Este artículo también está disponible en español.

Bitcoin has had a volatile week, with its price fluctuating between a local high of $69,500 and a low of $65,000. Following weeks of strong bullish momentum, the market has now cooled, and BTC is consolidating just below the crucial $70,000 level. This key threshold is seen as a trigger for intensified buying pressure if Bitcoin manages to break above it.

Related Reading

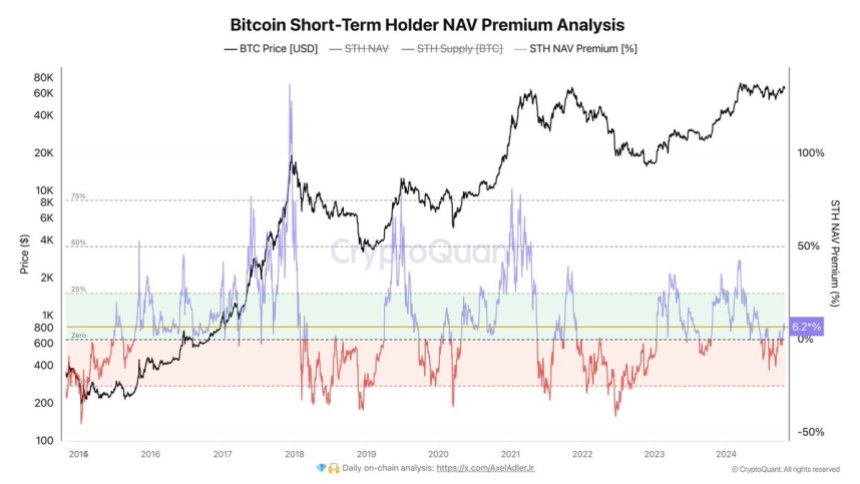

According to CryptoQuant data, there’s still room for further growth, as short-term holder (STH) coins are trading at a 6.2% net asset value (NAV) premium. This premium is often viewed as a gauge of market sentiment, reflecting the optimism of short-term holders who are willing to pay above the current market value to acquire Bitcoin. A higher NAV premium generally suggests that investors expect continued price appreciation and are positioning themselves for future gains.

As BTC stabilizes in its current range, all eyes are on the $70,000 mark as a potential breakout level that could pave the way for a fresh rally. With positive market sentiment and supportive data, Bitcoin’s outlook for the coming weeks remains encouraging, fueled by both technical signals and strong buyer interest.

Retail Buying Bitcoin (Again)

Bitcoin is experiencing growing demand from short-term holders as its price consolidates below key supply levels, close to all-time highs. Analyst Axler Adler recently shared critical insights on X, showing that Bitcoin’s net asset value (NAV) premium among short-term holders has climbed to 6.2%.

This 6.2% NAV premium indicates that Bitcoin’s current market price is trading 6.2% above the average acquisition cost for short-term holders. Essentially, these investors are valuing Bitcoin at a premium, suggesting optimism about the potential for further gains.

Adler explains that this metric acts as a bullish signal, highlighting room for continued price growth. An NAV premium of 25% or higher typically points to an overheated market, implying that demand has yet to reach excessive levels.

According to Adler’s analysis, the NAV premium is an important gauge of market sentiment. A moderate premium like 6.2% reflects healthy demand among short-term holders, aligning with an accumulation phase rather than a peak. This is especially relevant as Bitcoin’s price consolidates under significant resistance levels, potentially setting the stage for a breakout.

Related Reading

Bitcoin’s consolidation below its key supply levels and rising demand among short-term holders reflects a favorable environment for potential price appreciation. If short-term holder demand continues to grow, it could fuel BTC’s ascent to new highs.

The balance between premium demand and manageable NAV levels could signal sustained upward momentum. There is a potential rally on the horizon if buying pressure strengthens at current levels.

Technical Level To Watch

Bitcoin is trading at $66,900 after establishing solid support around $65,000. The price action signals resilience as it consolidates above this crucial level. This support around $65,000 marks a significant pivot, as holding above it reflects underlying strength and fuels optimism among investors. However, for Bitcoin to keep bullish momentum, a push above $70,000 is essential to confirm the uptrend.

If Bitcoin loses the $65,000 level, analysts foresee a retrace toward the 200-day moving average (MA) at $63,274. This level is relevant as a long-term support zone. A pullback to this area could attract new buyers, reinforcing it as a major support if tested.

Related Reading

Investors view the 200-day MA as a key anchor for Bitcoin’s bullish structure. If BTC can hold above $65,000 and eventually break $70,000, it would indicate a continuation of the current bullish phase. Conversely, a dip below these supports would shift focus to the 200-day MA. Holding above this moving average is crucial to prevent a bearish reversal.

Featured image from Dall-E, chart from TradingView