Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Focus on ECB rate decision and Q3 earnings

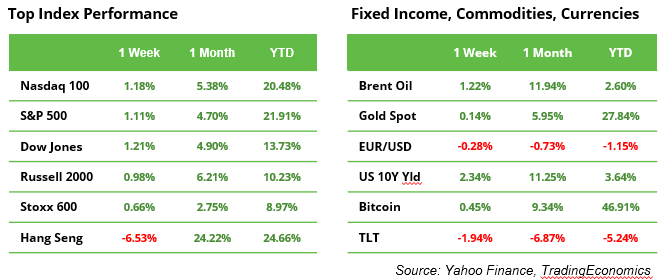

Markets moved relatively little last week. In the US, equities saw both the S&P 500 and Dow Jones indices climb the ‘wall of worries’ to record highs above 5,800 and 42,860, respectively. The yield on the US 10-year Treasury rose above 4% following a strong September jobs report on 4 October. In Hong Kong, the Hang Seng index dropped by 6% as additional economic stimulus was discussed but not committed. Oil prices hovered around $79 for Brent and $75 for WTI, with uncertainty over the next steps in the Middle Eastern conflict keeping markets cautious.

This week, beyond the release of US retail sales data and a range of macroeconomic indicators from China, the main focus will be on the ECB rate decision and the Q3 earnings season, with major companies in financial services, technology, and healthcare reporting their results.

ECB under pressure to step up the pace of interest rate cuts

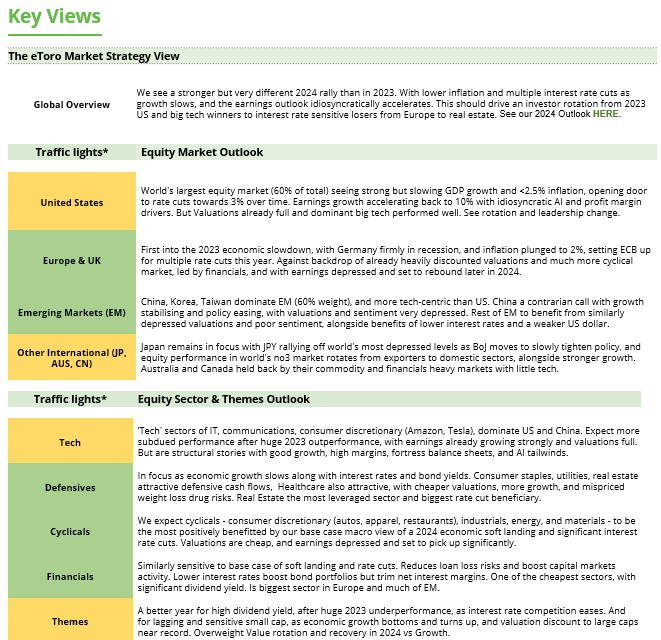

The ECB is expected to cut interest rates by 25 basis points to 3.25% on Thursday. Over the medium term, the central bank may adjust rates more rapidly and deeply than previously anticipated. Analysts predict rate cuts at every meeting through to March, heightening the focus on Lagarde’s comments during the upcoming press conference. These expectations are rooted in inflation falling below 2% for the first time since 2021 and the continued struggles of the German economy. Germany accounts for 28.6% of the Eurozone’s GDP and is facing a second consecutive year of recession. Lower borrowing costs could boost orders, revive industrial production, and support rising exports. However, to sustainably stimulate growth, additional measures, such as fiscal incentives and innovation promotion, are essential.

The Clash of the Empires

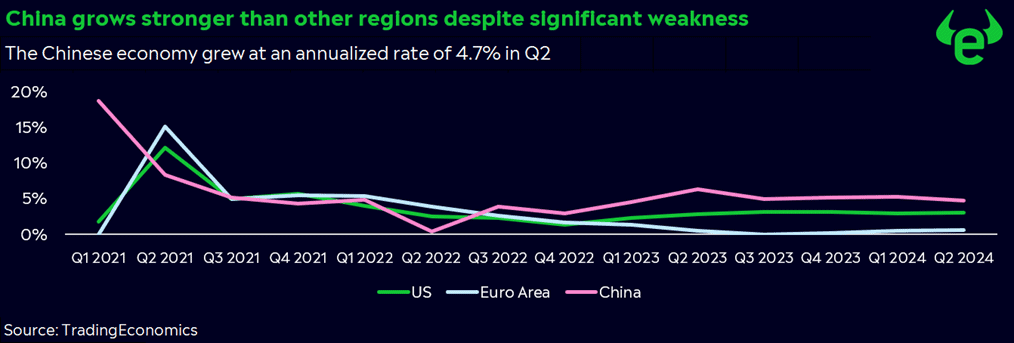

China will release its first estimate of Q3 GDP growth on 18 October, followed by the US and the Euro Area on 30 October. In China, growth is expected to have slowed slightly to 4.6% from 4.7% in Q2. In the previous quarter, US growth was a surprisingly strong 3.0%, while the Euro Area saw a marginal increase of 0.6% (see chart). In particular, China and the EU continue to clash over trade as each seeks to revive its economic growth to previous levels.

China’s stimulus: a first step, but not a solution to all problems

Stimulus packages alone cannot address China’s deep-rooted structural issues. With around 60% of the population owning depreciated property, there are persistent deflation risks and consumer reluctance. For stock prices to grow sustainably, support must reach the real economy and be reflected in economic data. Greater clarity about planned measures is also necessary, along with proactive steps in the coming months. Despite an improved outlook, reduced transparency in the Chinese stock market may deter investors. Commodities offer indirect investment opportunities, as China accounts for 40% of global copper demand and leads in gold demand.

Hurricane Milton to drive up orange juice prices?

Florida, which produces 70% of the US’ orange juice, faces a potential setback as hurricane Milton damaged major orange-growing regions last week. This follows recent challenges, including low production levels and high prices. Last month, orange juice futures in New York reached an all-time high due to reduced output in Florida and Brazil, where a historic drought and greening disease have severely impacted production. If damage caused by Milton turns out to be significant, orange juice prices could rise further due to reduced supply.

Earnings and events

Tech earnings from Dutch chip equipment maker ASML, leading Taiwanese foundry TSMC and streaming services provider Netflix will be important to watch as they may set the tone for a recovery of technology stocks from the sell-off in Q2. A revenue update from French luxury goods maker LVMH will be seen as an indicator for Western company sales in China.

Macro releases:

17 Oct. ECB rate decision, US retail sales

18 Oct. China GDP growth Q3, industrial production, retail sales

20 Oct. China FDI (foreign direct investments, previously -31.5%)

Earnings releases:

15 Oct. Bank of America, Citigroup, Goldman Sachs, UnitedHealth, Johnson & Johnson, LVMH

16 Oct. ASML, Morgan Stanley, Abbott Laboratories, Alcoa

17 Oct. TSMC, Infosys, Nestle, Netflix, Intuitive Surgical

18 Oct. Procter & Gamble, American Express