Bitcoin’s rise and subsequent fall from its new ATH of $108,200 spurred quite a bit of market activity. Last week’s price volatility led to spikes in both spot and derivatives trading, with rising volumes and sky-high liquidations showing the market’s aggressive reaction to the price drop.

Looking at trading volumes alone might show a market in a fearful sell-off. However, we can see that the reaction is limited to the retail market when considering the changes in OTC desk balances.

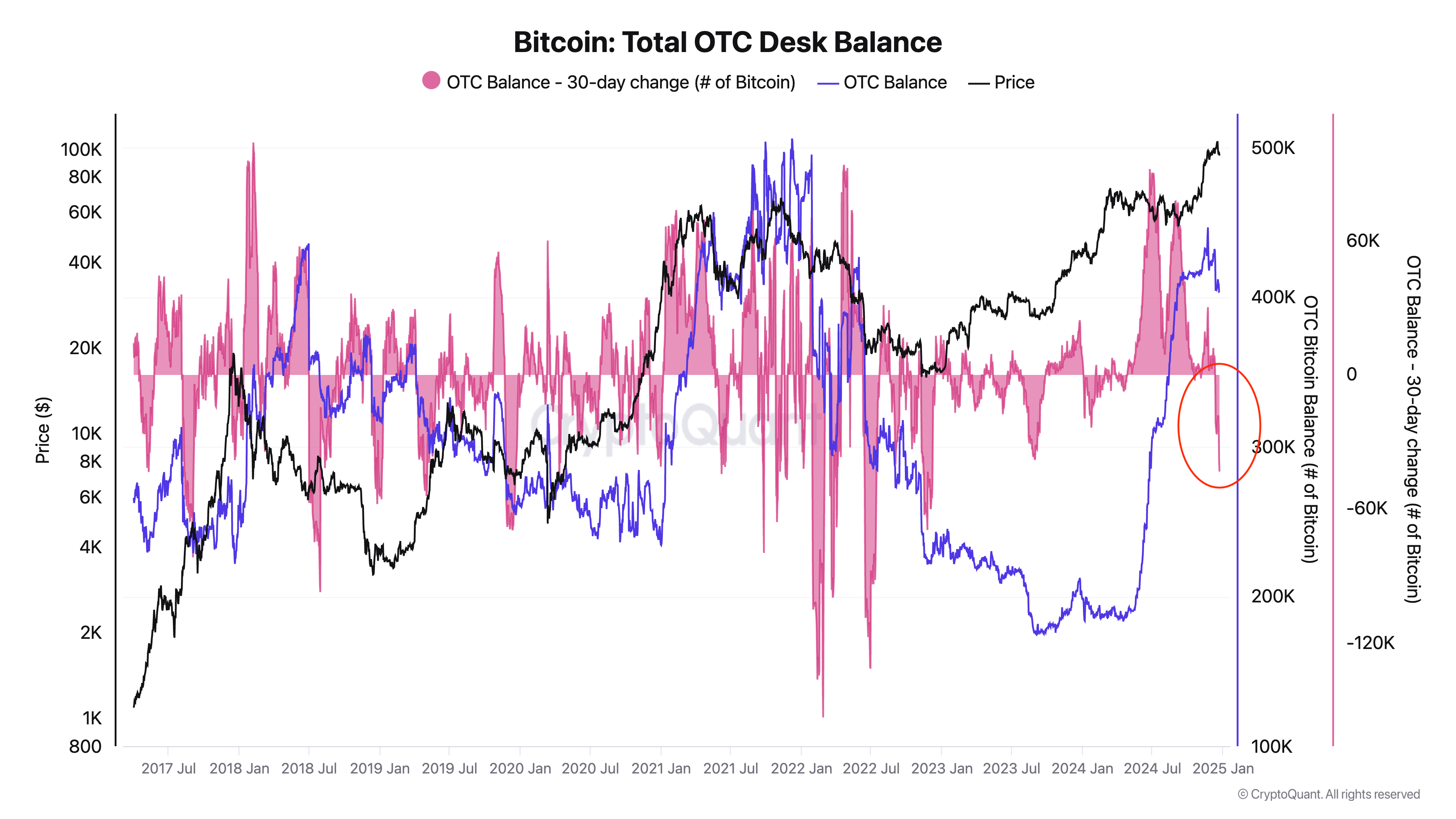

Data from CryptoQuant showed that the OTC desk balance has seen significant outflows. OTC (over-the-counter) desks are platforms that facilitate large trades directly between buyers and sellers, bypassing public exchanges. Institutions and high-net-worth individuals often use these desks to execute substantial trades without causing significant market disruption. Changes in OTC balances can provide insight into the behavior of these large market participants. When OTC balances decrease, it often signals accumulation, as investors withdraw Bitcoin from these desks, typically for cold storage or strategic purposes. Conversely, increasing balances indicate quite a bit of BTC has been sold.

However, estimating OTC balances comes with challenges. Not all OTC desks report their data, and the movement of Bitcoin to and from these desks doesn’t always imply immediate buying or selling activity. Despite these limitations, OTC balance trends remain a valuable metric for gauging the sentiment and strategies of large market players.

This withdrawal of Bitcoin from OTC desks aligns with a broader narrative of accumulation by whales and institutions. A declining OTC balance, especially when paired with a significant negative 30-day change, suggests that these players are moving Bitcoin off platforms and likely into cold storage. Such behavior often indicates long-term accumulation strategies, as it reduces liquidity in OTC markets and implies a tightening supply.

Most of this decline occurred while Bitcoin’s price dropped from $108,200 to $94,000. And while this led to panic among retail investors, the correction seems to have served as a prime buying opportunity for large investors. Large-scale investors may have strategically leveraged the falling price to accumulate Bitcoin at what they perceive as a discount. By withdrawing these assets from OTC desks, they signal confidence in Bitcoin’s long-term value despite short-term volatility.

A sustained reduction in OTC desk balances can lead to tightening supply, which could drive upward pressure on Bitcoin’s price in the medium to long term. This effect could be amplified if retail sentiment shifts back toward optimism when Bitcoin breaks the $100,000 level, fueling demand in a market with constrained supply. Furthermore, the activity we’ve seen from institutions hints at strategic positioning ahead of potential catalysts.

Institutional players seem to have used the price drop as an opportunity to accumulate, signaling confidence in Bitcoin’s long-term trajectory. With supply tightening and demand likely to increase, Bitcoin’s current price levels may represent a foundation for future growth.

The post Drop in OTC balances shows large investors are accumulating discounted Bitcoin appeared first on CryptoSlate.