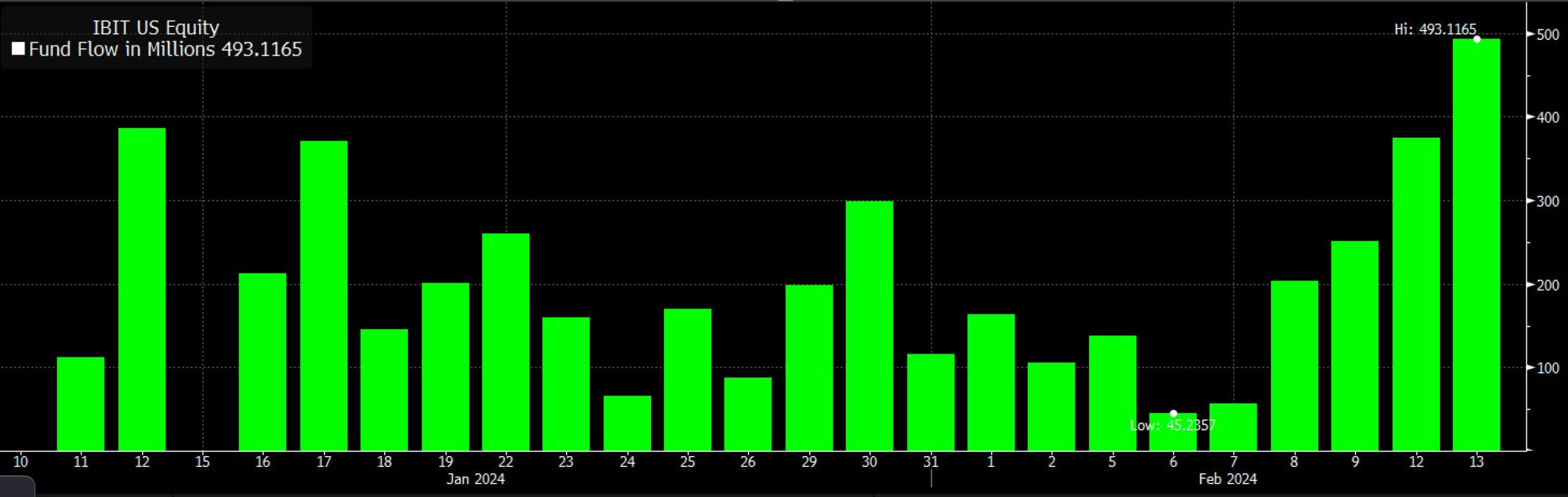

BlackRock’s spot Bitcoin ETF — the iShares Bitcoin Belief (IBIT) — surpassed a report excessive of $720 million in every day quantity on Feb. 14 to take the primary spot by way of quantity, in accordance with knowledge from Coinglass.

Commenting on IBIT’s greater than $700 million in quantity on Feb. 14, Bloomberg ETF analyst Eric Balchunas described the trend as a “more uncommon second wind power” for the fund. He defined:

“[The] reason that is fascinating and strange is [because] early on IBIT’s quantity was correllated [with] GBTC outflows and maybe to any ‘lined up’ money [BlackRock] had. Thought all that will wind down a bit in unison, and it began too, however then IBIT broke the [f—] unfastened.”

IBIT cements lead

Balchunas famous that quantity for the “New child 9” normally signifies inflows as there aren’t many current traders seeking to promote, in comparison with a fund like GBTC that was transformed into an ETF and had pre-existing holders.

IBIT reached $493 million in every day quantity on Feb. 13, with everything being inflows, based mostly on Farside Buyers’ knowledge, which reveals that IBIT’s quantity has been rising persistently after hitting a report low on Feb. 6.

Comparatively, Grayscale Bitcoin Belief (GBTC) recorded $72.8 million in outflows on Feb. 13, indicating a big slowdown in promote strain in comparison with final month. The fund’s outflows have remained below the $100 million stage for essentially the most half over the previous week.

At 9:27 pm UTC on Feb. 14, Coinglass confirmed that GBTC was reporting $681 million in quantity, whereas the Constancy Smart Origin Bitcoin Fund (FBTC) was at $455 million. The market’s seven different spot Bitcoin ETFs had lower than $200 million in quantity every.

BlackRock’s complete inflows are set to surpass $5 billion as soon as buying and selling closes for the day, bringing its Bitcoin hoard to a bit over 96,669 BTC.

In the meantime, FBTC is shut on its heels with complete inflows of just below $4 billion.

High 7%

BlackRock’s IBIT can also be the second largest spot Bitcoin ETF when ranked by market cap and is competing with among the greatest conventional funds in every day quantity.

Grayscale’s GBTC, which existed as a non-exchange traded fund earlier than it was transformed to an ETF in January, has a considerably larger market cap of $24 billion but additionally has extra vital outflows.

When ranked amongst all non-cryptocurrency ETFs, IBIT’s present market cap locations it among the many 250 largest funds based mostly on rankings from 8marketcap.

Balchunas famous:

“[$5 billion AUM] places it in High 7% of all ETFs by dimension in simply 23 buying and selling days. “

Roughly 3,100 ETFs exist within the US at current.