Fast Take

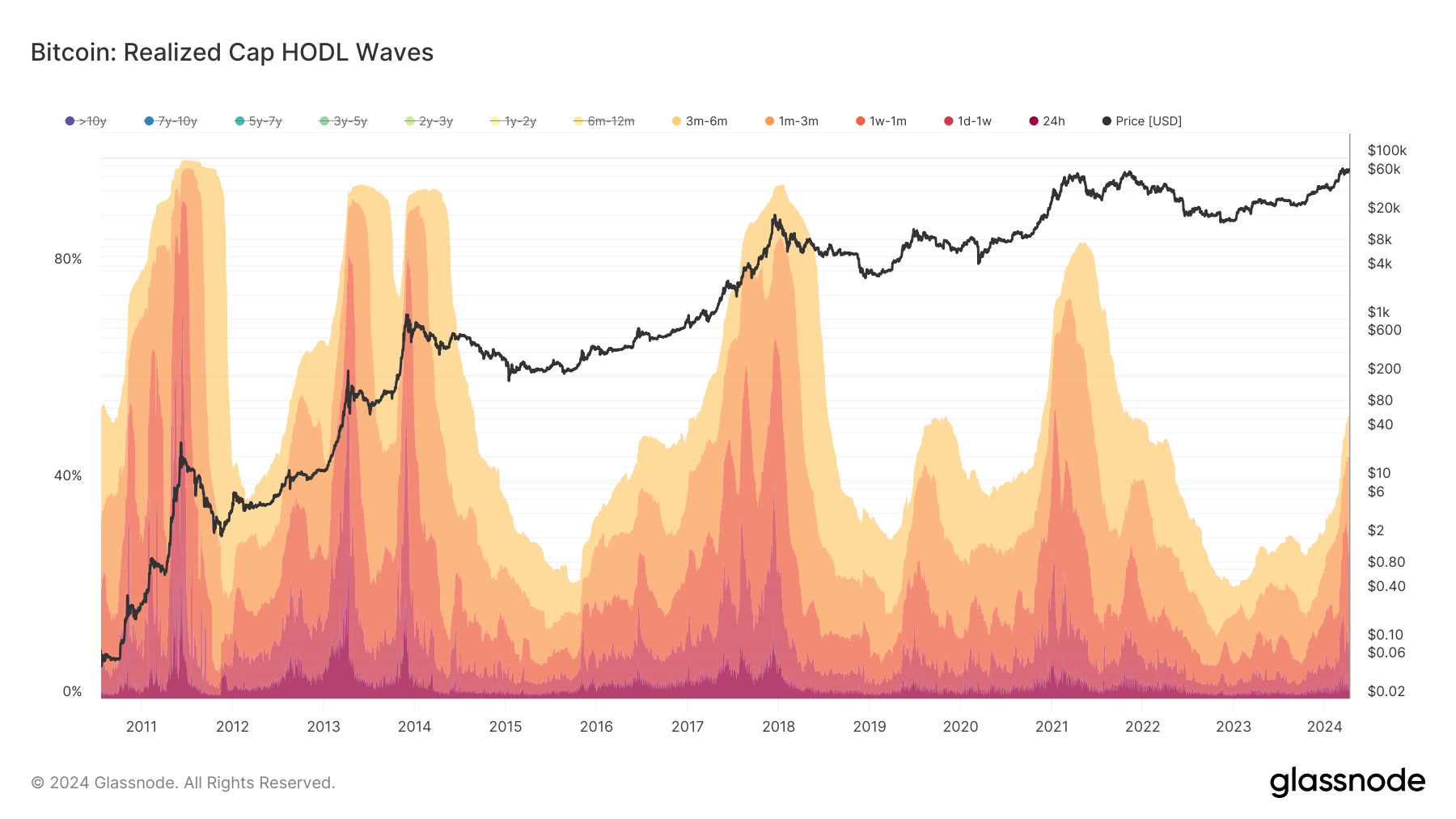

Bitcoin’s value cycles are sometimes influenced by the conduct of short-term holders (STHs), outlined as traders who’ve held the digital asset for lower than 155 days. In response to Glassnode knowledge, throughout market peaks, STHs usually possess 80% or extra of the Bitcoin provide, with the prevailing cohort transitioning from shorter to longer holding intervals in every subsequent cycle.

Knowledge from Glassnode exhibits that on the peak in 2011, STHs commanded 96% of the availability, primarily comprising holders of one-day to one-week durations. By the 2013 peak, 90% of the availability was held by STHs, predominantly these holding for one-day to one-week intervals. Shifting to the 2017 peak, STHs nonetheless dominated over 90% of the availability, however the principal cohort shifted to one-week to one-month holders, indicating a barely maturing market.

In March 2021, on the peak, 85% of the availability was held by STHs, with the predominant group being holders of one-month to three-month durations, based on Glassnode.

Presently, with Bitcoin hovering close to all-time highs, STHs management 54% of the availability, which suggests potential for additional development. The gradual transition in dominant STH teams from shorter to longer durations implies an evolving market maturity.

The publish From days to months: How Bitcoin holder conduct predicts value peaks appeared first on CryptoSlate.