Knowledge exhibits the futures aspect of the crypto market has witnessed liquidations of $221 million as Bitcoin has damaged above the $51,500 mark.

Bitcoin Has Continued Its Newest Rally With A Break Above $51,500

Bitcoin had slumped again beneath the $49,000 mark simply yesterday, prompting many to wonder if the sooner surge above $50,000 was solely short-term.

Throughout the previous day, nonetheless, the coin has sharply moved up and has not solely recovered again above $50,000 however has additionally been exploring new highs for the yr, because it has jumped previous the $51,500 barrier.

The beneath chart exhibits how the unique crypto has carried out throughout the previous few days.

The value of the asset has shot up over the previous couple of days | Supply: BTCUSD on TradingView

Solely Cardano (ADA) has put collectively higher positive factors than Bitcoin’s rally in the course of the previous day. Following this surge, the asset is at its highest level since December 2021, greater than two years in the past.

With BTC going via a rollercoaster previously day, it’s unsurprising that one improvement has occurred out there, a mass liquidation occasion on the futures aspect.

Crypto Futures Market Has Noticed Massive Liquidations Throughout Final 24 Hours

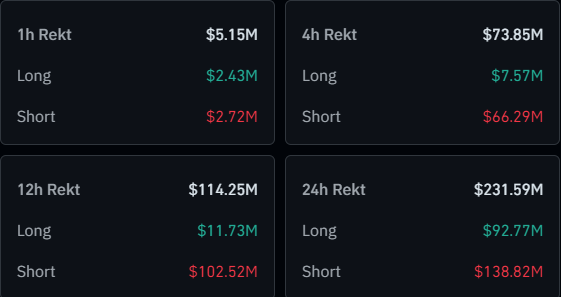

In accordance with information from CoinGlass, greater than $231 million in crypto futures contracts have been flushed down in the course of the previous 24 hours. The desk beneath exhibits the breakdown of those liquidations between longs and shorts.

The info for the liquidations previously day | Supply: CoinGlass

It could seem that $138 million of the liquidations concerned the brief holders. That is equal to greater than 60% of the overall liquidations for the interval, that means that the occasion was a short-majority one.

This is sensible as a result of cryptocurrency has elevated its web quantity previously day. Nevertheless, as the worth motion hasn’t been straight up however down and up, a major quantity of longs (nearly $93 million) have additionally been caught on this flush.

Occasions like these, the place many liquidations happen without delay, are popularly referred to as “squeezes.” Because the shorts made up the most recent squeeze, it might be an instance of a “brief squeeze.”

In a squeeze, liquidations can cascade collectively like a waterfall, inflicting an amplification impact on the worth swing that triggered them. This can be why Bitcoin’s surge has been so sharp.

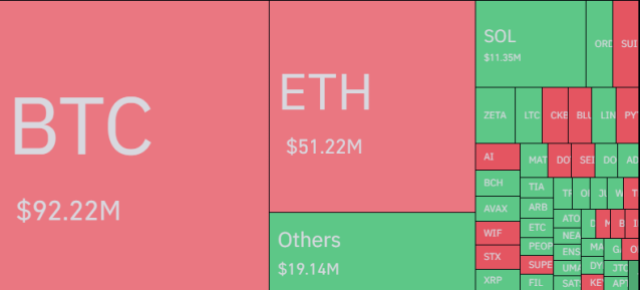

Relating to the person contribution in the direction of the squeeze by the assorted symbols, BTC is unsurprisingly on the prime with $92 million in liquidations. Ethereum, the second largest crypto, is likewise second with $51 million in liquidations.

The distribution of the liquidation occasion per image | Supply: CoinGlass

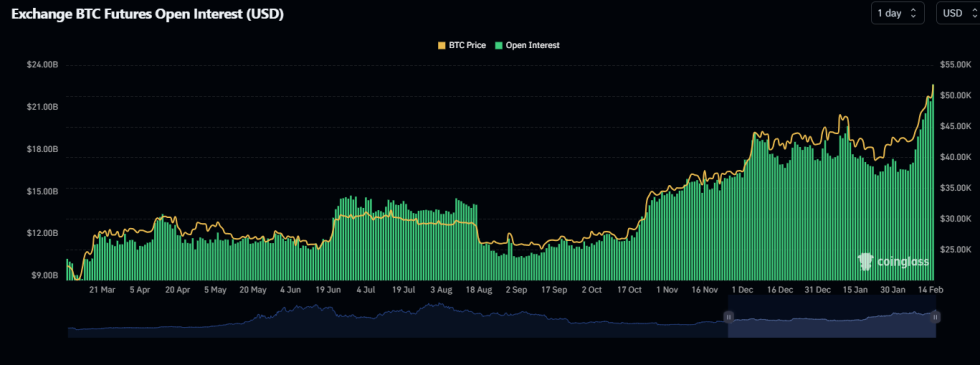

Whereas many liquidations have piled up on the crypto futures market previously day, the speculators haven’t been dissuaded but, because the Bitcoin Open Curiosity has solely continued to march upwards.

Appears like the worth of the metric has been going up lately | Supply: CoinGlass

Featured picture from Shutterstock.com, Coinglass.com, chart from TradingView.com