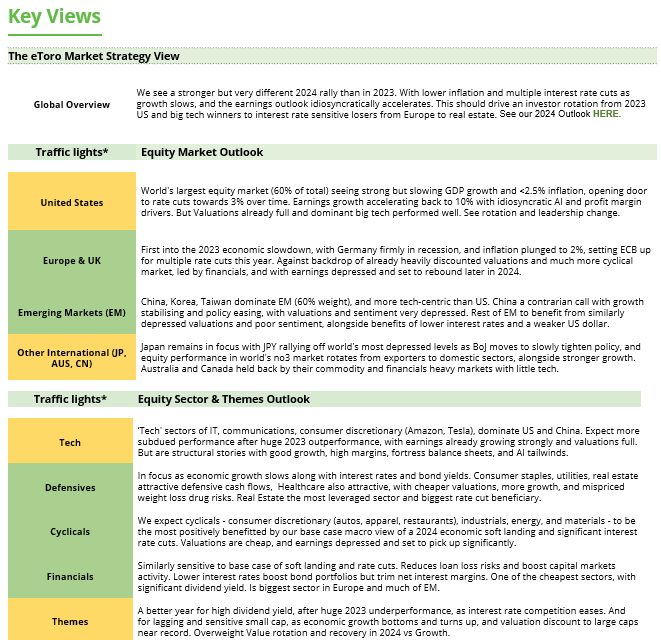

Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

S&P 500, Dow Jones, Bitcoin and gold all continue to follow a positive trend

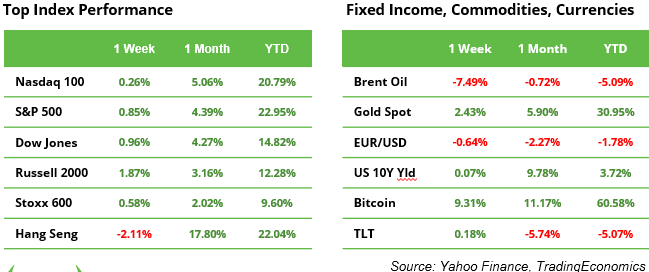

In an eventful week, the S&P 500 hit its 47th record high of the year, while the Dow Jones reached its 40th. Bitcoin gained 9%, while oil dropped 7%. Meanwhile, gold steadily climbed above $2,700, bringing its year-to-date return to 31%.

US equities were boosted by strong earnings from major companies, ranging from top-tier banks to Netflix, along with solid retail sales figures. Rate-sensitive sectors like healthcare, materials, and industrials led the way, as a disappointing outlook from Dutch chip machine maker ASML pushed some tech investors toward safer options. However, strong earnings from TSMC reignited optimism around AI stocks.

Looking ahead, 112 S&P 500 companies, including 7 of 30 Dow Jones constituents, are set to report their Q3 results in the upcoming week. On Thursday, the US, Eurozone, and UK will release new PMI data, offering a snapshot of the manufacturing sector in each region. With just two weeks until the US presidential election, expectations about potential policy changes could introduce significant market volatility. In the meantime, Russia will host the 16th BRICS Summit.

Bitcoin hodlers see themselves confirmed

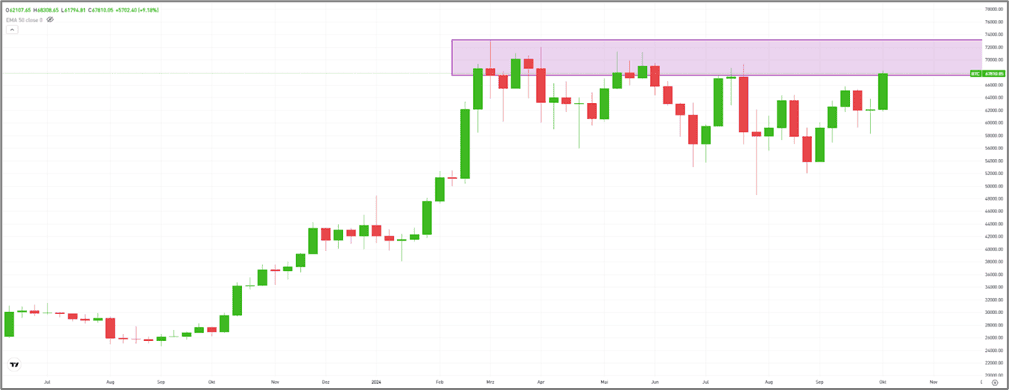

After months of consolidation, Bitcoin is gaining bullish momentum. Last week, its price surged by 9%, climbing above $68,000—just 8% shy of its all-time high of $73,835, set on March 1, 2024. For many holders, Bitcoin continues to serve as a hedge against fiat currency devaluation, especially as interest rate cuts increase the money supply and drive inflation. Institutional investors are also turning to Bitcoin, which has risen 60% since the start of the year. The growing acceptance of Bitcoin ETFs remains a significant tailwind for the leading cryptocurrency, potentially pushing it to new record highs (see chart). As Bitcoin often rallies once key levels are breached, FOMO (fear of missing out) may set in at the next peak.

A thought experiment: What if every investor allocated just 1% of their portfolio to Bitcoin?

Chart: Bitcoin is testing a key resistance zone between $68,000 and $73,000

Russia hosts 16th BRICS Summit in Kazan

Talks of a new world order are set to intensify this week as the BRICS countries convene for their 16th Summit in Kazan, Russia, from October 22 to 24. The founding nations, Brazil, Russia, India, China, and South Africa, will be joined for the first time by new members Egypt, Ethiopia, Iran, and the UAE, along with representatives from two dozen other countries considering membership. BRICS aims to establish an alternative to the G7 and IMF (meeting this same week), focusing on sanction-proof financing by promoting trade in local currencies rather than relying on the US dollar. While rapid change is not expected, momentum is building that could eventually challenge the dominance of the US dollar and the value of US Treasury bonds, factors that partly explain the recent rise in gold prices. However, the BRICS nations often have conflicting interests and don’t always see eye-to-eye.

US, UK and Eurozone to release PMI data for October

Why does it matter? Manufacturing on both sides of the Atlantic faces fierce competition from China, which is attempting to export its way out of a property crisis. Each region has its own challenges: Europe is trying to revive its economy, while the US aims to avoid a hard landing. In both cases, investors are keen to avoid further declines in the PMI Composite, particularly in manufacturing. Consensus estimates put the Eurozone PMI Composite at 49.7, marginally up from 49.6 in September. In the US, PMI Manufacturing is expected to recover to 48.2 from 47.3 the previous month. Disappointing results could reignite recession fears, though interest rate cuts in both regions provide some cushion against worsening economic conditions. On the other hand, stronger-than-expected data might reduce the likelihood of further rate cuts.

Earnings and events

Tesla will be in focus after a lacklustre robotaxi event without numbers. General Motors and Mercedes-Benz will provide another look at the automotive sector. Hermès and Kering will be watched in particular after the disappointing LVMH figures last week.

Earnings releases:

21 Oct. SAP

22 Oct. GE Aerospace, Danaher, Verizon, Texas Instruments, RTX, General Motors, L’Oreal

23 Oct. Tesla, Coca Cola, IBM, ServiceNow, NextEra Energy, AT&T, Boeing, Iberdrola, Kering

24 Oct. Unilever, RELX, Unicredit, Hermes, Honeywell

25 Oct. Mercedes-Benz