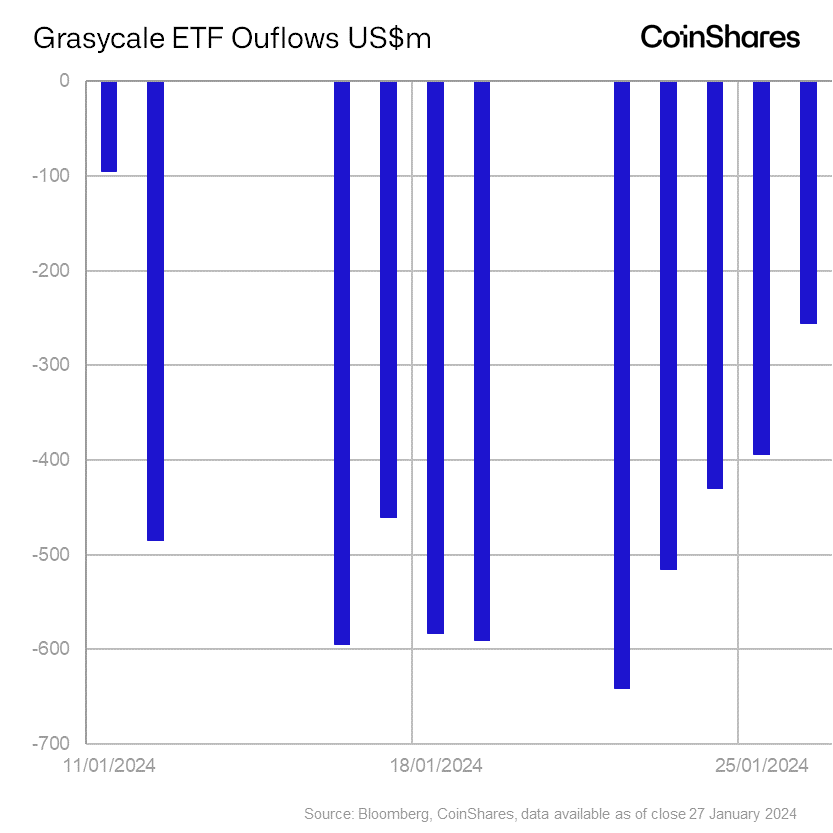

“Latest worth declines prompted by the substantial outflows from the incumbent ETF issuer (Grayscale) within the U.S. totaling $5 billion, have probably prompted additional outflows from different areas,” CoinShares Head of Analysis James Butterfill defined.

Grayscale outflows ‘subside’

The publish World Bitcoin ETP holdings over 900,000 BTC as Grayscale outflows ‘subside’ appeared first on CryptoSlate.