The beneath is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

America federal authorities has as soon as once more added to its substantial Bitcoin hoard, transferring $922 million value from wallets related to Bitfinex hackers in a seizure.

Over the course of a sequence of assorted seizures and different asset forfeitures, the US federal authorities has gathered and holds sufficient Bitcoin to unquestionably rely as one of many largest whales. Within the earliest days of the Bitcoin scene, the overwhelming crypto-anarchist spirit among the many group led to a sequence of assorted extralegal enterprise ventures, most famously the Silk Street. This overtly illegalist period of the trade is kind of fully over, however the success of those early ventures gathered large quantities of Bitcoin: which has in time been gathered by the US authorities.

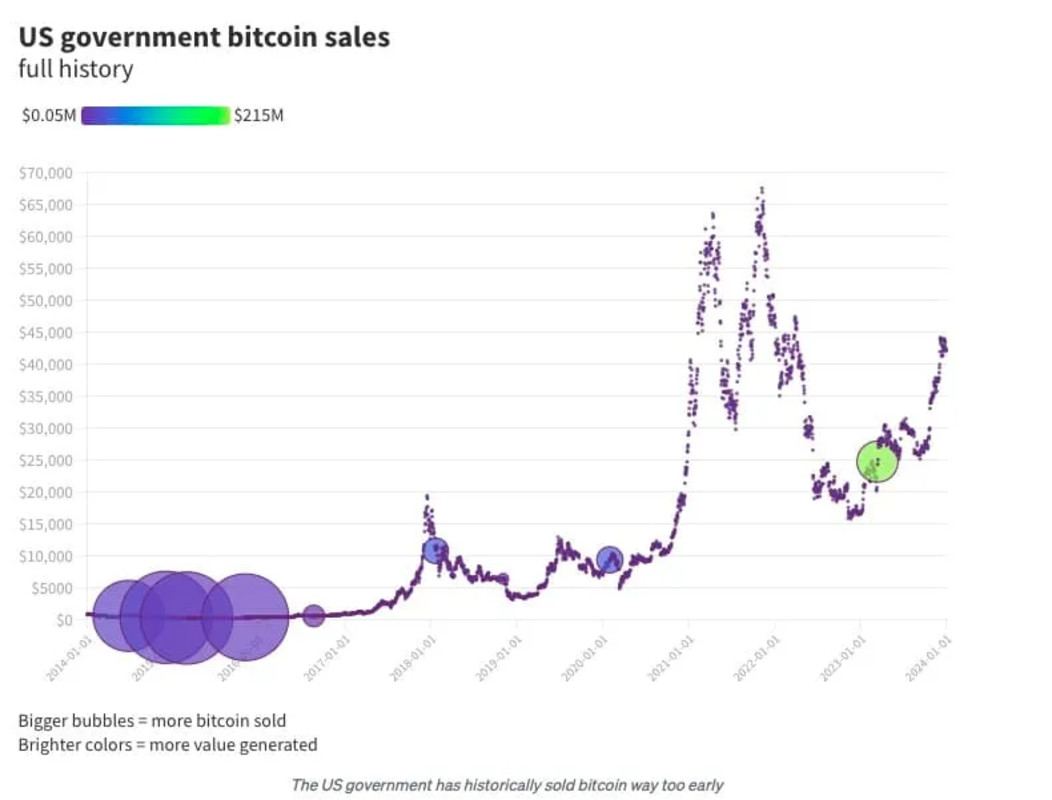

The Silk Street alone has been on the middle of a number of large seizures from legislation enforcement businesses, with the location’s precise coffers removed from the one supply. On a number of events over the previous few years, numerous hackers who robbed the Silk Street have in flip seen their belongings seized and added to the federal authorities’s large stockpile. Regardless that a whole bunch of tens of millions of bitcoins from this supply have already been offered at authorities auctions or by way of different means, there are nonetheless billions left to go. For his or her half, legislation enforcement businesses appear to be in no hurry to clean their arms of those belongings.

On February 29, the stockpile grew as soon as once more when the federal government moved greater than 15k bitcoins from the wallets of two Bitfinex hackers. The hackers, Ilya Lichtenstein and Heather “Razzlekhan” Morgan, lately testified about their 2016 hack of Bitfinex, which ranks as some of the worthwhile heists of all time with almost 120k bitcoins stolen. Bitfinex, one of many oldest still-operating exchanges in the complete crypto ecosystem, remains to be a outstanding service, however their operations nonetheless bear lingering scars from a theft of this magnitude. For one factor, US residents are fully forbidden from accessing the platform, together with residents from a number of different nations. Maybe it is because of this that the Justice Division has refused to state whether or not or not the federal government intends to reimburse Bitfinex’s 2016 prospects, who truly had their cash stolen.

No matter what the federal government’s plans are with this cash, a seizure like this has as soon as once more highlighted the sheer measurement of the federal authorities’s Bitcoin reserve. Fortunately, the federal government’s dealings with these belongings are all a matter of public file, and Bitcoin transactions themselves are all fully clear on the blockchain. For that reason, analysts are assured within the declare that the US holds simply shy of 200k bitcoins, value roughly $12.1 billion. This makes them unmistakably one of many largest whales on the market, with solely Binance and Satoshi holding better quantities. In reality, the federal government at present holds almost 1% of all Bitcoin in circulation. No matter claims that prosecutors have no real interest in maximizing earnings when disposing of those belongings, it’s simple that the federal government holds substantial leverage over the entire house.

These seizures are significantly attention-grabbing resulting from some current feedback made by exiled whistleblower Edward Snowden. Particularly, contemplating the rising international acceptance of Bitcoin in regulation and conventional finance, Snowden predicted that “A nationwide authorities can be revealed this yr to have been shopping for Bitcoin—the fashionable substitute for financial gold—with out having disclosed that reality publicly”. If Bitcoin is the digital gold, in any case, it could solely make sense that highly effective nations would wish to construct up reserves. The technique has famously labored for the Salvadoran president, Nayib Bukele, who greeted the brand new bull market with a declaration that his nation’s Bitcoin funding has gone up by 40% because the preliminary purchases. Not, after all, that he plans to promote.

In any occasion, Snowden’s feedback appear particularly related in that the US hasn’t truly bought any of the Bitcoin it at present holds. Regardless that the federal government has a theoretical duty to dispose of those belongings, the tempo as of but has been glacial, and within the meantime, it could be extraordinarily easy for Congress to halt these gross sales. All it could take is a need for the coverage to alter, and a real Bitcoin reserve might spring up in a single day. That is the crux of Snowden’s particular prediction that governments will purchase Bitcoin secretly and that the federal government has ample believable deniability. We don’t have a reserve; we simply occur to be reserving these belongings for a later sale. There may be nothing suspicious about that!

If a authorities did truly wish to purchase large portions of Bitcoin in secret, it could run into a large number of transparency issues attributable to the trustless nature of Bitcoin’s blockchain. The nameless “Mr. 100” has made headlines all through the month of February, buying a thoughts boggling 100 BTC per day and reaching the standing of the fifteenth largest whale. As chain analysts have tried to find out the client’s id, hypothesis has already begun {that a} nationwide authorities is the offender. Primarily based on the timing of the purchases and several other different components, the client is probably going in Asia, particularly the Center East. Qatar, the United Arab Emirates, Saudi Arabia—all these are sturdy candidates to be the cash’ rightful homeowners.

In different phrases, if a authorities needs to construct up a Bitcoin reserve, it is perhaps simpler to grab the belongings outright quite than purchase them at honest worth. In spite of everything, if the transactions can be recorded on the blockchain both means, why not save their cash? The UK appears well-positioned to construct up a stockpile on this means just like the Individuals, having seized $1.77 billion in January. Not solely have been these bitcoins seized from a overseas nationwide at present on the run, with no recourse to recoup these funds, however the British authorities has subsequently handed laws deepening its energy to grab or freeze cryptocurrency belongings. It wouldn’t take a lot to begin increase a notable hoard in its personal proper.

By this level, the times when Bitcoin’s core group held a defiant perspective in the direction of legislation enforcement are a distant reminiscence. Though folks can commit crimes centered round Bitcoin similar to they’ll with some other forex, the actual fact of the matter is that Bitcoin is barely turning into extra reputable for the world’s governments. US regulators accredited a Bitcoin ETF, and different nations are falling like dominoes to endorse it themselves. Ultimately, it’ll be a necessity for highly effective governments to remain on par with their opponents and keep their very own reserves of Bitcoin. The US, in any case, controls almost 1% of an enormous trade with substantial leverage over it. Are they going to be the one nation with this leverage? It might be troublesome for any nation to construct up these stockpiles in secret, besides, the race has already begun. Irrespective of who wins it, it’s Bitcoin that can be on prime ultimately.