Major Developments for the Week

- Bitcoin crosses $100K, hits $103K as market optimism soars

- Ethereum breaks $4,000 mark, driven by record ETF inflows

- Dogecoin hits $0.48, highest price since 2021

- Pepe memecoin flips Uniswap in market cap, reaching $11 billion

- Algorand’s TVL surges 300%, reflecting DeFi momentum

- BNB token achieves new all-time high amid altcoin rally

- El Salvador plans to ease BTC acceptance requirement to unlock $3B in loans

- Mt. Gox moves $2.4 billion in Bitcoin after $100K breakthrough

- Trump appoints Paul Atkins as SEC chair, signaling pro-crypto regulatory shift

- David Sacks named “AI and crypto czar,” boosting dYdX token by 30%

- Fed Chair Powell: Bitcoin competes with gold, not the U.S. dollar

- Speculation surrounds Gensler’s potential blocking of Solana ETFs

Bitcoin’s $100K milestone and its knock-on effect on the crypto market

Bitcoin has shattered expectations and historical records, crossing the $100,000 threshold and eventually reaching an all-time high of $103K. This achievement underscores the cryptoasset’s resilience and growing acceptance as a legitimate asset class. It marks a pivotal moment for Bitcoin and the broader crypto market, with significant implications for investors and enthusiasts alike.

The milestone was reached in the early hours of December 5, continuing a rally that has seen Bitcoin rise more than 120% since January. The rally has pushed Bitcoin’s market capitalization to $2 trillion, firmly placing it among the most valuable assets in the world.

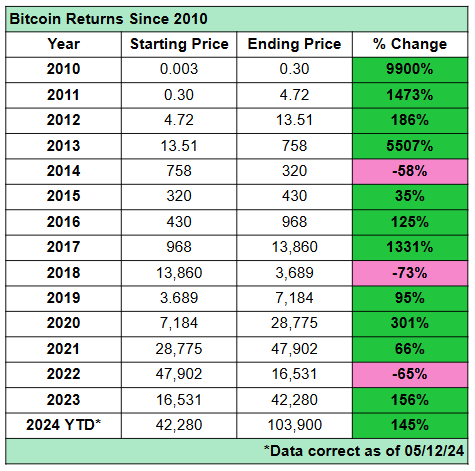

The percentage pattern of Bitcoin’s yearly returns since 2010

Image by Sam North, eToro analyst

Past performance is not an indication of future results.

What’s driving Bitcoin’s record surge?

Several factors have fueled this surge. The launch of spot Bitcoin ETFs earlier this year by giants like BlackRock and Fidelity has been a game changer. November alone saw $6.1 billion in Bitcoin ETF inflows, providing a new avenue for institutional investors to enter the market. Additionally, the April halving event tightened Bitcoin’s supply, historically a precursor to price surges.

Politics also played a role. Donald Trump’s victory in the U.S. presidential election and his subsequent crypto-friendly appointments, including Paul Atkins as SEC Chair, have renewed hopes for clearer regulations. The potential for Bitcoin to play a strategic role in national reserves has further bolstered confidence.

MicroStrategy’s continued Bitcoin accumulation exemplifies corporate adoption. The company now holds over 400,000 BTC, valued at $40.5 billion, and has inspired others to follow suit. This institutional confidence signals a shift in how Bitcoin is viewed—not just as a speculative asset but as a legitimate store of value.

Yet, challenges remain. The recent transfer of 24,000 BTC by the bankrupt exchange Mt. Gox raised concerns about sell-side pressure. While analysts argue this has been priced into the market, it serves as a reminder of the volatility inherent in crypto.

Ethereum, Memecoins, and Layer-2 Tokens: Altcoins Shine

While Bitcoin dominated headlines, other cryptoassets have also been making waves, riding the coattails of its rally or carving out their own paths.

Ethereum surged past $4,000 for the first time since March, driven by a spike in ETF inflows totaling $750 million in December. Though still below its all-time high of $4,878, the move signals growing confidence in Ethereum as the backbone of decentralized finance (DeFi).

Memecoins like Pepe and Dogecoin had their moment as well. Pepe, often dismissed as a speculative token, reached a market cap of $11 billion, flipping Uniswap in the rankings. Its rise mirrors the speculative frenzy seen in earlier market cycles. Meanwhile, Dogecoin hit $0.48, its highest price since 2021, as renewed market enthusiasm spilled over into long-time favorites, before correcting ($0.40 at time of writing).

Layer-2 tokens and altcoins affiliated with Bitcoin and Ethereum also enjoyed renewed attention. Stacks and Ethereum Classic posted double-digit gains, signaling that the rally’s effects are being felt across the board. dYdX, the token of a decentralized exchange, surged 30% after Trump named David Sacks, a known crypto advocate, as “AI and Crypto Czar.”

DeFi and XRP: Building Momentum

In the DeFi space, Algorand’s Total Value Locked (TVL) surged over 300% in November, driven by the success of protocols like Folks Finance. Algorand’s native token, ALGO, mirrored this growth, breaking key technical levels despite slight retracements.

XRP also saw a resurgence, hitting $2.82 early last week, its highest level in seven years. Optimism about Trump’s crypto policies has bolstered XRP, which climbed approximately 275% over the last month.

HEAR MORE ABOUT XRP’S RECENT SURGE ON ETORO’S LATEST DIGEST & INVEST PODCAST

A Bull Run to Remember: Bitcoin Leads, Altcoins Surge

Bitcoin’s $100K achievement is not just a milestone but a signal of a broader bull run that is reigniting excitement across the crypto market. Institutional adoption, regulatory optimism, and technological advancements are setting the stage for what could be a transformative period for digital assets.

Yet, the market’s inherent volatility remains a factor. As Bitcoin consolidates around six figures, the broader market will likely follow its lead, with both opportunities and risks ahead. For now, the world’s first cryptocurrency has reminded everyone why it remains the undisputed leader in the digital asset space.