F%$Ok Unhealthy Analysis: I spent over a month analyzing a bitcoin mining research and all I acquired was this trauma response.

“We should confess that our adversaries have a marked benefit over us within the dialogue. In only a few phrases they will announce a half-truth; and with a view to display that it’s incomplete, we’re obliged to have recourse to lengthy and dry dissertations.” — Frédéric Bastiat, Financial Sophisms, First Sequence (1845)

“The quantity of vitality wanted to refute bullshit is an order of magnitude greater than that wanted to provide it.” — Williamson (2016) on Brandolini’s Legislation

For too lengthy, the world has needed to endure the fallout of subpar educational analysis on bitcoin mining’s vitality use and environmental impression. The end result of this bullshit analysis has been surprising information headlines which have turned some well-meaning folks into indignant politicians and deranged activists. So that you simply by no means must endure the brutality of one in every of these sloppy papers, I’ve sacrificed my soul to the bitcoin mining gods and carried out a full-scale evaluation of a research from the United Nations College, printed not too long ago within the American Geophysical Union’s Earth’s Future. Solely the bravest and hardest of all bitcoin autists might proceed to the next paragraphs, the remainder of you possibly can return to watching the worth chart.

Your delicate child ears may need screamed with shock on the sturdy proclamation in my lede that the largest and squeakiest analysis on bitcoin mining is bullshit. Should you’ve ever learn Jonathan Koomey’s 2018 weblog put up on the Digiconomist–often known as Alex deVries, or his 2019 Coincenter report, or Lei et al. 2021, or Sai and Vranken 2023, or Masanet et al. 2021, or… Effectively, the purpose is that there’s 1000’s of phrases already written which have proven that bitcoin mining vitality modeling is in a state of disaster and that this isn’t remoted to bitcoin! It’s a wrestle that information middle vitality research have confronted for many years. Individuals like Jonathan Koomey, Eric Masanet, Arman Shehabi, and people good guys Sai and Vranken (sorry, we’re not but on a first-name foundation) have written sufficient pages that might in all probability cowl the partitions of no less than one males’s lavatory at each bitcoin convention that’s occurred final yr, that present this to be true.

My holy altar, which I maintain in my bed room closet, is a hand-carved, elegant but ascetic shrine to Koomey, Masanet, and Shehabi for the many years of labor they’ve completed to enhance information middle vitality modeling. These sifus of computing have made all of it very clear to me: should you don’t have bottom-up information and also you depend on historic tendencies whereas ignoring IT machine vitality effectivity tendencies and what drives demand, then your analysis is bullshit. And so, with one broad but very surgical stroke, I swipe left on Mora et al. (2018), deVries (2018, 2019, 2020, 2021, 2022, and 2023), Stoll et al. (2019), Gallersdorfer et al. (2020), Chamanara et al. (2023), and all of the others which can be talked about in Sai and Vranken’s complete evaluate of the literature. World, let these burn in a single violent but metaphorically majestic mega-fire someplace off the coast of the Pacific Northwest. Reporters, and policymakers, please, I implore you to cease listening to Earthjustice, Sierra Membership, and Greenpeace for they know not what they do. Absolve them of their sins, for they’re however sheep. Amen.

Now that I’ve set the temper for you, my pious reader, I’ll now let you know a narrative a couple of latest bitcoin vitality research. I pray to the bitcoin gods that this would be the final one I ever write, and the final one you’ll ever must learn, however my feeling is that the gods are punishing gods and won’t have mercy on my soul–even in a bull market. One deep breath (cue Heath Ledger’s Joker) and Right here… We… Go.

On a considerably bearish October afternoon, I acquired tagged on Twitter/X on a put up a couple of new bitcoin vitality use research from some authors affiliated with the United Nations College (Chamanara et al., 2023). Little did I do know that this research would set off my autism so onerous that I might descend into my very own form of drug-induced-gonzo-fear-and-loathing-in-vegas state, and hyper-focus on this research for the subsequent 4 weeks. Whereas I’m in all probability exaggerating in regards to the heavy drug use, my recollection of this time could be very a lot a techno-colored, poisonous relationship-level fever dream. Do you keep in mind Frank from the critically acclaimed 2001 movie, Donnie Darko? Yeah, he was there, too.

As I began taking notes on the paper, I noticed that Chamanara et al.’s research was actually complicated. The paper was perplexing as a result of it is a poorly designed research that bases its raison d’etre totally on de Vries and Mora et al. It makes use of the Cambridge Middle for Different Finance (CCAF) Cambridge Bitcoin Power Consumption Index (CBECI) information with out acknowledging the constraints of the mannequin (see Lei et al. 2021 and Sai and Vranken 2023 for an in-depth evaluation of the problems with CBECI’s modeling). It conflates its outcomes from the 2020-2021 interval with the state of bitcoin mining in 2022 and 2023. The authors additionally relied on some environmental footprint methodology that may make you suppose it was truly potential so that you can shrink or develop a reservoir relying on how onerous you Netflix and chill. Actually, that is what Obringer et al. (2020) inferentially conclude is feasible and the UN research cites Obringer as one in every of its methodological foundations. By the way in which, Koomey and Masanet didn’t like Obringer et al.’s methodology, both. I’ll mild one other soy-based candle on the altar of their honor.

Right here’s a extra clearly acknowledged enumeration of the crux of the issue with Chamanara et al. (and by the way in which, their corresponding writer by no means responded to my electronic mail asking for his or her information so I may, you recognize, confirm, not belief. ?):

The authors conflated electrical energy use throughout a number of years, overreaching on what the outcomes may reveal based mostly on their strategies.

The authors used historic tendencies to make current and future suggestions regardless of intensive peer-reviewed literature clearly exhibiting that this results in overestimates and exaggerated claims.

The paper guarantees an vitality calculation that may reveal bitcoin’s true vitality use and environmental impression. They use two units of knowledge from CBECI: i) whole month-to-month vitality consumption and ii) common hashrate share for the highest ten international locations the place bitcoin mining is operated. Remember the fact that CBECI depends on IP addresses which can be tracked at a number of mining swimming pools. CBECI-affiliated mining swimming pools characterize a median of 34.8% of the full community hashrate. So, the information used probably have pretty extensive uncertainty bars.

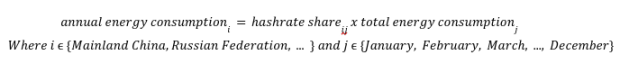

After about an hour or so of Troy Cross speaking me off a somewhat spectacular, artwork deco and weather-worn ledge that’s in all probability seen a couple of Nice Gatsby flappers soar–a results of feeling an awesome sense of terror after my exasperated self realized that no quantity of cognitive behavioral remedy would get me by means of this research–I made up my mind the equation that the authors used to calculate the vitality use shares for every of the highest ten international locations with probably the most share of hashrate (based mostly on the IP tackle estimates) needed to be the next:

Don’t let the mathematics scare you. Right here’s an instance of how this equation works. Let’s say China has a shared share for January 2020 of 75%. Then, let’s additionally say that the full vitality consumption for January 2020 was 10 TWh (these are made-up numbers for simplicity’s sake). Then, for one month, we’d discover that China used 7.5 TWh of vitality. Now, save that quantity in your reminiscence palace and do the identical operation for February 2020. Subsequent, add the vitality use for January to the vitality use discovered for February. Do that for every subsequent month till you’ve added up all 12 months. You now have CBECI’s China’s annual vitality consumption for 2020.

Earlier than I present the desk with my outcomes, let me clarify one other caveat to the UN research. This research makes use of an older model of CBECI information. To be truthful to the authors, they submitted their paper for evaluate earlier than CBECI up to date their machine effectivity calculations. Nonetheless, because of this Chamanara et al.’s outcomes will not be even near life like as a result of we now consider that CBECI’s older mannequin was overestimating vitality use. Furthermore, to do that comparability, I used to be restricted to information by means of August 31, 2023, as a result of CBECI switched to the brand new mannequin for the remainder of 2023. To get this older information, CCAF was beneficiant and shared it with me upon request.

One other difficult factor about this research is that they mixed the vitality use for each 2020 and 2021 into one quantity. This was actually difficult as a result of should you take a look at their figures, you’ll discover that the largest textual content states, “Whole: 173.42 TWh”. It’s additionally barely complicated as a result of the determine caption states, “2020-2021”, which for many individuals could be interpreted as a interval of 12 months, not 24 months. Effectively, no matter. I broke them up into their particular person years so everybody may see the steps that have been taken to get to those numbers.

Have a look at the far proper column with the header, “% Change Between 2020 + 2021 Calculations (%)”. I calculated the % change between my calculations and Chamanara et al.’s. That is somewhat curious, isn’t it? Based mostly on my conversations with the researchers at CCAF, the numbers needs to be equivalent. Possibly the changelog doesn’t replicate a smaller change someplace, however our numbers are barely completely different nonetheless. China has a higher share and america has a smaller share within the information that CCAF shared with me in comparison with the UN research. Regardless of this, the totals are pretty shut. So, let’s give the authors the good thing about the doubt and say that they did an inexpensive job calculating the vitality share, given the constraints of the CBECI mannequin. Please keep in mind that noting that their calculation was affordable doesn’t imply that it’s affordable to make use of these historic estimates to make claims in regards to the current and future and direct coverage. It isn’t.

One night whereas working by candlelight, I glanced to my left and noticed Frank’s stabbing, black pupils (the Donnie Darko character I discussed earlier) looking at me like two items of Stronghold waste coal, fastened in a quiet mattress of pearly sand. He was reminding me that this report was nonetheless not completed and one thing about time journey. I grabbed my extra-soft curls (I switched to bar shampoo, it’s a godsend for frizz) and yanked as onerous as I may. Willie Nelson’s 1974 Austin Metropolis Limits pilot episode blasting on my cheap-ass Chinese language knock-off monitor’s mono audio system was transferring by means of my ears like heroin by means of Lou Reed’s 4-lanes extensive community of veins. Begrudgingly, I accepted my destiny. I wanted to go deeper down this rabbit gap. I wanted to do a deeper evaluation of the 2020 and 2021 CBECI information to indicate how essential it’s to do an annual evaluation and never blur the years into one calculation. Realizing I used to be out of my onerous liquor of selection, a splash of sherry in a Shirley Temple (shaken, not stirred), I grabbed a bottle of bootleg antiseptic that I acquired in the course of the pandemic lockdown and chugged.

I flipped by means of my notes. I’ve a lot of notes as a result of I’m a severe individual. What in regards to the mining map points? Can we do that by means of an evaluation of the 2 separate years? What was occurring for every of the ten international locations? Does that inform us something about the place hashrate went after the China ban? What in regards to the Kazakhstan crackdown? That’s post-2021, however the UN research acts prefer it by no means occurred after they’re speaking in regards to the present mining distribution…

To not the authors’ credit score, they failed to say to the peer-reviewers and to their readers that the mining map information solely goes by means of January 2022. So, despite the fact that they discuss bitcoin mining’s vitality combine as if it represents the current, they’re utterly mistaken. Their evaluation solely captures historic tendencies, not the current and positively not the long run.

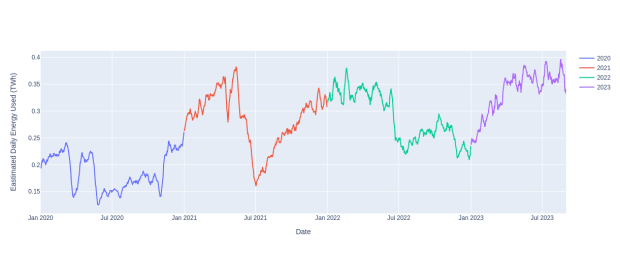

See this multi-colored plot of CBECI’s estimated each day vitality use (TWh) from January 2020 by means of August 31, 2023? At this macro scale, we see loads of variability. But additionally it’s obvious simply from inspection that every yr is completely different from the subsequent by way of variability and vitality use. There are a selection of potential causes for the reason for variability at this scale. Some potential influences on vitality use might be bitcoin worth, problem adjustment, and machine effectivity. Extra macroscale influences might be on account of regulation, such because the Chinese language bitcoin mining ban that occurred in 2021. Most of the Chinese language miners fled the nation for different components of the world, Kazakhstan and america are two international locations the place hashrate discovered refuge. In reality, the facility of the Texas mining scene actually got here to be at this unprecedented second in hashrate historical past.

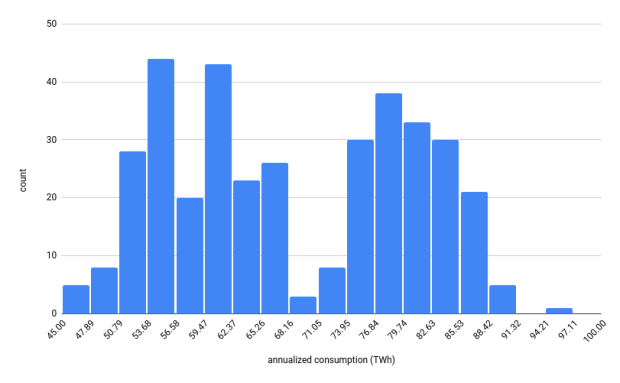

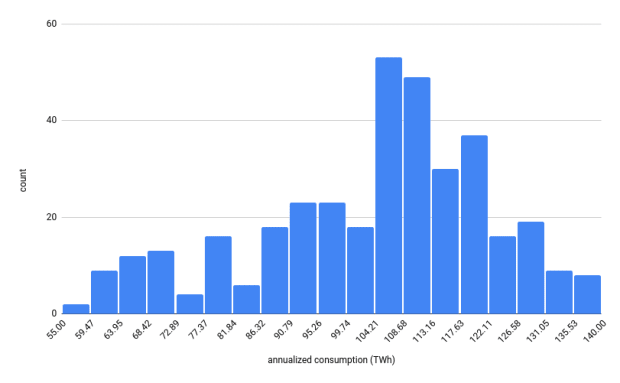

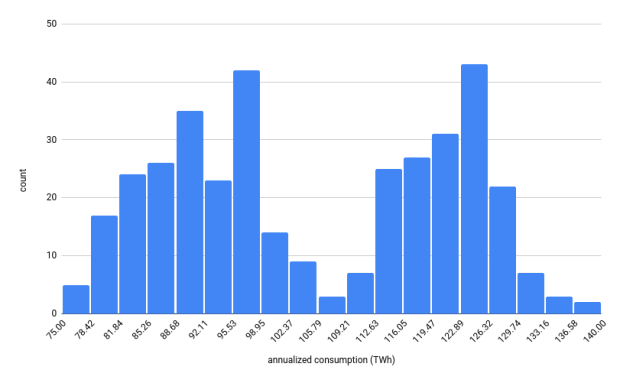

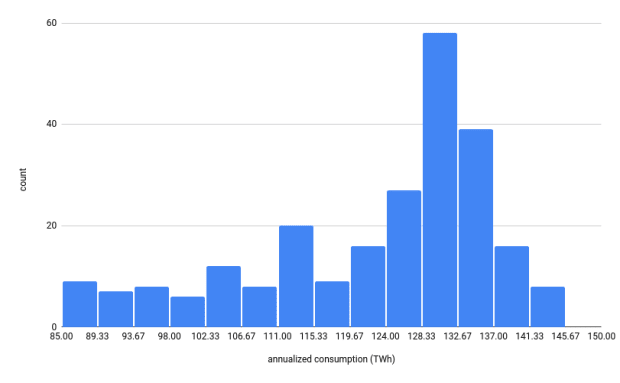

Have a look at the histograms for 2020 (prime left), 2021 (prime proper), 2022 (backside left), and 2023 (backside proper). It’s apparent that for annually, the estimated annualized vitality consumption information exhibits completely different distributions. Despite the fact that we do see some potential distribution patterns, we’ve to watch out to not take this as a sample that occurs each four-year cycle. We’d like extra information to make certain. For now, what we are able to say is that some years in our evaluation present a bimodal distribution whereas different years present a form of skewed distribution. The primary level right here is to indicate that the statistics for vitality use for every of those 4 years are completely different, and distinctly so for the 2 years that have been utilized in Chamanara et al.’s evaluation.

Within the UN research, the authors wrote that bitcoin mining exceeded 100 TWh per yr in 2021 and 2022. Nonetheless, if we take a look at the histograms of the each day estimated annualized vitality consumption, we are able to see that each day estimates differ fairly a bit, and even in 2022 there have been many days the place the estimated vitality consumption was beneath 100 TWh. We’re not denying that the ultimate estimates have been over 100 TWh within the older estimated information for these years. As an alternative, we’re exhibiting that as a result of bitcoin mining’s vitality use just isn’t fixed from each day and even minute-to-minute, it’s price doing a deeper evaluation to know the origin of this variability and the way it would possibly have an effect on vitality use over time. Lastly, it’s price noting that the up to date information now estimates the annual vitality use to be 89 TWh for 2021 and 95.53 TWh for 2022.

One final remark, Miller et al. 2022 confirmed that operations (particularly buildings) with excessive variability in vitality use over time are typically not appropriate for emission research that use averaged annual emission elements. But, that’s what Chamanara et al. selected to do, and what so many of those bullshit fashions are inclined to do. A superb portion of bitcoin mining doesn’t function like a continuing load, Bitcoin mining could be extremely versatile in response to many elements from grid stability to cost to regulation. It’s about time that researchers began enthusiastic about bitcoin mining from this understanding. Had the authors spent even a modest period of time studying beforehand printed literature, somewhat than working in a silo like Sai and Vranken famous of their evaluate paper, they could have no less than addressed this limitation of their research.

—

So, I’ve by no means been to a honky tonk joint earlier than. At the very least not till I discovered myself in a taxi cab with a number of different conferencegoers on the North American Blockchain Summit. Fort Price, Texas, is precisely what you’d think about. Cowboy boots, gallon-sized cowboy hats, Wrangler blue denims, and cowboys, cowboys, cowboys in all places you regarded by means of the principle drag. On a brisk Friday night time, Fort Price appeared frozen in time, folks truly walked round at night time. The shops regarded just like the form of mom-and-pop outlets you’d see on an episode of The Twilight Zone. I felt utterly disoriented.

My companions satisfied me that I ought to discover ways to two-step. Me, your normal California lady, whose physics advisor as soon as advised her that when you can take the lady out of California, you possibly can’t take California out of the lady, ought to two-step?! I didn’t know a two-step from an electrical slide and the one nation I keep in mind experiencing was a Garth Brooks industrial I noticed as soon as on tv once I was a baby. He was actually standard within the nineties. That’s about as a lot nation as this bitcoin mining researcher will get. The place was crammed with kitschy present outlets and shiny lights in all places radiating from neon indicators. On the middle of the principle room, a bartender sporting a black diamond studded belt with a white leather-based gun holster and lined with evenly spaced silver bullets. Who the hell is aware of what sort of gun he was packing, but it surely did remind me of the weapons within the 1986 movie, Three Amigos.

It was right here, in opposition to the backdrop of what appeared like a rustic band that wasn’t totally certain that it was nation, that I watched the Texas Blockchain Council’s Lee Bratcher tackle a ball with the form of trigonometric grace that you can solely discover on the finish of a cue and land that billiard in a tattered, leather-based pocket for what appeared just like the hundredth time that night time. The graceful clank of billiard in opposition to billiard awoke one thing inside me. I noticed that I used to be not but out of the rabbit gap that Frank despatched me down. I remembered someplace scribbled in my notes that I had not plotted the hashrate share over time for the international locations talked about within the UN research. So, at half previous three within the morning, I threw my head again to take a swig of some membership soda and bumped it in opposition to the wall of the photograph sales space the place nuclear households may pose with a mechanical bull, and fell unconscious.

Three hours later, I used to be again in my resort room. Fortunately, somebody positioned some nugatory fiat in my hand, loaded me right into a cab, and had the driving force take me again to the non-smoking room I checked into on the very middle of the decay of twenty-first-century enterprise journey, the Marriott Lodge. Fuzzy-brained and bleary-eyed, I let the blinding, dangerously blue mild from my laptop display wash over my drained face and improve my probabilities of growing macular degeneration. I continued my evaluation.

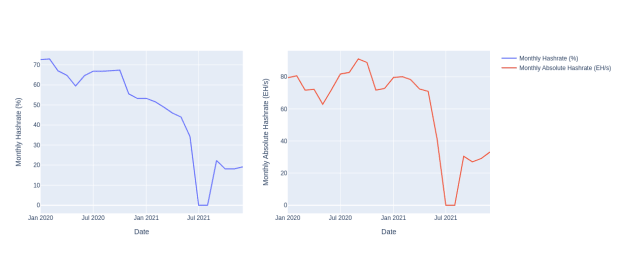

What follows are a collection of plots of CBECI mining map information from January 2020 by means of January 2022. Unsurprisingly, Chamanara et al. focus consideration on China’s contribution to vitality use, and subsequently to its related environmental footprint. China’s month-to-month hashrate peaked at over 70 % of the community’s whole hashrate in 2020. In July 2021, that hashrate share crashed to zero till it recovered to about 20 % of the share on the finish of 2021. We don’t know the place it stands at present, however trade insiders inform me it’s probably nonetheless hovering round this quantity, which signifies that in absolute phrases, the hashrate remains to be rising there regardless of the ban.

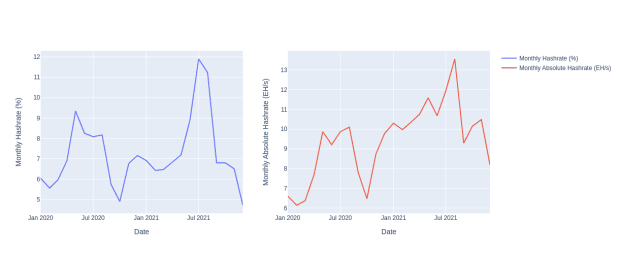

Russia, additionally unsurprisingly, will get mentioned as effectively. But, based mostly on the CBECI mining map information from January 2020 by means of January 2022, it’s onerous to argue that Russia was an instantaneous off-taker of exiled hashrate. There’s actually an instantaneous spike, however is that this actual or simply miners utilizing VPN to cover their mining operation? By the top of 2021, the Russian hashrate declined to beneath 5 % of the hashrate and in absolute phrases, declined from a short peak of over 13 EH/s to a bit over 8 EH/s. When trying on the whole yr’s price of CBECI estimated vitality use for Russia, we do see that Russia did maintain a good portion of hashrate, it’s simply not clear that when working with such a restricted set of knowledge, we are able to make any affordable claims in regards to the current contribution to hashrate and surroundings footprint for the community.

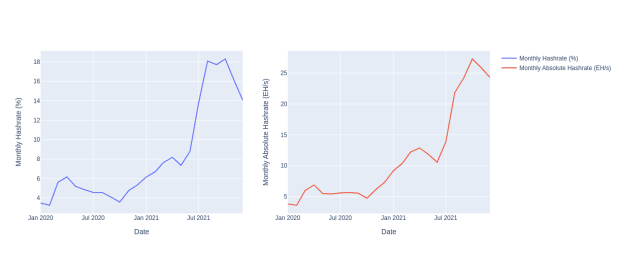

Essentially the most controversial dialogue in Chamanara et al. offers with Kazakhstan’s share of vitality use and environmental footprint. Clearly, the CBECI mining map information exhibits that there was a big improve in hashrate share each in relative and absolute phrases. It additionally seems that this development began earlier than the China ban was applied, however actually seems to quickly improve simply earlier than and after the ban was applied. Nonetheless, we do see a pointy decline from December 2021 to January 2022. Was this an early sign that the federal government crackdown was coming in Kazakhstan?

Of their evaluation, Chamanara et al. ignored the latest Kazakhstan crackdown, the place the federal government imposed an vitality tax and mining licenses on the trade, successfully pushing hashrate in another country. The authors overemphasized Kazakhstan as a present main contributor to bitcoin’s vitality use and thus environmental footprint. If the authors had stayed throughout the limits of their strategies and outcomes, then noting the contribution of Kazakhstan’s hashrate share to the environmental footprint for the mixed years of 2020 and 2021 would have been affordable. As an alternative, not solely do they ignore the federal government crackdown in 2022, however in addition they declare that Kazakhstan’s hashrate share elevated by 34% based mostly on 2023 CBECI numbers. CBECI’s information has not been up to date since January 2022 and CCAF researchers are presently ready for information from the mining swimming pools that may permit them to replace the mining map.

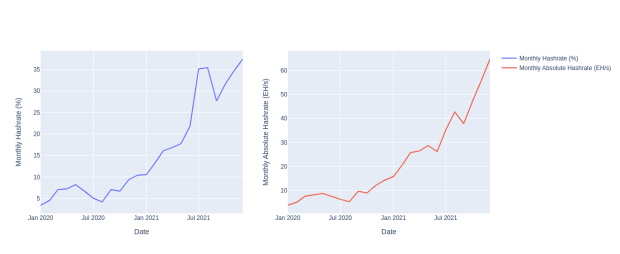

I do know I’ve proven you, my trustworthy reader, a whole lot of information, however go forward and have one other shot of the toughest liquor you have got in your cupboard, and let’s check out yet one more determine. This one represents america hashrate share within the older CBECI mining map information. The development we see for america can also be comparable for Canada, Singapore, and what CBECI Calls “Different international locations”, which characterize the international locations that didn’t make the highest ten listing for hashrate share. There’s a transparent sign that displays what we all know to be true. The US took a good portion of Chinese language hashrate and this hashrate share grew quickly in 2021. Whereas we all know that the CBECI mining map information is restricted to lower than a majority of the community hashrate, I do suppose that their share is no less than considerably consultant of the community’s geographic distribution. Hashrate geographic distribution appears to be closely formed by macro tendencies. Whereas electrical energy costs matter, authorities stability and pleasant legal guidelines play an essential position. Chamanara et al. ought to have completed this sort of evaluation to assist inform their dialogue. If they’d, they could have realized that the community is responding to exterior pressures at various occasions and geographic scales. We’d like extra information earlier than we are able to make sturdy coverage suggestions with regards to the results of bitcoin’s vitality use.

—

At this level, I used to be not certain if I used to be a bitcoin researcher or an NPC, misplaced in a recreation the place the one factors tallied have been for the depth of self-loathing I used to be feeling for agreeing to this enterprise. On the similar time, I may odor the top of this evaluation was close to and that, with sufficient somatic remedy and EMDR, I’d truly keep in mind who I was earlier than I acquired dragged into this mess. Simply two days prior, Frank and I had a falling out over whether or not Courier New was nonetheless one of the best font for displaying mathematical equations. I used to be alone on this rabbit gap now. I dug my fingers into the filth partitions surrounding me and slowly clawed my manner again to sanity.

Upon exiting the opening, I grabbed my laptop computer and determined it was time to handle the research’s environmental footprint methodology, wrap up this pet, and put a bow on it. Chamanara et al. claimed that they adopted the strategies utilized by Ristic et al. (2019) and Obringer et al. (2020). There are a couple of the explanation why their environmental footprint strategy is flawed. First, the footprint elements are sometimes used for assessing the environmental footprint of vitality technology. In Ristic et al., the authors developed a metric referred to as the Relative Aggregated Issue that included these elements. This metric allowed them to guage the location of latest electrical energy mills like nuclear or offshore wind. The concept behind this strategy was to be conscious that whereas carbon dioxide emissions from fossil fuels have been the principle driver for growing vitality transition targets, we must also keep away from changing fossil gas technology with technology that might create environmental issues in several methods.

Second, Obringer et al. used most of the elements listed in Ristic et al. and mixed them with community transmission elements from Aslan et al. (2018). This was a foul transfer as a result of Koomey is a co-author on this paper, so it shouldn’t be stunning that in 2021, Koomey co-authored a commentary alongside Masanet the place they referred to as out Obringer et al. In Koomey and Masanet, 2021, the authors chided the idea that short-term adjustments in demand would result in rapid and proportional adjustments in electrical energy use. This critique may be utilized to Chamanara et al., which checked out a interval when bitcoin was experiencing a run-up to an all-time excessive in worth throughout a novel financial surroundings (low rates of interest, COVID stimulus checks, and lockdowns). Koomey and Masanet made it clear of their commentary that ignoring the non-proportionality between vitality and information flows in community gear can yield inflated environmental-impact outcomes.

Extra importantly, we’ve but to characterize what this relationship appears to be like like for bitcoin mining. Demand for conventional information facilities is outlined by the variety of compute cases wanted. What’s the equal for bitcoin mining once we know that the block dimension is unchanging and the block tempo is adjusted each two weeks to maintain a median 10-minute spacing between every block? This deserves extra consideration.

Both manner, Chamanara et al. didn’t appear to pay attention to the criticisms of Obringer et al.’s strategy. That is actually problematic as a result of as talked about in the beginning of this screed, Koomey and Masanet laid the groundwork for information middle vitality analysis. They need to have identified to not apply these strategies to bitcoin mining as a result of whereas the trade has variations from a conventional information middle, it’s nonetheless a kind of knowledge middle. There’s quite a bit that bitcoin mining researchers can take from the torrent of knowledge middle literature. It’s disappointing and exhausting to see papers printed that ignore this actuality.

What extra can I say apart from this shit has to cease. Brandolini’s Legislation is actual. The bullshit asymmetry is actual. I actually need this new halving cycle to be the one the place I not have to handle unhealthy analysis. Whereas I used to be penning this report, Alex de Vries printed a brand new bullshit paper on bitcoin mining’s “water footprint”. I haven’t learn it but. I’m unsure that I’ll. But when I do, I promise that I can’t write over 10,000 phrases on it. I’ve acknowledged my case and made my peace with this style of educational publishing. It was a enjoyable trip, however I feel it’s time to follow some self-care, deal with myself to a number of evenings of wholesome binge-watching, and dream of the ineffable.

—

Should you loved this text, please go to btcpolicy.org the place you possibly can learn the complete 10,000-word technical evaluation of the Chamanara et al. (2023) research.