Even after reaching a brand new all-time excessive on March 11, the founding father of LookintoBitcoin, Philip Swift, in a put up on X, believes the Bitcoin bull market is simply getting began and has “an extended method to go.” Supporting this bullish preview, Swift factors to a preferred on-chain metric, the MVRV Z-Rating, which at the moment sits at 2.87.

Bitcoin Bulls In Cost, MVRV Z-Rating Low

Bitcoin bulls have been relentless when writing, driving costs to contemporary highs. After easing previous $70,000 final week, costs roared larger on March 11, pushing the coin to an all-time excessive of $72,800. Bulls stay buoyant, anticipating extra positive factors and even new all-time highs within the coming periods.

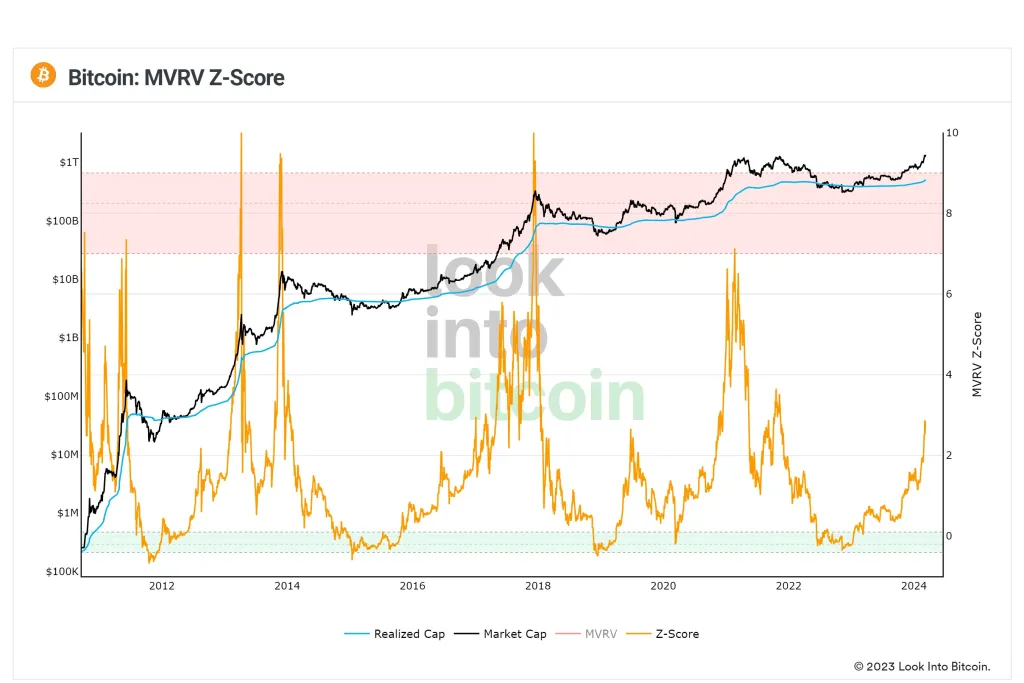

Whereas this develops, the MVRV Z-Rating stays low however rising as of March 12. On-chain analysts typically leverage this metric to evaluate the stage of the bull cycle. Analysts can use this device to find out durations when Bitcoin is undervalued relative to its truthful worth.

Traditionally, and as defined by LookintoBitcoin, the MVRV Z-Rating has confirmed useful in figuring out when spot charges have surged effectively past the realized worth. On this case, the realized worth is the common value holders paid for all of the circulating cash.

From LookintoBitcoin knowledge, the MVRV Z-Rating is as much as 2.87, rising from 2.82 when Swift posted on X. When Bitcoin costs soared to all-time highs within the final bull cycle in 2021, the rating stood at over 5.

Accordingly, at spot readings, the low studying means that bulls have extra room to drive costs even larger within the coming periods. This additionally implies that the present all-time excessive of $72,800 will seemingly be damaged as costs soar.

As Bitcoin developments at round all-time highs and confidence develop, the low MVRV Z-Rating solely provides to the rising refrain of bullish sentiment surrounding the world’s most dear coin. The present spike is usually pinned on establishments doubling down on the coin, taking extra cash from circulation.

Wall Road Gamers Accumulating BTC

MicroStrategy, the enterprise intelligence agency buying and selling on Nasdaq, has accrued Bitcoin. Presently, the agency controls 205,000 BTC value over $9 billion, purchased at a median value of barely lower than $34,000. From February 26 to March 10, MicroStrategy purchased one other 12,000 BTC.

Furthermore, spot Bitcoin exchange-traded fund (ETF) issuers are amassing extra cash on behalf of their purchasers. As of March 11, Lookonchain knowledge shows that BlackRock purchased 4,853 BTC, pushing their complete haul near 196,000 BTC.

Characteristic picture from Canva, chart from TradingView