In an ongoing effort to recover assets to repay creditors affected by its collapse in 2022, defunct crypto exchange FTX, once run by 25-year convict Sam Bankman-Fried, has reached an agreement with UAE-based crypto platform Bybit, allowing it to withdraw assets as part of a $228 million settlement.

FTX To Recoup Funds From Bybit

According to a report from Bloomberg, the settlement involves FTX dropping its litigation against Bybit Fintech Ltd. and related entities. The company has requested approval from the US Bankruptcy Court for the District of Delaware to finalize this agreement, which comes after months of negotiations.

Under the terms of the deal, FTX is set to recover approximately $175 million in digital assets held on Bybit and sell BIT tokens to Bybit’s investment arm, Mirana Corp., for nearly $53 million.

The legal dispute stemmed from allegations that Mirana had withdrawn $327 million in assets from FTX just before the exchange’s collapse, utilizing “special privileges”. At the same time, other users struggled to access their funds.

As part of the settlement, defendants who withdrew funds shortly before FTX filed for bankruptcy will be allowed creditor claims amounting to 75% of their account balances at the time of the bankruptcy filing. FTX described this arrangement as generating “significant net savings for the debtors’ estates.”

FTX expressed confidence in the settlement in its filing, stating, “Through the Settlement Agreement, the Debtors will be recovering substantially everything that they seek to recover.”

The company emphasized that this agreement would help secure a significant recovery for stakeholders while avoiding “costs and uncertainties” associated with ongoing litigation and potential enforcement challenges abroad.

The settlement is one of several agreements orchestrated by FTX’s new CEO, John J. Ray III, who took the helm following the exchange’s downfall. Earlier this month, the court approved its wind-down plan to distribute at least $12.6 billion to customers whose assets have been trapped on the platform.

Creditor Payouts Expected By Early 2025

As previously reported by Bitcoinist, Judge John Dorsey from the US Bankruptcy Court has approved the reorganization plan that seeks to initiate creditor repayments nearly two years after FTX’s collapse.

K33 analysts Vetle Lunde and David Zimmerman have projected that creditor payouts may commence in the latter half of Q4 2024 and extend into early Q1 2025. These payouts are expected to occur within a 60-day window of the court’s effective date, which is anticipated to be announced in mid-November.

Analysts suggest that Bitcoin (BTC) prices could benefit from these developments as funds are released back into the market. However, a significant portion of the claims—estimated between $14.4 billion and $16.3 billion—has already been purchased by credit funds, reducing the likelihood of these assets re-entering the market.

Furthermore, approximately 33% of the remaining claims are tied to sanctioned entities and individuals without proper know-your-customer (KYC) verification, making those assets unlikely to be reclaimed.

Taking into account these factors, analysts estimate that around 20% to 40% of the remaining $8 billion could potentially re-enter the market. This prediction hinges on the nature of FTX’s trader base, which consists largely of “aggressive, crypto-native risk-takers.”

At the time of writing, the exchange’s native token, FTT, is trading at $1.80.

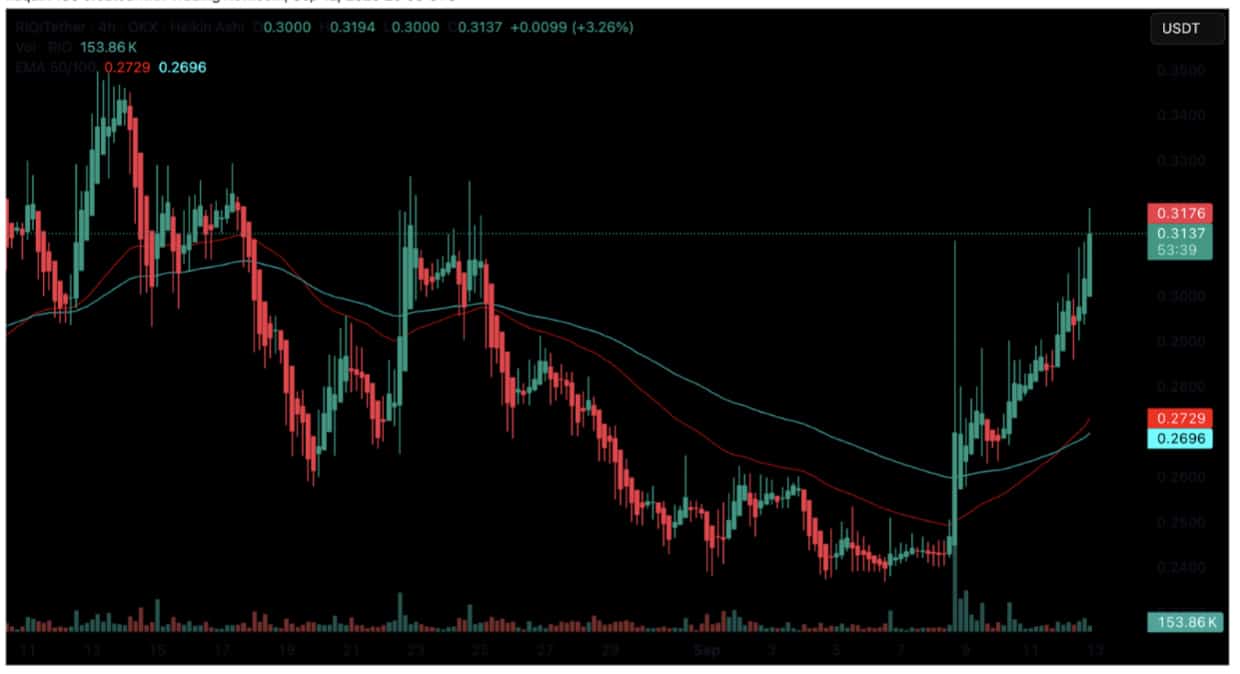

Featured image from DALL-E, chart from TradingView.com