Este artículo también está disponible en español.

After a historic rally, Bitcoin has faced its first major setback, pulling back 7% from its all-time high of $99,800. This comes after an impressive surge from $67,500 on November 5, marking a nearly 50% climb in just a few weeks. The price action has largely been “only up,” attracting significant attention from traders and investors alike.

Related Reading

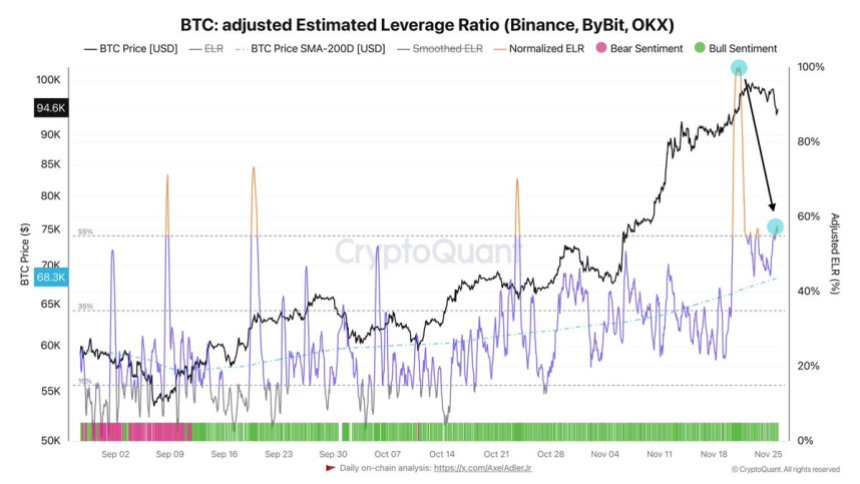

However, the current pullback highlights growing caution in the market. Market caution said leverage levels remain elevated despite recent deleveraging efforts. Adler’s analysis reveals that increasing short positions and consolidation below the psychological $100,000 mark have contributed to the retracement.

While Bitcoin’s performance remains strong in the broader context, this dip signals a potential shift in market sentiment. The question is whether BTC can gather enough momentum to break past the $100,000 barrier or if further consolidation is on the horizon.

Many investors consider this pullback a healthy pause in a bullish cycle, but the high leverage levels suggest continued volatility. All eyes are on Bitcoin as it navigates this critical phase, with the next few days likely to determine its short-term direction.

Bitcoin Bears Showing Up

After three weeks of minimal resistance from bears, signs of their resurgence emerge as Bitcoin struggles to break past the $100,000 level. This critical price point, which many believed would act as a springboard for further gains, has instead highlighted growing bearish sentiment. According to CryptoQuant analyst Axel Adler, the recent price action marks a potential shift in momentum.

Adler’s analysis on X reveals that despite a wave of recent deleveraging, leverage levels in the market remain elevated. Many key long positions were established around the $93,000 mark, providing bears with an opportunity to profit as BTC failed to push higher. This level has now become a battleground, with Bitcoin’s inability to sustain upward momentum signaling the possibility of further downside risk.

Bitcoin’s price hovers around this key level, raising the likelihood of a correction toward $88,500 or prolonged sideways consolidation below $100,000. Such a scenario would impact Bitcoin and set the tone for altcoin performance in the coming weeks.

Related Reading

The next two weeks will be pivotal as market participants closely watch Bitcoin’s price action. A decisive move, whether up or down, will shape the broader cryptocurrency landscape and determine whether this is merely a pause in a larger rally or the start of a deeper correction.

BTC Testing Fresh Demand

Bitcoin is trading at $93,500 as bears regained control after it hit an all-time high last Friday. This retracement marks a shift in momentum, but bulls still can reclaim dominance if the price remains strong above the critical $92,000 support level. Holding this level would keep Bitcoin’s price action structurally bullish and signal resilience in the face of increased selling pressure.

If Bitcoin sustains strength above $92,000, the outlook for the short term remains optimistic, with the potential for another attempt at breaking key resistance levels. However, a drop below this mark would signal short-term weakness, potentially triggering further declines. The next critical level to watch would be around $84,000, where the 4-hour 200 EMA aligns as a support zone.

This level represents a major line in the sand for bulls. A breakdown below it could accelerate bearish momentum, extending the correction and dampening market sentiment. On the other hand, holding above $92,000 would reinforce bullish confidence, setting the stage for a recovery and a potential pushback toward previous highs.

Related Reading

Traders and investors are closely watching these levels, as Bitcoin’s ability to stay above $92,000 will determine whether it remains in a short-term bullish structure or succumbs to bearish pressures.

Featured image from Dall-E, chart from TradingView