The current launch of spot Bitcoin ETFs (Alternate Traded Funds) has sparked a surge in funding, with capital flows surpassing gold ETFs over the previous two weeks, in line with Bitwise CIO Matt Hougan.

Spot Bitcoin ETFs Draw Extra Capital, Flip Gold ETFs

In a publish on X, Huogan notes that Bitcoin ETFs attracted $1.7 billion within the first 14 buying and selling days, in comparison with $1.3 billion for gold ETFs. This pattern could recommend a shift in investor choice, with some viewing Bitcoin as a digital different to conventional safe-haven belongings.

Even so, when adjusted for inflation, gold flows stay barely bigger. Nonetheless, it’s price noting that Bitcoin ETFs have been launched when gold had established its presence out there, turning into a retailer of worth asset for the higher a part of human historical past.

Analysts responding to Hougan’s comparability additionally word that the determine may have been larger. Over the previous few weeks, for the reason that launch of spot Bitcoin ETFs, Grayscale Funding has been liquidating its Grayscale Bitcoin Belief (GBTC), offloading billions price of BTC.

Grayscale Funding is actively unwinding its GBTC belief, changing it to an ETF. Subsequently, the CIO notes that excluding GBTC, spot Bitcoin ETFs noticed a internet influx of $7.1 billion over the past two durations, considerably exceeding gold.

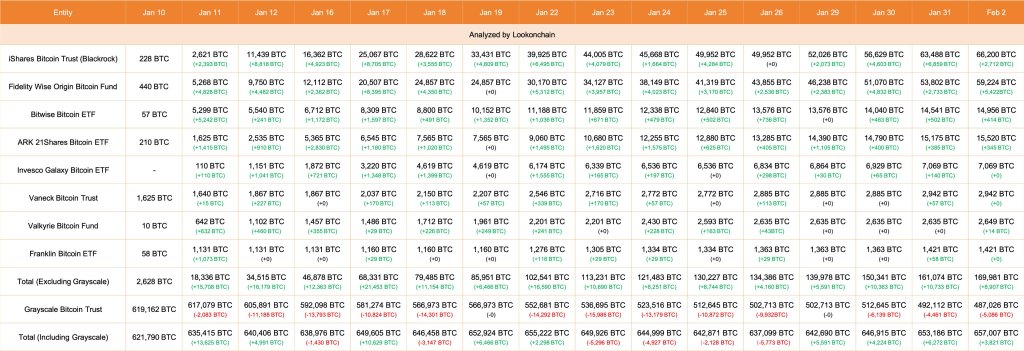

In keeping with Lookonchain data, GBTC bought 5,086 BTC price over $218 million as of February 1. On the similar time, eight spot Bitcoin issuers scooped 8,907 BTC price over $382 million.

Out of this quantity, Constancy purchased 5,422 BTC. Constancy controls over 59,000 BTC, coming second after BlackRock, whose fund has purchased over 66,200 BTC as of February 1.

Writing On The Wall For Gold?

This fast shift is monumental. It notably highlights Bitcoin’s potential to disrupt the normal funding panorama and spots Bitcoin ETFs. Over time since launching, Bitcoin has grown to command a market cap of over $840 billion, information from CoinMarketCap exhibits.

Supporters are accumulating Bitcoin, citing its deflationary nature and long-term progress potential. Information from Bitcoin Treasuries exhibits that some public corporations like MicroStrategy, Tesla, and Sq. maintain tens of millions and billions of {dollars} within the coin.

Bitcoin is agency however wobbling when writing, transferring sideways, as evidenced by the every day chart. Bulls have failed to interrupt above $47,000 and $50,000, with the chances of additional losses under $39,500 rising.

Characteristic picture from Canva, chart from TradingView