The crypto market is ending the year on a strong note as a record $18 billion worth of options contracts are set to expire.

Options allow traders to speculate or hedge against price movements. A call option grants the right to buy an asset at a specific price, while a put option provides the right to sell under similar terms.

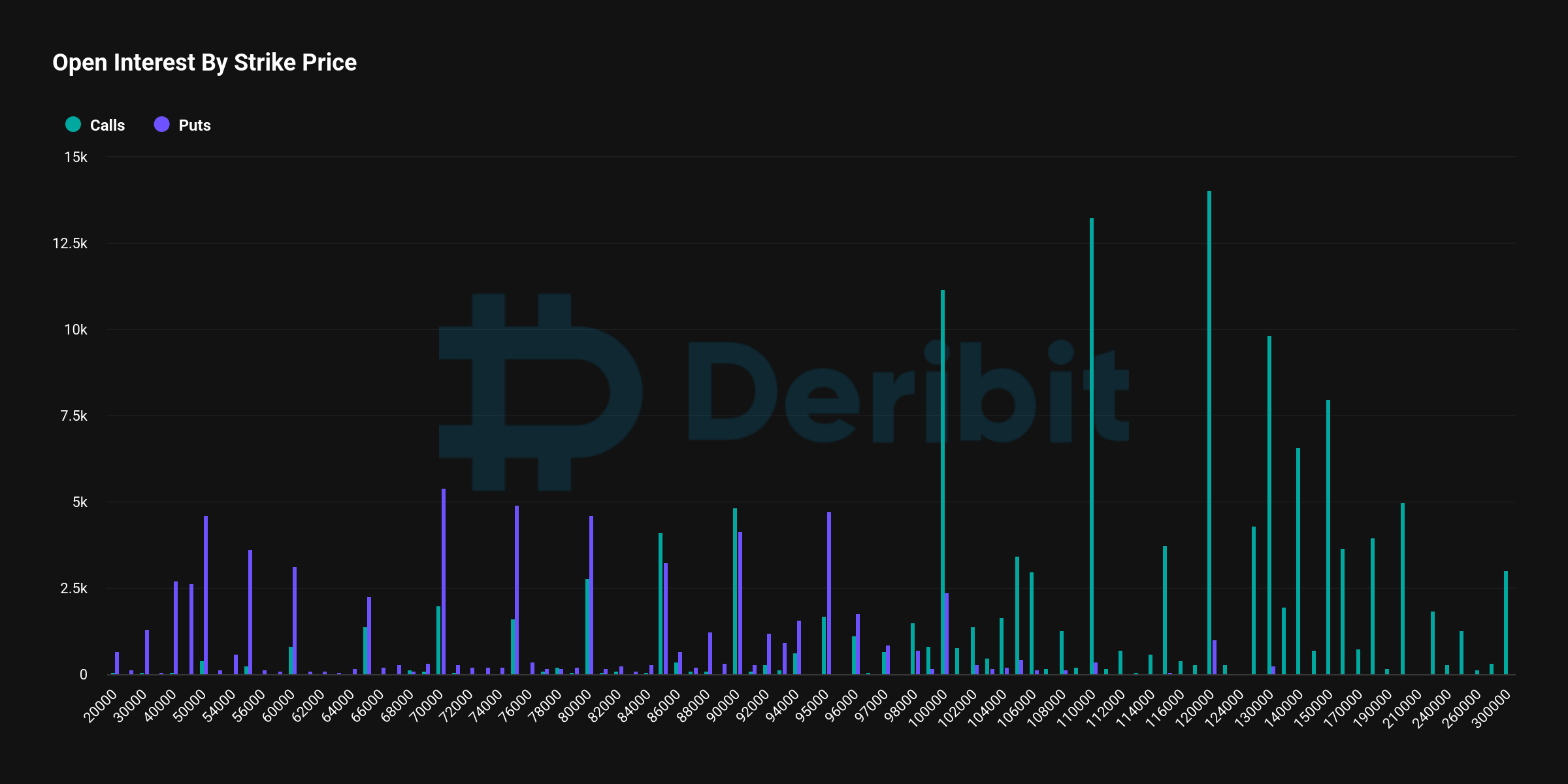

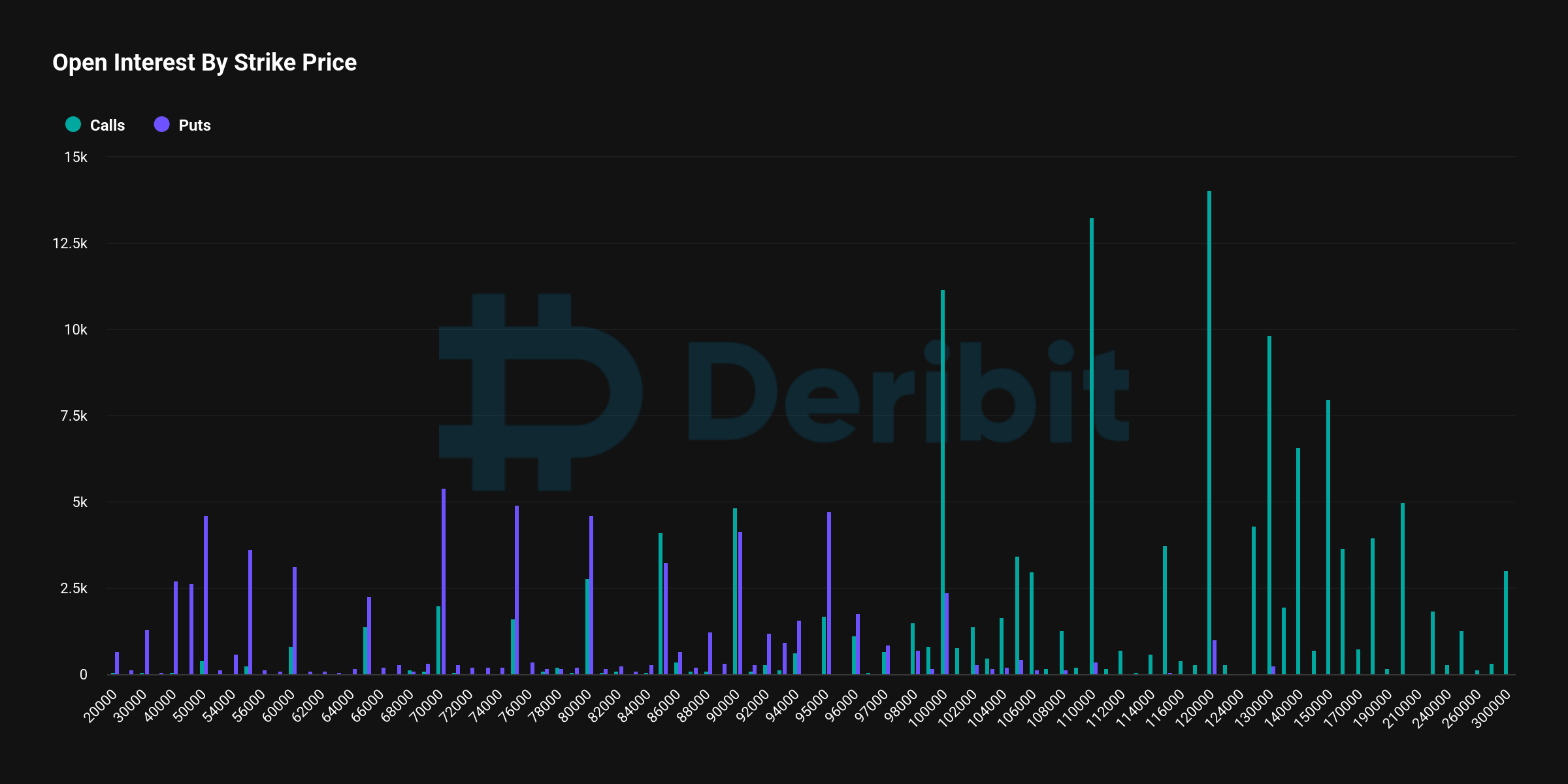

Data from Deribit shows that nearly 150,000 Bitcoin (BTC) contracts—valued at $14.17 billion—are involved in this expiry.

These contracts show a Put-Call Ratio of 0.69, meaning bullish traders dominate as they bet on higher prices. The Max Pain level, where most buyers face losses and sellers profit, is $85,000.

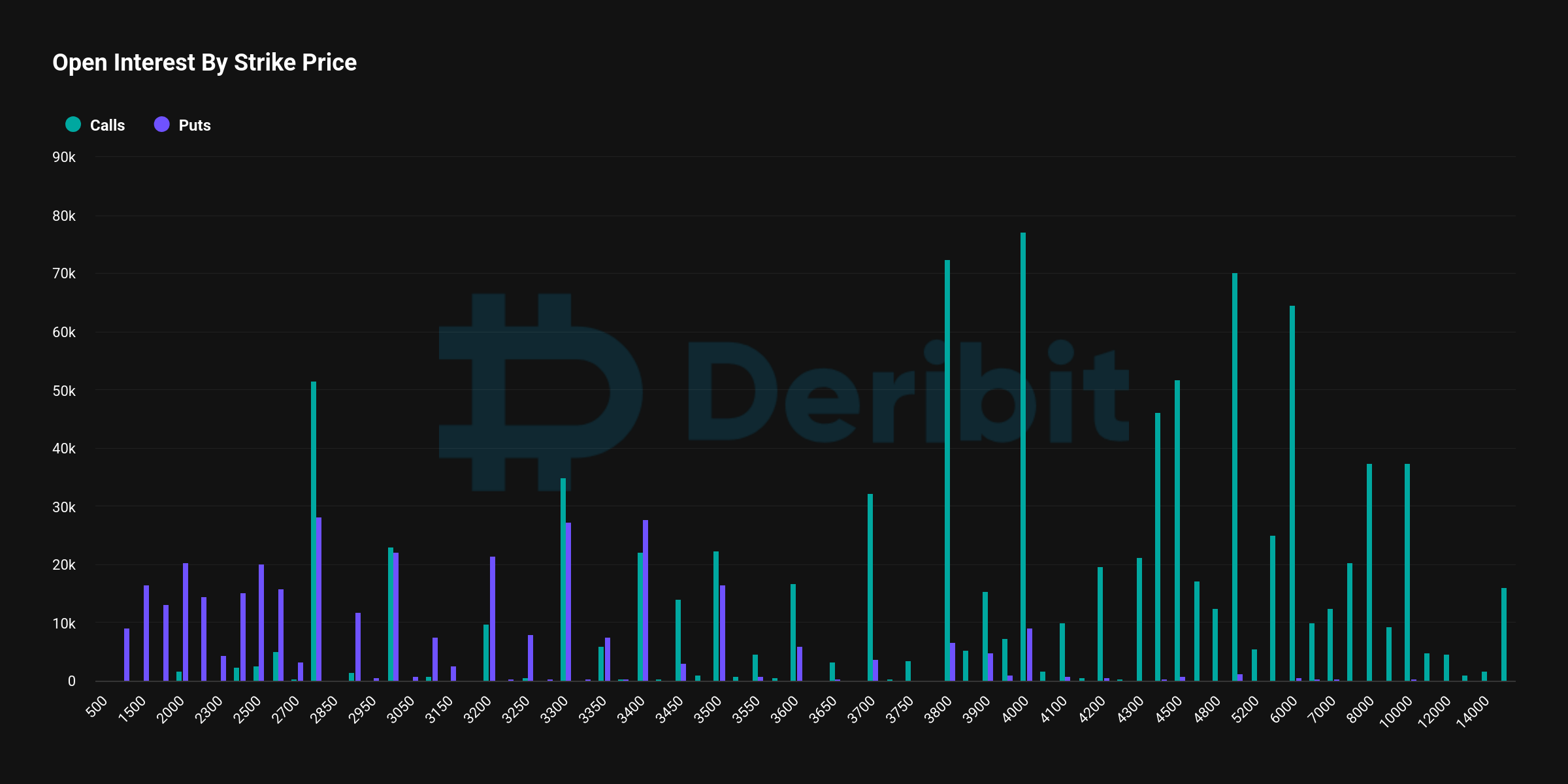

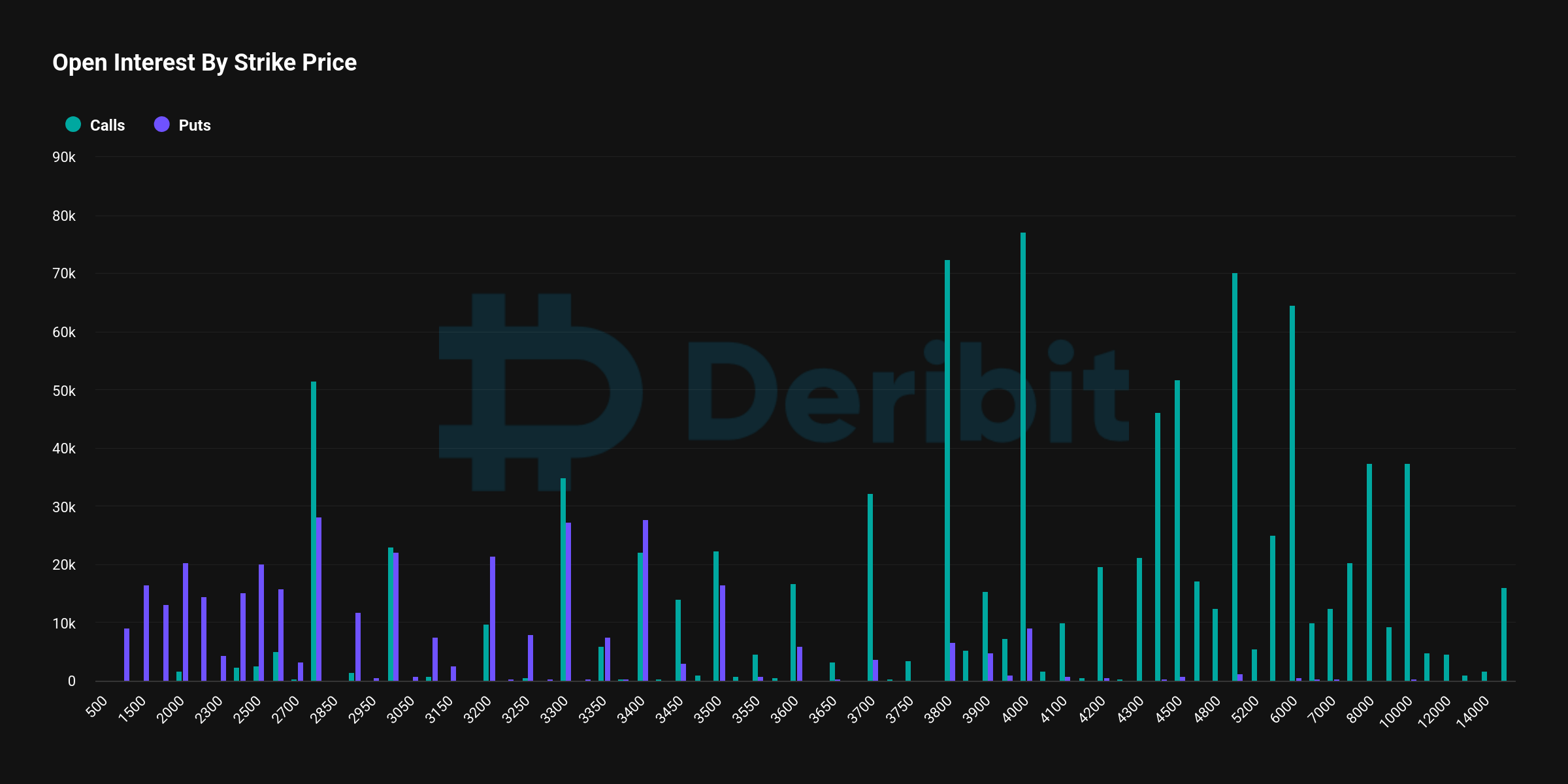

Ethereum (ETH) options are also experiencing significant activity, with 1.12 million contracts expiring. These contracts, carrying a combined value of over $3 billion, reflect a bullish market outlook with a Put-Call Ratio of 0.41. The maximum pain price is $3,000.

Deribit stated that this year-end event illustrates the bullish year for crypto markets, but uncertainty remains high. The firm noted that fluctuations in volatility measures like the Deribit Volatility Index (DVOL) and vol-of-vol suggest the potential for sharp price swings.

It added:

“With the market heavily leveraged to the upside, any significant downside move could trigger a rapid snowball effect.”

![Best Altcoins Under $1 in 2025 [September] – Top Crypto Picks for High Growth Best Altcoins Under $1 in 2025 [September] – Top Crypto Picks for High Growth](https://changelly.com/blog/wp-content/uploads/2025/02/best-altcoins-under-1.png)