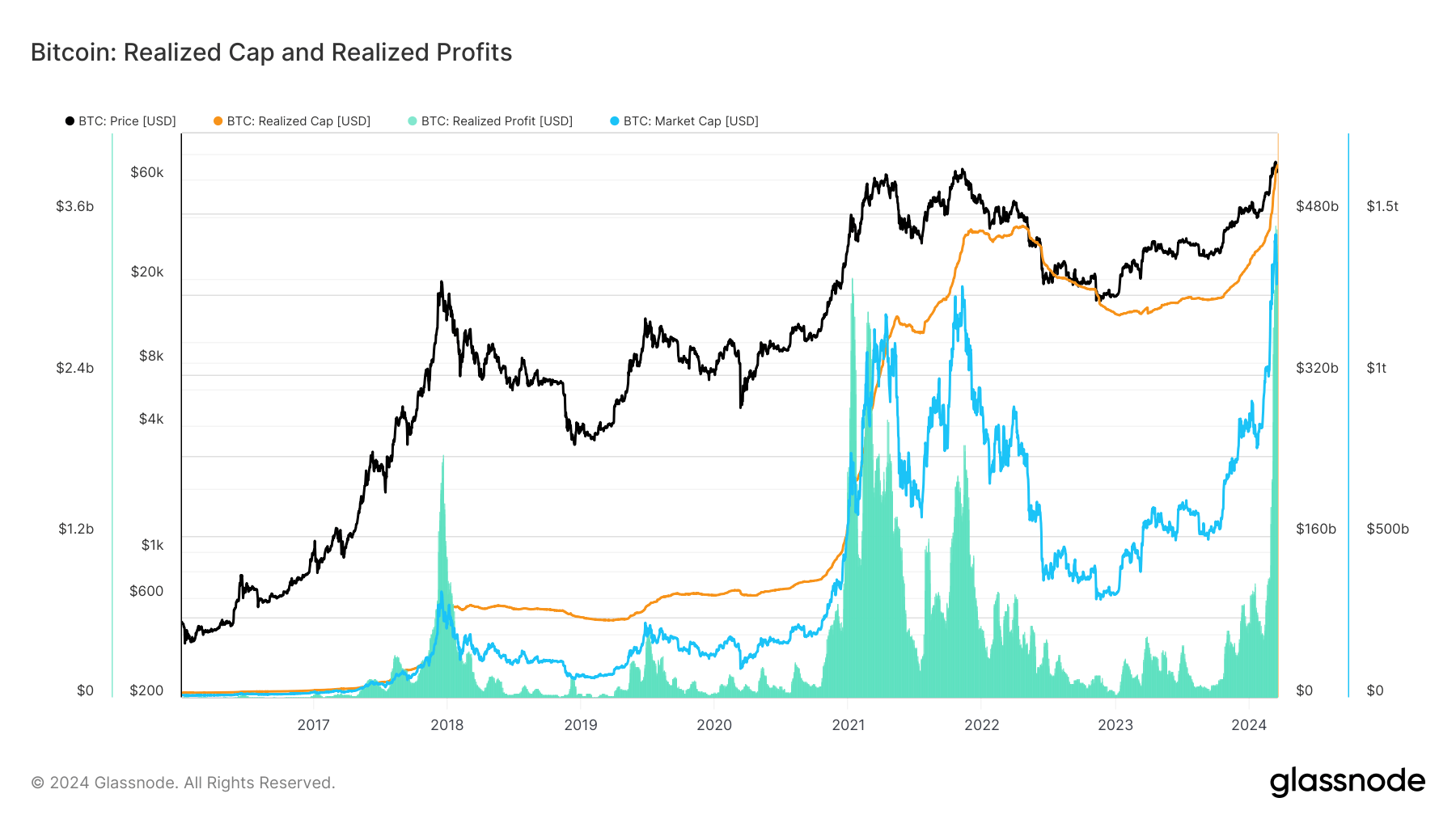

Realized revenue represents the cumulative revenue of all Bitcoins moved on-chain, calculated because the distinction between the acquisition and motion costs. It’s a direct measure of the profitability for Bitcoin holders, indicating when buyers are prone to promote and take income.

Alternatively, the realized cap gives a extra correct illustration of the market’s valuation than the standard market cap. It calculates Bitcoin’s capitalization by valuing every unit on the value when it was final moved moderately than the present value. This metric reveals the market’s combination price foundation, revealing the typical acquisition value of all Bitcoins.

These metrics are important for understanding the depth of market exercise, investor sentiment, and the true financial weight behind value actions.

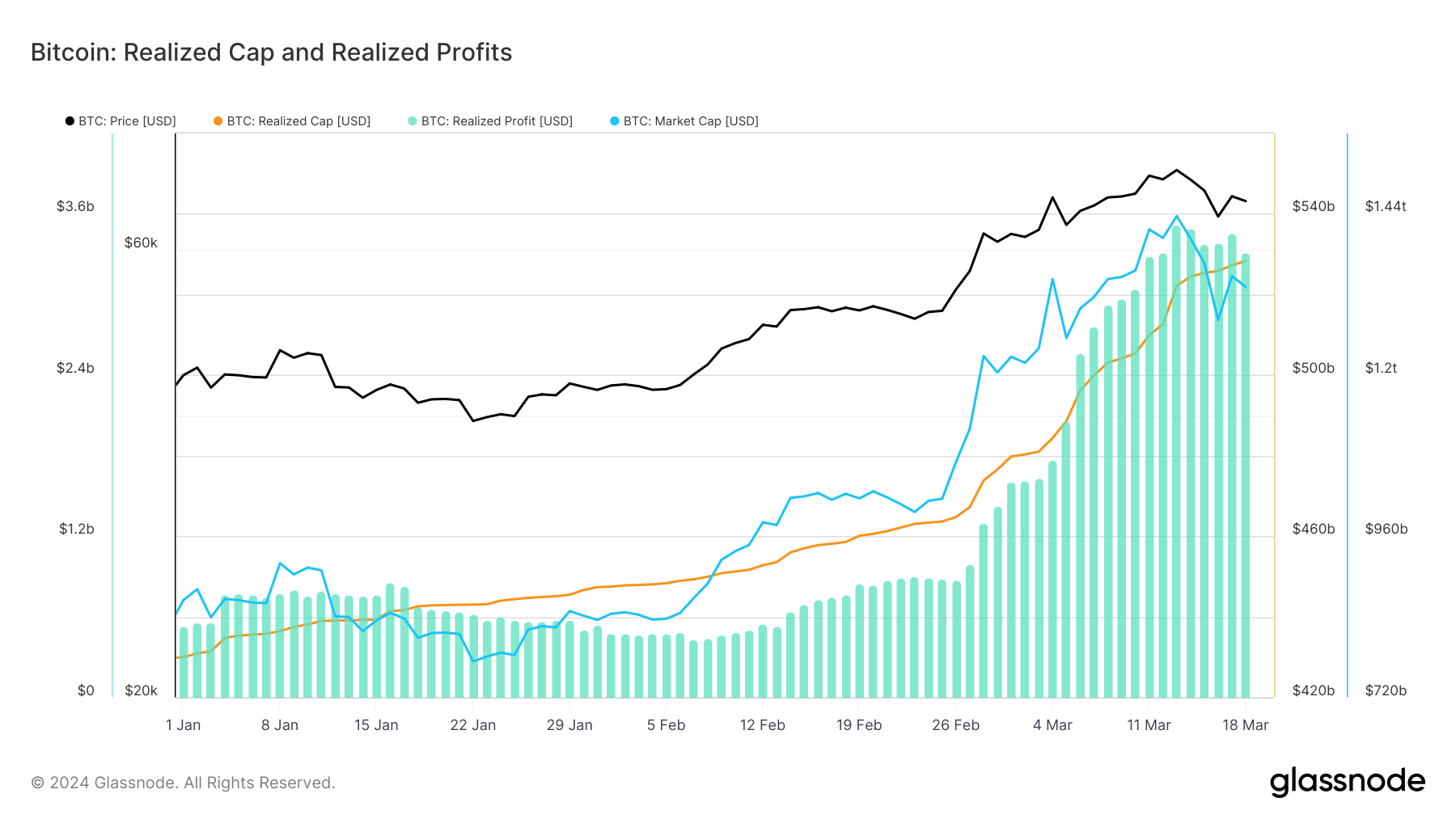

Because the starting of the yr, Bitcoin’s realized revenue has been rising steadily, and an enormous spike started in March. Realized revenue peaked at $3.51 billion on Mar. 13, reaching its all-time excessive. This spike in RP got here as Bitcoin broke its ATH and traded at simply above $73,100 for the day.

It was solely a matter of time earlier than a excessive profit-taking stage occurred out there. The second-highest realized revenue was $3.130 billion, recorded on Jan. 10, 2021. Bitcoin’s value volatility within the following days was probably a results of buyers capitalizing on the worth surge — the decline to $3.31 billion in realized revenue by Mar. 18 suggests a normalization following the sell-off.

It’s exhausting to pinpoint what prevented Bitcoin from slipping under additional $65,000 on Mar. 16. Whereas some metrics present strong help was fashioned at that stage, it’s additionally probably that the continual accumulation performed a major half in absorbing a lot of that promoting stress.

That is seen within the constant development of Bitcoin’s realized cap, which elevated from $429.97 billion in the beginning of the yr to $528.32 billion on Mar. 18. This steady development contrasts with the adjustments within the extra unstable market cap, indicating ongoing accumulation regardless of value fluctuations. The regular improve within the realized cap, even throughout value corrections, reveals a sturdy confidence in Bitcoin that appears to have established a strong basis for additional development.

This information highlights the market’s resilience, displaying that regardless of short-term speculative pressures, the underlying pattern is one in every of sustained accumulation and confidence. The divergence between the realized cap’s regular ascent and the market cap’s volatility highlights a maturing market the place long-term accumulation methods nonetheless handle to prevail over short-term hypothesis.

The submit Bitcoin’s realized revenue hits ATH however market retains accumulating appeared first on CryptoSlate.