With Bitcoin now making six-figure territory feel normal and higher prices a seeming inevitability, the analysis of key on-chain data provides valuable insights into the underlying health of the market. By understanding these metrics, investors can better anticipate price movements and prepare for potential market peaks or even any upcoming retracements.

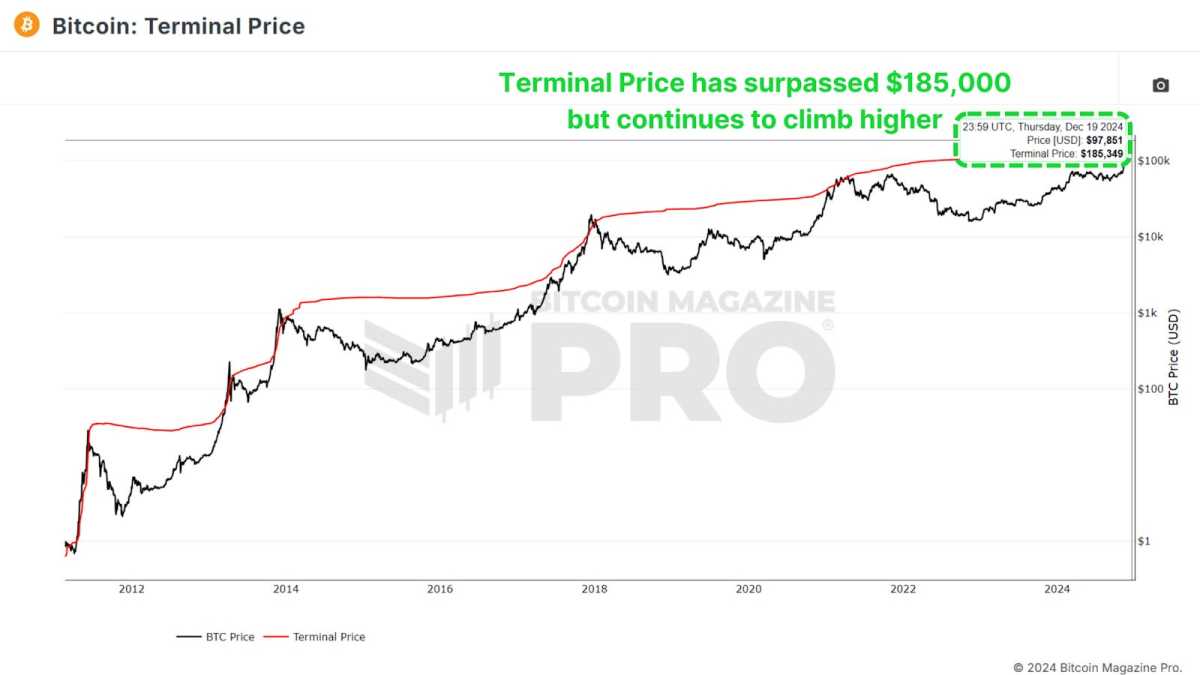

Terminal Price

The Terminal Price metric, which incorporates the Coin Days Destroyed (CDD) while factoring in Bitcoin’s supply, has historically been a reliable indicator for predicting Bitcoin cycle peaks. Coin Days Destroyed measures the velocity of coins being transferred, considering both the holding duration and the quantity of Bitcoin moved.

View Live Chart 🔍

Currently, the terminal price has surpassed $185,000 and is likely to rise toward $200,000 as the cycle progresses. With Bitcoin already breaking $100,000, this suggests we may still have several months of positive price action ahead.

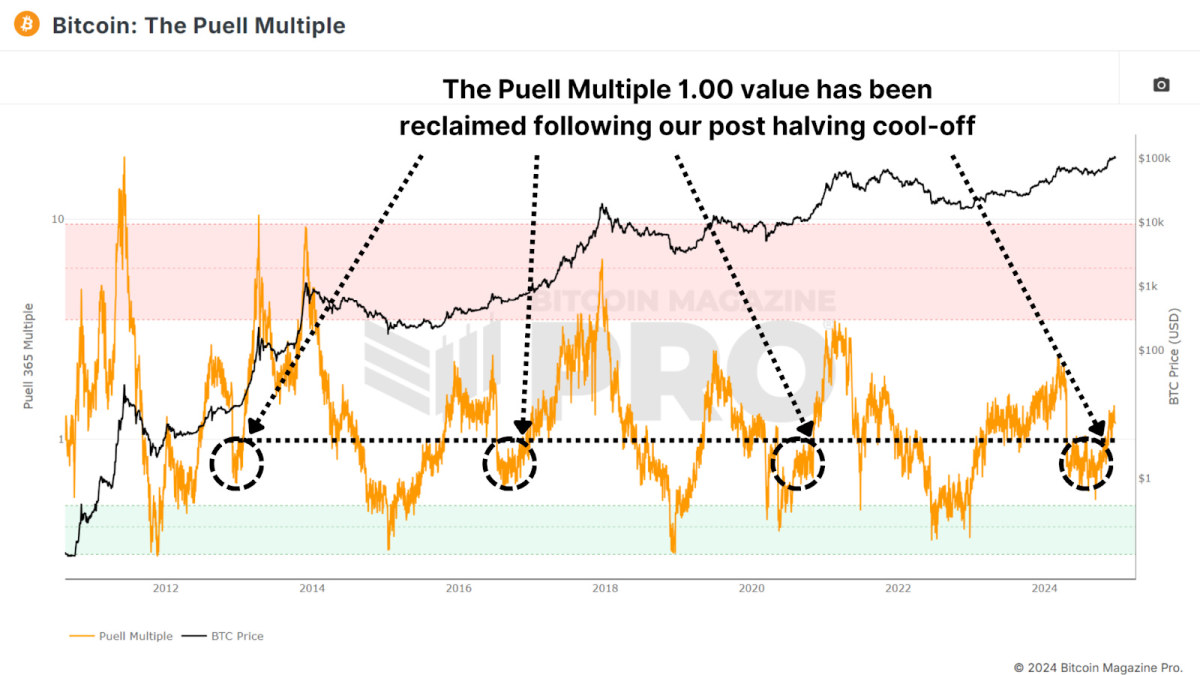

Puell Multiple

The Puell Multiple evaluates daily miner revenue (in USD) relative to its 365-day moving average. After the halving event, miners experienced a sharp drop in revenue, creating a period of consolidation.

View Live Chart 🔍

Now, the Puell Multiple has climbed back above 1, signaling a return to profitability for miners. Historically, surpassing this threshold has indicated the later stages of a bull cycle, often marked by exponential price rallies. A similar pattern was observed during all previous bull runs.

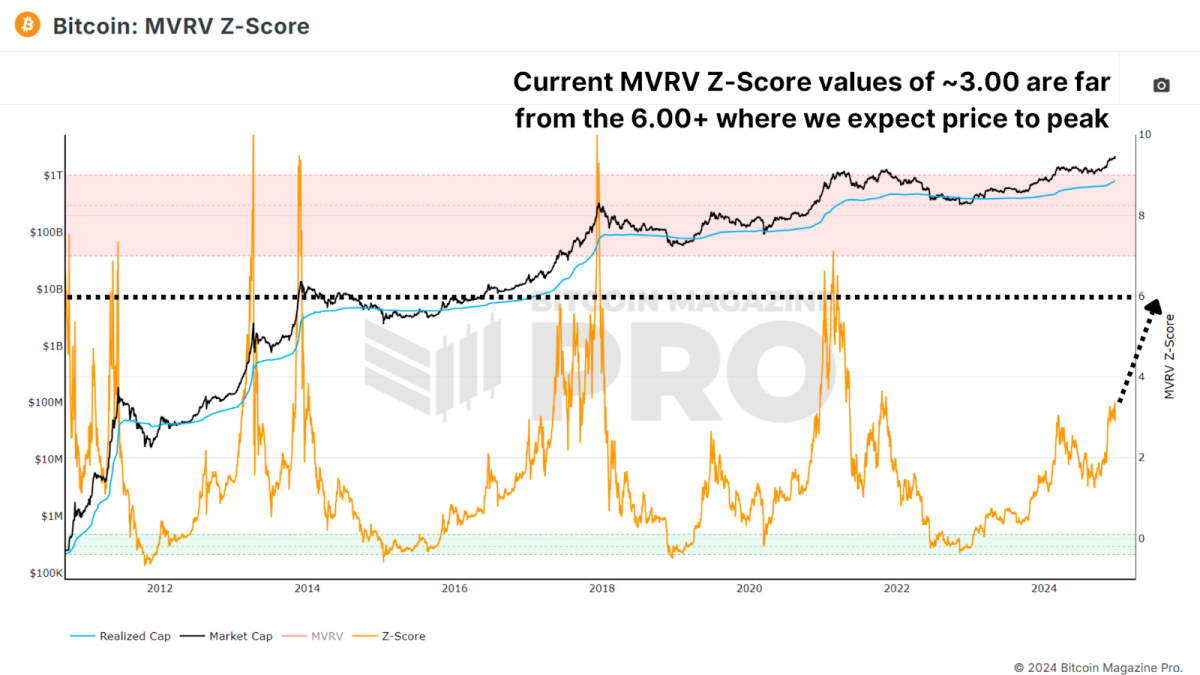

MVRV Z-Score

The MVRV Z-Score measures the market value relative to the realized value (average cost basis of Bitcoin holders). Standardized into a Z-Score to account for the asset’s volatility, it’s been highly accurate in identifying cycle peaks and bottoms.

View Live Chart 🔍

Currently, Bitcoin’s MVRV Z-Score remains below the overheated red zone with a value of around 3.00, signaling that there’s still room for growth. While diminishing peaks have been a trend in recent cycles, the Z-Score suggests that the market is far from reaching a euphoric top.

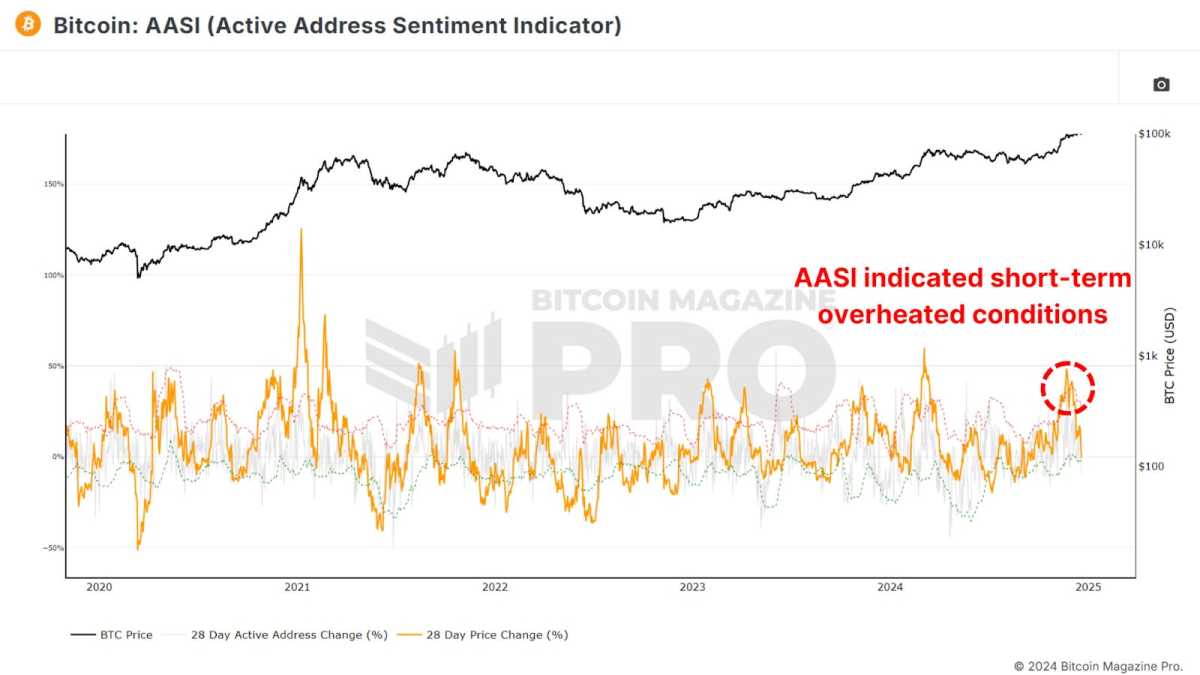

Active Address Sentiment

This metric tracks the 28-day percentage change in active network addresses alongside the price change over the same period. When price growth outpaces network activity, it suggests the market may be short-term overbought, as the positive price action may not be sustainable given network utilization.

View Live Chart 🔍

Recent data shows a slight cooling after Bitcoin’s rapid climb from $50,000 to $100,000, indicating a healthy consolidation period. This pause is likely setting the stage for sustained long-term growth and does not indicate we should be medium to long-term bearish.

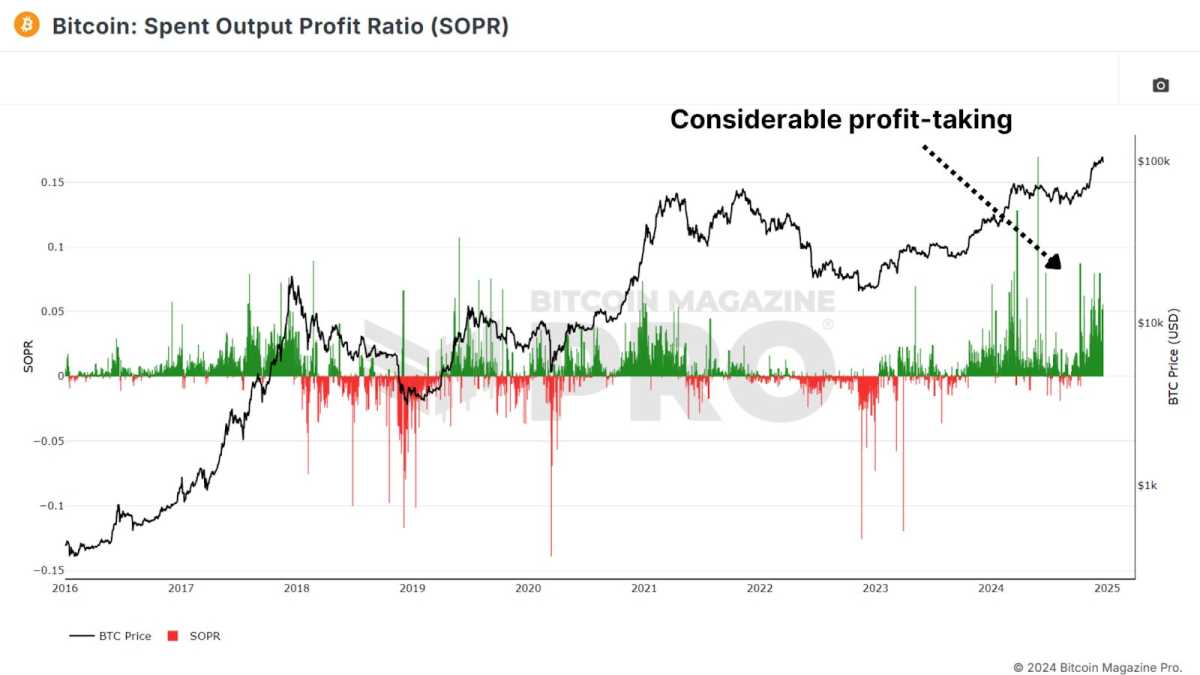

Spent Output Profit Ratio

The Spent Output Profit Ratio (SOPR) measures realized profits from Bitcoin transactions. Recent data shows an uptick in profit-taking, potentially indicating we are entering the latter stages of the cycle.

View Live Chart 🔍

One caveat to consider is the growing use of Bitcoin ETFs and derivative products. Investors may be shifting from self-custody to ETFs for ease of use and tax advantages, which could influence SOPR values.

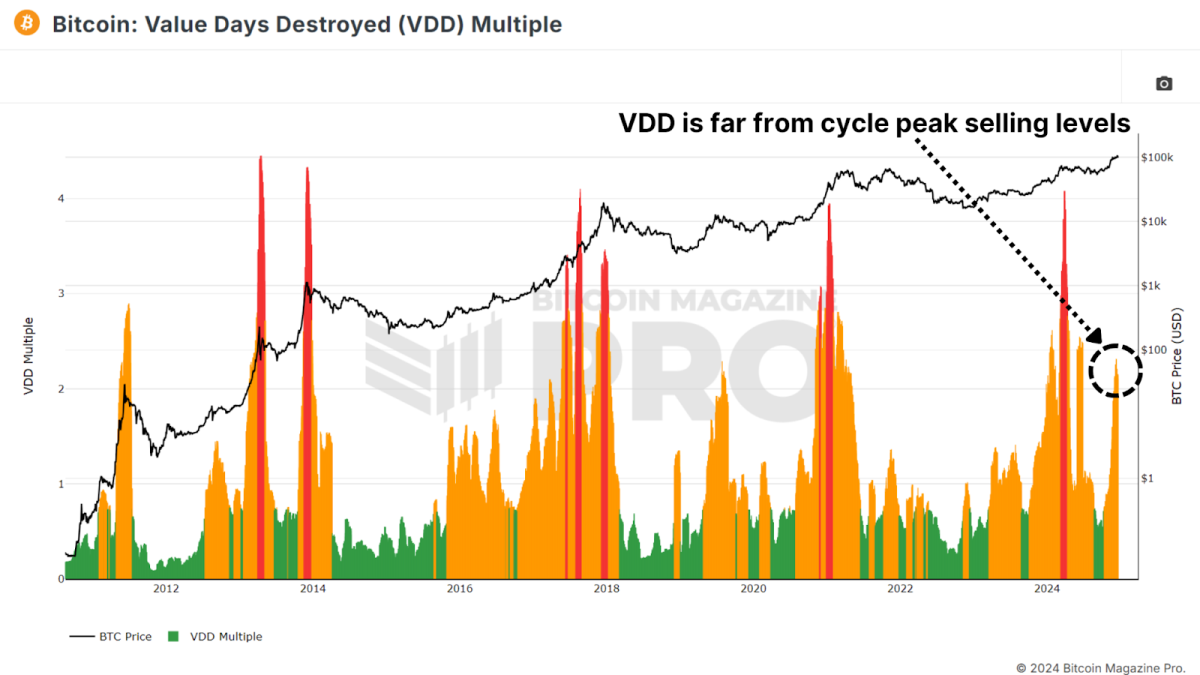

Value Days Destroyed

Value Days Destroyed (VDD) Multiple expands on CDD by weighting larger, long-term holders. When this metric enters the overheated red zone, it often signals major price peaks as the market’s largest and most experienced participants begin cashing out.

View Live Chart 🔍

While Bitcoin’s current VDD levels indicate a slightly overheated market, history suggests it could sustain this range for months before a peak. For example, in 2017, VDD indicated overbought conditions nearly a year before the cycle’s top.

Conclusion

Taken together, these metrics suggest that Bitcoin is entering the latter stages of its bull market. While some indicators point to short-term cooling or slight overextension, most highlight substantial remaining upside throughout 2025. Key resistance levels for this cycle may emerge between $150,000 and $200,000, with metrics like SOPR and VDD providing clearer signals as we approach the peak.

For a more in-depth look into this topic, check out a recent YouTube video here: What’s Happening On-chain: Bitcoin Update

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.