Because the cryptocurrency world grapples with the twin forces of innovation and regulation, Circle’s latest announcement of the termination of the USDC token help on the Tron blockchain underscores the complicated interaction between advancing know-how and adhering to regulatory requirements.

The Announcement and Its Implications

In a transfer that has despatched ripples by the cryptocurrency neighborhood, Circle, a serious participant within the U.S. crypto market, introduced its choice to terminate help for its USDC token on the Tron blockchain.

This choice, efficient instantly, halts the minting of recent USDC tokens on Tron, a platform that has gained reputation for its quick and environment friendly stablecoin transactions. Circle, headquartered in Boston, emphasised that this step is consistent with its dedication to sustaining USDC as a trusted, clear, and protected forex.

With USDC being the second-largest stablecoin by market cap, trailing solely behind Tether (USDT), and with $335 million of its worth hosted on Tron, this transfer marks a big shift within the stablecoin ecosystem.

Background and Context

Circle’s choice comes in opposition to the backdrop of regulatory scrutiny confronted by Tron’s founder, Justin Solar, in the USA. Final yr, Circle additionally terminated accounts related to Solar and his corporations following lawsuits from the Securities and Alternate Fee (SEC) accusing Solar of manipulating buying and selling volumes and promoting unregistered securities. This context of authorized challenges and compliance points seems to have influenced Circle’s strategic reassessment of its blockchain partnerships.

Regardless of not citing particular causes for ending help on Tron, Circle has made it clear that it repeatedly evaluates the suitability of blockchains underneath its danger administration framework. The corporate has laid out plans for a phased withdrawal of USDC from Tron, advising each retail and institutional shoppers on how you can switch their holdings to different blockchains or redeem them for conventional forex, with a last deadline set for February 2025.

Go to our essential web page to change USDC on Tron for different networks, or promote it for money.

The Shift to Solana and the Way forward for Stablecoins

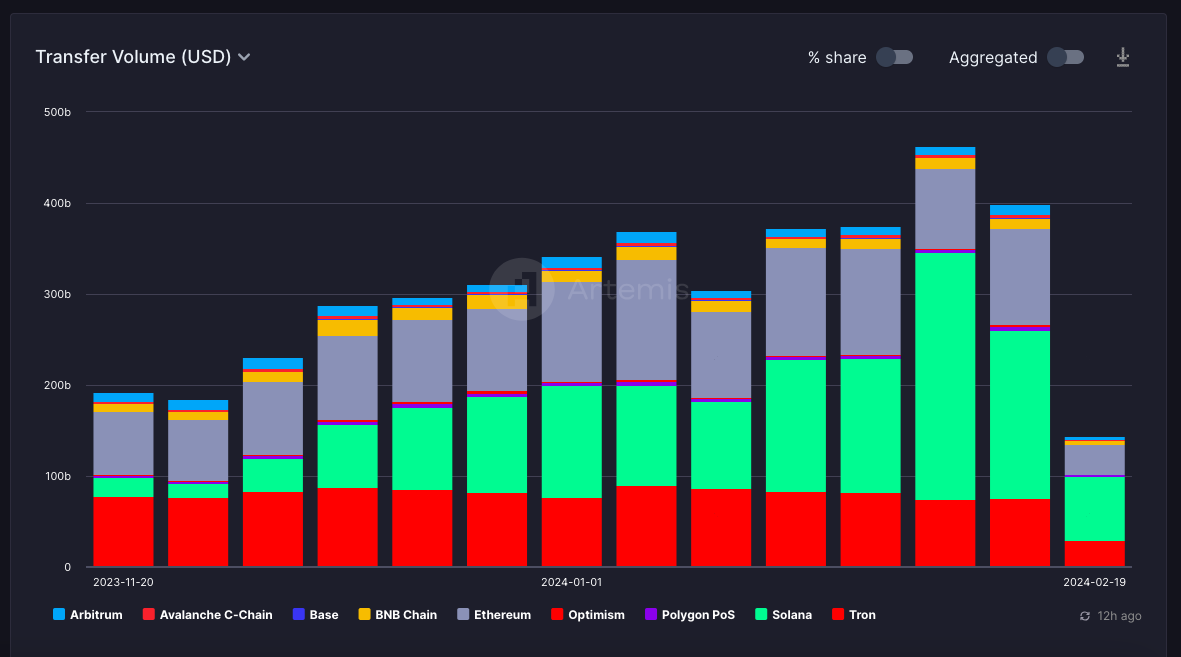

This growth coincides with a notable shift within the stablecoin panorama, the place Solana has emerged as a brand new favourite for USDC transactions, overtaking Tron in reputation. Prior to now six months, Solana has facilitated over 80% of USDC transactions, highlighting its rising dominance within the stablecoin house. This surge in exercise is a testomony to Solana’s technical capabilities, however besides that, it alerts a broader development of diversification inside the stablecoin market.

Solana has seen a big improve in stablecoin switch quantity over the previous few months. Screenshot: Artemis.

Furthermore, the introduction of recent stablecoins on Solana, corresponding to Paxos’s USDP, additional cements the blockchain’s place as a number one platform for stablecoin exercise. Nevertheless, it’s essential to notice that regardless of these shifts, Tron stays a big participant within the stablecoin area, notably for USDT, which nonetheless boasts over $50 billion in circulation on the platform.

Market Dynamics and the Continued Position of Tron

Whereas Circle’s withdrawal from Tron would possibly seem to be a setback for the blockchain, it’s essential to acknowledge that Tron continues to carry a considerable portion of the stablecoin market, particularly with USDT. The dynamics between USDC and USDT illustrate the aggressive but complementary nature of the stablecoin ecosystem, the place a number of platforms and tokens coexist, catering to numerous person wants and preferences.

In conclusion, Circle’s choice to finish USDC help on Tron underscores the evolving nature of the cryptocurrency panorama, the place regulatory, technical, and market components repeatedly form the methods of main gamers. Because the stablecoin market matures, the concentrate on compliance, transparency, and person security turns into more and more paramount, guiding the choices of companies like Circle. In the meantime, the rise of Solana as a most popular chain for stablecoin transactions alerts a shift within the stability of energy, suggesting that the way forward for stablecoins might lie within the means of blockchains to adapt, innovate, and foster belief amongst customers.

Disclaimer: Please observe that the contents of this text will not be monetary or investing recommendation. The data supplied on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.